views

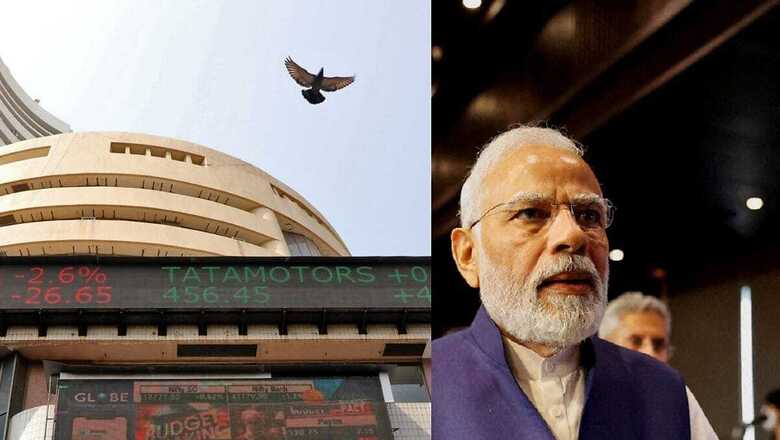

Indian shares exhibited a fluctuating pattern of gains and losses during early trading on Wednesday after posting their worst day in over four years in the previous session. This came amid a narrow win for Prime Minister Narendra Modi’s alliance, which raised concerns about policy continuity.

The BSE Sensex index soared 2,303 points, or 3.2 per cent, to end at 74,382 levels, while the Nifty50 topped the 22,600 mark to close at 22,620, up 736 points or 3.36 per cent.

They hit intraday highs of 74,535, and 22,670, respectively.

The recovery came after the ruling Bhartiya Janata Party (BJP) looked firm in securing support from its allies to form a coalitition government. Indian bourses retreated heavily on Tuesday, as most exit polls were proved wrong by the early result trends for the Lok Sabha polls.

NSE Nifty 50 and S&P BSE Sensex closed nearly 6% lower each on Tuesday as voting trends indicated that BJP would have to depend on at least three regional allies to form the government.

The recovery however came as the BJP-led NDA alliance managed to secure verbal promises from its two major allies including Chandrababu Naidu’s led TDP and Nitish Kumar’s Janata Dal United (JDU), cementing its place in parliament and restoring faith in investors, while brushing away any fears of a hung parliament or a change in government.

TDP secured a 16 seats, JDU 12 and the BJP own its own won 240 seats in the 2024 general elections. According to reports, both alliance partners will hand in letters of support to the ruling party today, in a NDA alliance meeting in New Delhi at 5 PM.

“The market will take some time to absorb the unexpected election results. Stability will return to the market soon but volatility will continue till there is clarity on the cabinet and the key portfolios,” said V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services.

“One positive of the sharp market correction is that the excessive valuations have moderated a bit and this will facilitate institutional buying once clarity emerges on the formation and composition of the cabinet,” Vijayakumar said.

Nifty Technical

In technical terms, according to Anand James, chief market strategist at Geojit Financial Services, the immediate support for the Nifty index is placed at 21,940.

“Should we head higher, the index may face resistance at 22,280-22,350 region or 22,600. A break below the support will push the index towards 20,900,” he said.

On the bourses today, Sensex heavyweights such as Reliance Industries (RIL), HDFC Bank, Infosys, Mahindra and Mahindra, HUL, and ITC recovered after Tuesday’s fall.

HUL, M&M, Asian Paints, Nestle India and Kotak Mahindra Bank soared in the range of 4-6 per each. Others such as RIL, TCS, Wipro, Bajaj Finance, Bharti Airtel and Tata Motors surged by 1-3 per cent each.

The broader markets also rebounded, with the MidCap index rising 2.73 per cent, and SmallCap surging 1.73 per cent. Among sectoral trends, Nifty Auto hiked by 3.61 per cent, Nifty Pharma by 3.49 per cent, Nifty IT by 2.61 per cent and Nifty FMCG by 4.44 per cent.

What Should Investors Do Now?

According to analysts in the near term defensives including FMCG, IT and healthcare will outperform capex oriented sectors. Additionally, some of the sectors with strong narratives – PSUs, defense, railways will take a breather and can potentially see some de-rating from the current near all-time high valuations.

Gaurav Goel, SEBI registered investment advisor, noted, “The market is looking at the policy-making decisions of the NDA govt and the upcoming budget and how the cabinet is going to be, these are the factors that the market is initially looking at. The market might consolidate in the near to short term.”

Goel also echoed the sentiments regarding the financial markets. “We remain extremely optimistic on stock markets over the long period of time. We expect the Government to continue on the path of economic reforms and the Indian economy should continue to prosper. However, hard reforms like land and labour would take a backseat. We feel that the fall makes the Indian market attractive from a fundamental valuation perspective. Those investors who are currently sitting on losses after yesterday’s massacre should continue to hold. They can rejig the portfolio and replace junk with quality. If investors have spare cash then they should start systematic buying over the next 6 months. SIPs should continue unabated,” he advised the investors.

Comments

0 comment