views

Identifying Fringe Benefits

Determine what types of wages are required by law. If a wage is required by law, it will not be considered a fringe benefit. One easy way to identify fringe benefits is to eliminate the benefits you know are not fringe. Examples of non-fringe benefits include: Base wages and salaries; Payments to fund social security; Unemployment compensation; and Workers' compensation.

Locate a copy of your employment contract. You will be able to begin finding fringe benefits by looking at a copy of your employment contract. The contract will dictate what type benefits you receive from your employer. For example, your employment contract may state your employer will pay for health insurance. If your contract says this, you can include health insurance as a fringe benefit. If your employer states you will have access to a company car, this would be a fringe benefit as well. In another example, your employment contract may state your employer will pay you a salary of $75,000 per year. This type of payment is required by law and will therefore not be considered a fringe benefit.

Ask your employer for help. If you are unsure what fringe benefits you receive, and your employment contract is unclear, talk to your employer. Sometimes employers do not include every fringe benefit in your contract for employment. When you talk to your employer, ask them if there are benefit they offer or that you receive that are not included in your employment contract.

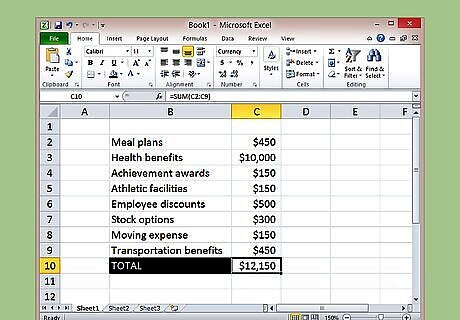

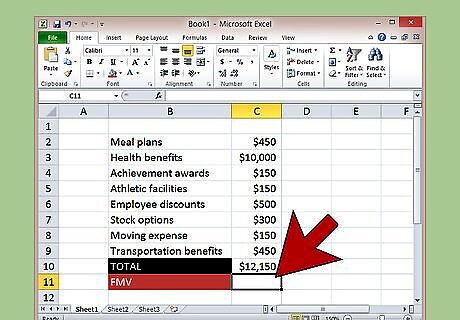

Determine the fringe benefits you receive (or give). After you know the difference between fringe benefits and non-fringe benefits, and you know where to look to identify them, you can tally up all the fringe benefits you receive. Examples of common fringe benefits include: Meal plans; Health benefits; Achievement awards; Athletic facilities; Employee discounts; Stock options; Moving expense reimbursements; and Transportation benefits.

Calculating Your Own Fringe Benefits as an Employee

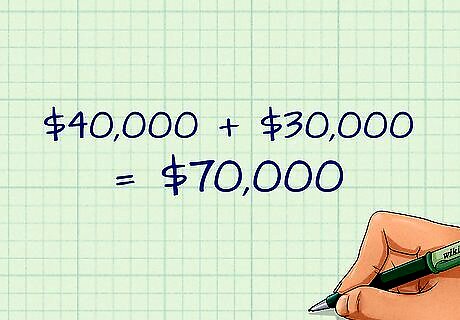

Consider why you would calculate your fringe benefits. If you are an employee, or potential employee, you may want to calculate fringe benefits to get an idea of the full value of your services. Also, if you are looking at a particular job, you may want to calculate the value of fringe benefits to get an idea of the full compensation package. For example, if you work at a job that pays you a salary of $40,000 per year and offers $30,000 in fringe benefits, you can add those together to get an idea of what you are receiving in return for your work ($70,000). In another example, assume you are looking at two separate jobs. One of them offers you a salary of $75,000 but no fringe benefits. The other job offers you a salary of $50,000 and includes fringe benefits equaling around $40,000. If you don't calculate the value of the second job's fringe benefits, you may think the first job is a better offer. However, when you add up the full compensation packages of each job, you may decide the second job offer is better.

Create a list of fringe benefits you receive.To start your calculations, create a spreadsheet on your computer or grab a piece of paper and make a series of columns and rows you can write in. In the first column, write down every fringe benefit you receive from your employer.

Compute the fair market value (FMV) of certain fringe benefits. Most fringe benefits are valued using their FMV. The FMV of a benefit is the amount you would have to pay a third party to buy or lease it. The FMV does not take into consideration what you believe the value of something to be. For example, if you are allowed to use athletic facilities owned by your employer, the FMV of that fringe benefit would be the amount of money it would cost you to pay for a gym membership in your city that includes the same types of athletic opportunities as you have with your employer. If you live in Los Angeles, California, you would not calculate the cost of a gym membership in Miami, Florida. Also, if your employer gives you access to a pool and basketball courts, you would not calculate the cost using a gym membership that only offers a weight room. Once you calculate the FMV of your fringe benefit, put that amount in the the column next to the fringe benefit you calculated and in the same row.

