views

Mumbai: L Capital, the private equity arm of LVMH, the world's biggest luxury goods group, has bought the 8 percent stake held by Wolfensohn Capital Partners in unlisted Indian ethnic wear chain Fabindia, two sources with direct knowledge of the matter said.

The valuations and terms of the agreement were not immediately available. Media reports have valued Fabindia at about 14 billion rupees.

"The deal is done. A formal announcement is expected shortly," one of the sources said.

Wolfensohn Capital Partners, the New York-based venture capital fund of former World Bank President James Wolfensohn, bought the stake in Fabindia in 2007 for about $10 million.

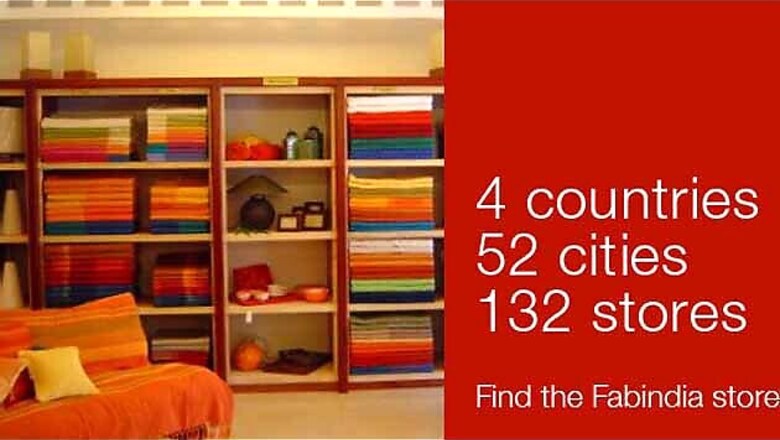

Fabindia, which sells clothing, furnishings and fabrics, also plans to raise funds for expansion, the sources said.

Wolfensohn India Managing Director Sanjiv Kapur and a spokeswoman for Fabindia declined to comment, while L Capital Managing Director Sanjay Gujral did not immediately respond to an email seeking comment.

Chinese fashion company Trendy International Group said on Wednesday that an L Capital-led consortium would buy a minority stake in it for about $200 million.

L Capital Asia launched a $640 million fund last year targeting emerging economies including China and India.

The Asia fund is the fourth fund by L Capital, whose best-known investments include Pepe Jeans, Gant and Princess Yachts.

The French fund last year bought 25.5 percent stake in Genesis Luxury Fashion Pvt Ltd, which distributes global luxury brands, mainly apparel and accessories.

LVMH reported a higher-than-expected full-year operating profit earlier this month and said the outlook for 2012 was excellent, in part due to rapid growth in Asia.

The L Capital-Wolfensohn transaction is a secondary deal that is, a transaction between private equity funds.

Such deals are less favoured by buyout firms but are becoming more common as a way to exit investments as weak capital markets limit opportunities for initial public offerings.

Private equity exits through the Indian IPO market dropped 66 percent to $85 million in 15 deals in 2011, according industry tracker VCCircle.

Comments

0 comment