views

New Delhi: Individuals with an annual income of above Rs 10 lakh but below Rs one crore have emerged as the biggest beneficiaries of the new taxation proposals, if they are aged below 60 years, while the super rich above this age bracket will be hit the hardest.

As per an analysis of new income tax proposals, an individual aged below 60 years can make additional saving of up to Rs 24,596 a year if his or her annual income is above Rs 10 lakh but below Rs one crore. For senior citizens in this income bracket, savings would be little lower at Rs 21,630.

At the same time, senior citizens above 60 years of age would have to pay additional tax of Rs 64,550 a year if their annual income is more than Rs one crore.

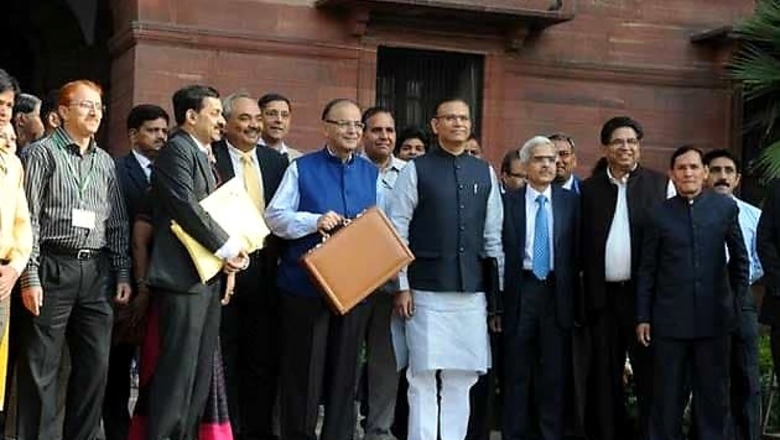

For the individuals below 60 years of age, with annual income of over Rs one crore, the additional tax works out to a little lower at Rs 61,271, according to an 'impact report' prepared by consultancy major PwC for the income tax proposals made by Finance Minister Arun Jaitley in his Budget on Saturday.

Jaitley has announced increasing the super-rich surcharge to 12 per cent from 10 per cent for those individuals earning more than Rs one crore. However, he has also proposed additional deductions in lieu of investments in pension and health insurance schemes.

The additional savings would be the lowest at Rs 7,210 for senior citizens in the age bracket of 60-80 years and with annual income of below Rs five lakh. For individuals below 60 years of age in this income bracket, the additional savings would be Rs 8,199.

In case of annual income of Rs 5-10 lakh, the additional savings would be Rs 16,398 for individuals below 60 years, while the same would be Rs 14,420 for senior citizens aged 60 years and above.

Under new proposals, further deductions of Rs 50,000 a year would be allowed for contribution made to the National Pension Scheme. Deduction on Mediclaim premium has been raised from Rs 15,000 to Rs 25,000, while that for senior citizen parents has been increased from Rs 20,000 to Rs 30,000.

A fresh deduction of Rs 30,000 has been provided for the amount paid on account of medical expenditure incurred on health of a very senior citizen where no amount is paid towards mediclaim premium.

PwC India Partner and Leader Personal Tax, Kuldip Kumar said that "having raised the basic exemption limit and 80C limit last year, there was hardly any scope for further concession.

"Raising the limit of health insurance premium, transport allowance exemption and additional deduction of 50,000 for NPS will help taxpayers save little more in taxes. However, super rich tax payers (having taxable income exceeding Rs 1 crore) will have to shell out more due to increase in surcharge from 10 to 12 per cent.

"Abolishment of wealth tax will give savings to those who are having taxable wealth. There is a greater focus in the budget on curbing of black money."

Comments

0 comment