views

Correcting Your Withholding

Use the withholding calculator on the IRS website. Money is withheld from your paycheck for federal income taxes according to the information you provided on Form W-4. If you owe taxes at the end of the year, this could be because you're not having enough money withheld from your paychecks. You can find the withholding calculator on the IRS website at https://www.irs.gov/individuals/irs-withholding-calculator. Estimate amounts you aren't sure of, but try to be as accurate as possible. When you've finished, compare the result to the W-4 you filled out with your employer and make changes as necessary.

Review the allowances you've claimed. Each allowance you claim reduces the amount of money that is withheld from your paychecks. If you end up owing money at the end of the year, it may be because you're claiming too many allowances. For example, if you've listed yourself as head of household, make sure you actually qualify for that allowance and are claiming it on your taxes. That could result in less money being withheld from your paycheck, which would mean you'd owe taxes at the end of the year.

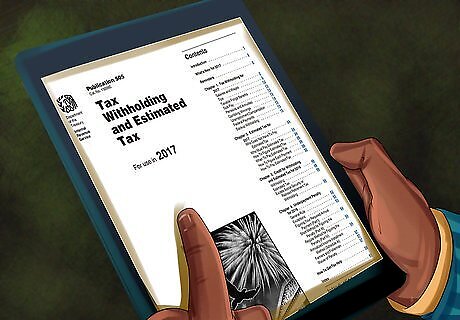

Use the Two-Earners/Multiple Jobs worksheet if necessary. This worksheet helps you ensure that the correct amount of money is being withheld from your paychecks if you are single and have more than one job. You should also use this if you're married and your spouse is employed. You can download the form from the IRS website at http://www.irs.gov/pub/irs-pdf/p505.pdf. When you complete the worksheet, it will let you know if you need to have additional money withheld from your paycheck so you won't owe taxes at the end of the year. Fill out a new W-4 with your employer and put that amount in the space that asks if you'd like an additional amount withheld.

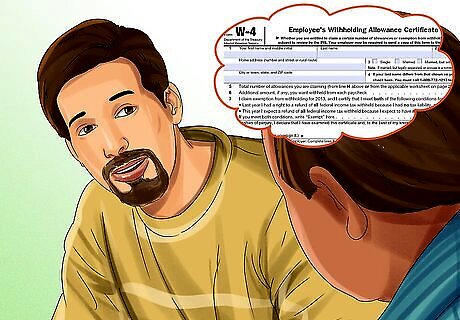

Adjust your withholding to account for major life changes. If you get married or divorced, or if you have a child, these changes will affect your tax liability. Ask your employer for a new W-4 and change it accordingly to avoid owing taxes. For example, suppose you get divorced. You were married when you completed your W-4, so taxes are being withheld at the lower married rate. However, if you file your tax return after the divorce, the IRS treats it as though you were single for the entire year and you'll end up owing taxes.

Request additional withholding. If all else fails, you can avoid owing taxes simply by filling out a new W-4 and requesting to have an additional amount withheld from your paycheck. This may be the easiest way to fix the issue if there have been no other changes in your life that weren't accounted for on your W-4. For example, if you file taxes and owe $1,000, you can simply fill out a new W-4 with your employer and request that an additional $1,000 be withheld from your paychecks over the course of the next year. If you don’t discover that too little is being withheld until the end of the year, you might ask your employer to withhold additional tax from any end-of-the-year bonuses you expect to receive. EXPERT TIP Paridhi Jain Paridhi Jain Certified Public Accountant Paridhi Jain is a Certified Public Accountant and the Co-Founder of Seva Ltd, a CPA firm operating in Maryland and Alabama. She has over 10 years of professional experience in the financial sector and has built a reputation for assisting small business owners navigate the intricacies of regulatory compliance, encompassing areas from company structuring and entity formation to detailed nexus determinations for income and sales tax. She is an active member of the Alabama Society of CPAs and has a certification in pre-professional accounting. She graduated Magna Cum Laude from the University of Maryland, Baltimore County with a major in Information Systems. Paridhi Jain Paridhi Jain Certified Public Accountant Consulting a tax advisor customizes planning for maximum savings. Meeting with a tax pro before year-end lets you strategize to minimize your taxes owed. While online services can file your return, an expert advisor gives personalized guidance based on your personal financial situation. Their know-how can spot savings worth way more than what you pay them.

Paying Quarterly Estimated Taxes

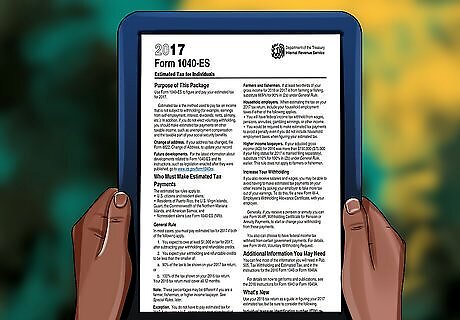

Use IRS Form 1040-ES to calculate your tax liability. If you expect to owe $1,000 or more in taxes at the end of the year, you may be required to pay estimated taxes to the IRS each quarter. Form 1040-ES can help you determine how much—if anything—you should be paying. You can download the form at https://www.irs.gov/pub/irs-pdf/f1040es.pdf. Use Form 1040-ES if you have income from self-employment, or receive other income that isn't subject to withholding. Estimate the amount of that income on the form as best you can. You may need to pay estimated taxes if you expect to owe $1000 in taxes and your withholding and refundable credits will be less than 90% of your current year’s total tax liability or 100% of last year’s tax liability. If your adjusted gross income was $150,000 or greater (or $75,000 or greater if you married and filing separately), then you may owe estimated taxes if your withholding and refundable credits will be less than 110% of your prior year tax liability.

