views

As retail inflation is hovering at multi-year high levels, it is hitting the pocket of a common man, whose budget and spending are getting affected adversely. The poor, who are the most vulnerable when it comes to the price hike impact, are seeing a fall in their spending on essentials.

Kumar Prakash, 50, a labourer in Delhi, seemed miffed at the price hikes. He said his income has remained the same whereas the prices of food items and other essential things have increased substantially. He said he is now buying less commodities than he used to do earlier.

“Ghar chalana mushkil ho raha hai mehengai ki wajah se. Kamai utni hi hai aur mehengai badh rahi hai. Tel, aata jitne ka laate the, ab bohot mehenga ho gya hai. (It’s getting difficult to run household due to high inflation. Income has been the same but inflation increasing. The prices of oil and flour have become high.),” he said. Prakash has five members in his family including his wife.

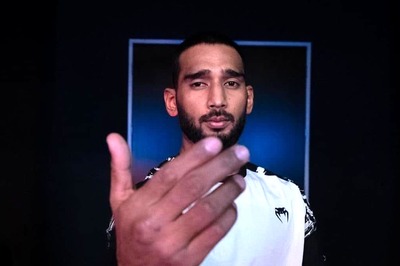

For those who are single and rely on hotel food rather than cooking themselves are also seeing the impact on their prices. Sahil Ansari, a small hotel owner at Chauhan Banger in Delhi, said edible oil prices have increased too much in the recent past, apart from price hikes for other items like spices and gas cylinders. Recently, oil priced even had got doubled.

“The price hikes of various items have reduced our profit margins substantially. It is forcing us to raise our prices. We have reduced the quantity of food items keeping the rate the same so far. But, if prices remain high for some more time, we will increase prices,” Ansari said.

Retail Inflation At 8-Year High

The Consumer Price Index (CPI)-based inflation, which the RBI takes as a reference point while deciding on the monetary policy, in April 2022 soared to an eight-year high of 7.79 per cent. It is as compared with 4.23 per cent in April 2021 and 6.97 per cent in March 2022. Inflation in the food basket rose to 8.38 per cent in April, from 7.68 per cent in the preceding month and 1.96 per cent in the year-ago month.

India Ratings and Research in its note said, “Retail inflation after averaging 4.1 per cent during FY16-FY19 had crossed the RBI’s upper tolerance band of 6 per cent for the first time in December 2019. Immediately after the economy fell in the grip of the first covid wave, resulting in the countrywide lockdown starting late March 2020 until May 2020. However, despite the collapse of demand, the monthly retail inflation mostly remained in excess of 6 per cent till November 2020 because of supply-side disruption.”

Will Inflation Increase Going Forward?

Experts are expecting the inflation to increase further before staring declining.

Ind-Ra expects the retail inflation to increase till September 2022 and start declining gradually thereafter. “The inflation is expected to remain in excess of 6 per cent for four consecutive quarters starting 4QFY22 till 3QFY23. Under the assumption of a normal monsoon in 2022 and average crude oil price (Indian basket) at USD100/bbl, the RBI in its April 2022 monetary policy has projected the retail inflation to be 5.7 per cent in FY23 and 1Q, 2Q, 3Q and 4Q inflation to be 6.3 per cent, 5.8 per cent, 5.4 per cent and 5.1 per cent, respectively.”

The rating agency expects even the core inflation to remain elevated due to the pass-through of rising input costs such as high industrial raw material prices and transportation costs to output prices.

Read all the Latest Business News here

Comments

0 comment