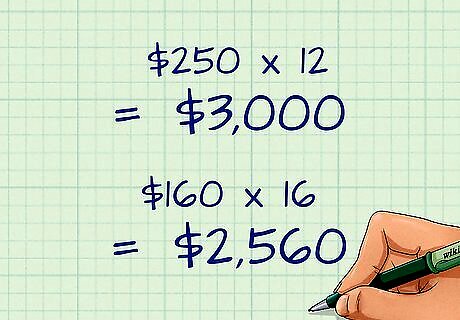

Determine the actual value of other benefits. You will be able to calculate the actual value of some of your fringe benefits. If you can do so, do not use the FMV. For example, if your employer pays for your health and/or dental insurance, you can ask them how much they contribute on an annual basis. This amount would be the value of your fringe benefit. Assume your employer pays your health insurance premiums, which equal $250 per month. If you multiply $250 by the 12 months in a year, you get $3,000, which is the annual value of that fringe benefit. In another example, assume you are paid $20 per hour and you work 40 hours per week. Also assume your employer offers you three sick days, nine vacation days, and four days of paid time off. In general, sick days, vacation days, and paid time off are paid as if you worked a full day and got paid. Therefore, to calculate the value of this benefit, you would first calculate your average daily pay ($20 x eight hours a day = $160). You would then add together all the paid days you receive (three sick days + nine vacation days + four days of paid time off = 16 paid days off). You will finally multiply your daily pay by the total number of paid days you receive ($160 x 16 days = $2,560). Therefore, the total value of this fringe benefit is $2,560.

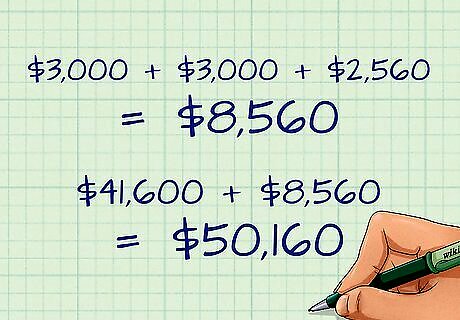

Calculate the sum of all your fringe benefits. Once you have calculated the value of each individual fringe benefit, you can add them all together to find the total value of the fringe benefits you receive. For example, assume you receive three fringe benefits as a part of your employment. The first is the use of athletic facilities, the FMV of which is $3,000 per year. The second is health insurance in the amount of $3,000 per year. Finally, you get a total of 16 paid days off, which is valued at $2,560. If you add all of these benefits up ($3,000 + $3,000 + $2,560), you get a total fringe benefit value of $8,560 every year. If you add this amount to your yearly salary, you can get an idea of your total compensation. For example, if you make $20 per hour and work 40 hours per week, your annual salary equals $41,600 (40 hours per week x 52 weeks in a year x hourly wage). If you add your annual salary to your annual fringe benefit value, you can see you are compensated annually in the amount of $50,160 ($41,600 + $8,560).

Determining the Cost of Fringe Benefits as an Employer

Consider the advantages of providing fringe benefits. As an employer, if you provide fringe benefits, you may entice quality talent to work for you and you may keep your workforce happy and healthy. In addition, employees might prefer fringe benefits for the reduced tax liability when fringe benefits aren't taxed (while your salary will be). For example, companies that provide health insurance can ensure their workforce stays healthy so they can come to work and be productive. You may even get tax breaks for providing group plans.

Think about the disadvantages of offering fringe benefits. Especially if you are a small employer, fringe benefits may be prohibitively expensive to provide. For example, paying an employee's healthcare (or multiple employees) can become very expensive. In another example, the cost of procuring and maintaining a gym for your employees could also be expensive. Think about these costs before you offer fringe benefits.