Enroll to pay taxes through the Electronic Federal Tax Payment System (EFTPS). If you find that you need to pay quarterly estimated taxes, the EFTPS provides the easiest way to do so. Visit the page at https://www.eftps.gov and click the "enroll" tab to begin. You'll have to enter information about yourself, including your Social Security number. If you're filing taxes for a business, enter the business's employer identification number (EIN).

Complete enrollment once you get your PIN. When you request enrollment in EFTPS, the IRS will verify your taxpayer identity and send a 4-digit PIN to you in the mail. You will need this PIN to log on to the system and complete your enrollment. You should receive your PIN in 5 to 7 business days. If you don't get it in that time, call 1-800-555-4477 and explain the situation to the agent. They will confirm your identity and then provide you with a PIN to use.

Enter your banking information on your profile. To make payments through EFTPS you must have a checking or savings account at a U.S. bank. When you set up a profile, you'll provide your account number and the routing number so electronic payments can be processed. Once you enter your banking information in the system, customer service agents will be unable to help you if you lose your PIN – so keep it somewhere safe. This is to protect the privacy of your financial information.

Schedule quarterly payments. Using EFTPS, you can schedule payments in the amount you calculated that you need to pay each quarter. EFTPS is simply a payment system—it can't determine the actual amount you owe. You may want to use bookkeeping software, such as QuickBooks, to keep up with your business income and expenses so that you can be certain you're calculating your estimated taxes properly. You'll need to adjust them to account for changes in income throughout the year if you want to avoid owing taxes.

Pay online, by mail, or over the phone if you prefer. The EFTPS is just one of several methods you can use to file and pay your estimated taxes. If you prefer, you can go to the IRS website and pay directly from your bank or a credit card, or mail your 1040-ES and a check to the appropriate address. There are also several numbers you can call to make a quick, secure payment by phone. To make a payment online, visit the IRS payment website here: https://www.irs.gov/payments. You can find a list of addresses for filing by mail here: https://www.irs.gov/filing/where-to-file-addresses-for-taxpayers-and-tax-professionals-filing-form-1040-es. To pay your estimated taxes by phone, call 1-844-729-8298, 1-888-872-9829, or 1-888-729-1040.

Report your payments on your tax return. When you file your tax return, you'll find a space where you can enter the total amount of estimated tax payments you've made for that year. That amount will be deducted from the amount of tax you owe. If you properly calculated your estimated payments, you shouldn't owe any taxes at the end of the year. You might even get a small refund.

Maximizing Your Deductions

Itemize your deductions. While most taxpayers simply take the standard deduction, choosing to itemize your deductions can allow you to deduct more of your yearly expenses. These greater deductions will reduce your tax liability. For example, you may be able to deduct your state income or sales taxes for the year – but you can only do this if you itemize your deductions. Other itemized deductions include home mortgage interest, medical expenses, and charitable contributions. If the thought of filing an itemized return intimidates you, simply retain receipts for potentially deductible expenses and take them to a tax professional at tax time. You can also use bookkeeping or personal finance software, which can help you identify deductible expenses.

Use bookkeeping software to organize deductible expenses. The IRS places deductible expenses in categories. In some of these categories, you must have a minimum amount of expenses before you can deduct anything at all. The minimum amount typically is expressed as a percentage of your adjusted gross income. For example, you can deduct medical expenses that exceed 7.5% of your adjusted gross income. Understanding how potentially deductible expenses are categorized can help you plan your spending and finances to get the maximum possible deduction each year.

Pay deductible expenses together to cross the threshold. You may be able to plan your spending so that you have enough deductible expenses in a particular category to allow you to deduct some or all of those expenses. For example, suppose you have medical bills each year that come to about 5% of your adjusted gross income. If you can bunch those bills together so that you're paying them all in the same year, they'd come to 10% of your adjusted gross income. That enables you to deduct 2.5% of those expenses.

Account for reinvested dividends when figuring your cost basis. If you have an investment account, such as a mutual fund, you may receive dividends on some of your investments. When you do, you must report that as income and pay capital gains tax. Remember to include any reinvested dividends in your cost basis, since this will help prevent you from overpaying on your capital gains tax. You can find detailed information on how to calculate your basis and capital gains in the 1040 Schedule D form: https://www.irs.gov/pub/irs-pdf/i1040sd.pdf.

Make a tax-deductible contribution to an IRA. If you add money to a traditional Individual Retirement Account (IRA) before the tax filing deadline of April 15th, you may be able to deduct some or all of that contribution from your tax bill. Your deduction may be limited if you (or your spouse, if you’re married) are already covered by a retirement plan at work. You can’t deduct contributions to Roth IRAs from your taxes.

Contribute to a High Deductible Health Plan if you have one. If you were covered by a High Deductible Health Plan during the tax year, you may be able to make a tax-deductible contribution to your Health Savings Account. To take advantage of this deduction, you must make a contribution before the April 15th filing deadline.

Evaluate your eligibility for tax credits. Many taxpayers overlook tax credits, which can significantly offset your tax liability. Tax credits are a dollar-for-dollar reduction in the amount of tax you have to pay, unlike deductions. Many credits are non-refundable, which means they can only reduce your tax liability to zero. However, some can result in a refund. The credits available change every year, but may include credits such as the Child Tax Credit and the Earned Income Tax Credit.

Comments

0 comment