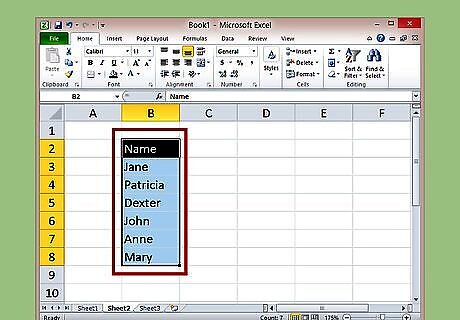

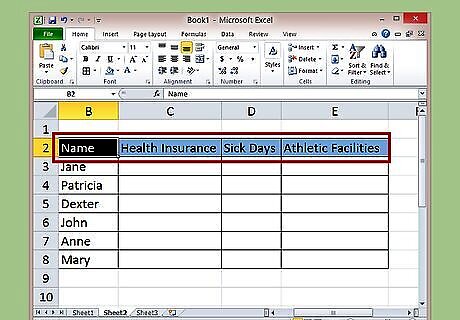

Make a list of all your employees. When you start calculating the amount you spend on fringe benefits, create a spreadsheet or use a piece of paper and write down the names of all your employees. Put all of these names in one column.

Make a list of all the possible fringe benefits you offer. In a series of rows, write down all of the fringe benefits you offer. At this point, do not worry about who receives what benefits.

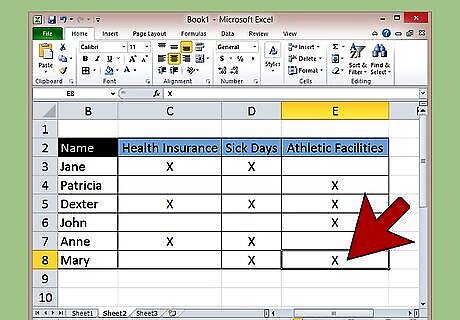

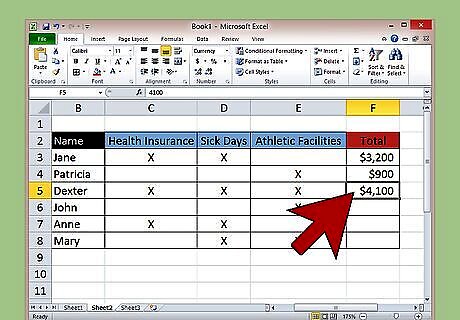

Determine what benefits each employee receives. Put an (X) or some other mark next to each fringe benefit each employee receives. This will allow you to easily identify the calculations you need to make going forward. For example, assume you have three employees. Assume you offer health insurance, sick days, and athletic facilities. However, Employee one only receives health insurance and sick days; Employee two only receives athletic facilities; and Employee three takes advantage of every fringe benefit.

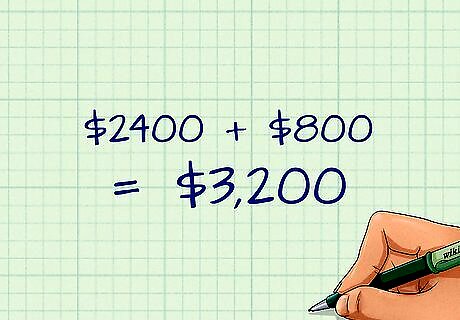

Quantify each employee's fringe benefits package. Now that you know what benefits you offer and who receives them, you can quantify the amount of each employee's package. For example: For Employee one (who receives health insurance and sick days): Calculate the actual value of these benefits. Assume you pay $200 per month ($2,400 annually) for their health insurance and you offer five sick days equaling $800. The value of their fringe benefits package is $3,200. For Employee two (who receives athletic facilities): Calculate the FMV of this benefit. Assume, based on your location and services offered, that the FMV of this benefit is $75 per month ($900 annually).

For Employee three (who receives every benefit): Assume the total value of their benefits equals $4,100.

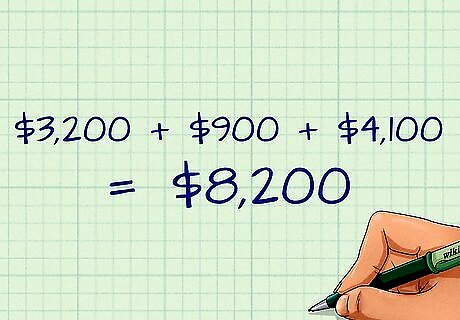

Add up all the fringe benefits you provide as an employer. After you calculate the compensation you are providing each individual employee, you can add all of them together in order to understand how much you are paying every year as an employer. For example, you can add together the packages you give all three of your employees, which would equal $8,200 ($3,200 + $900 + $4,100). This is the amount you pay every year to your employees in order to offer fringe benefits.

Valuating Your Fringe Benefits for Tax Purposes

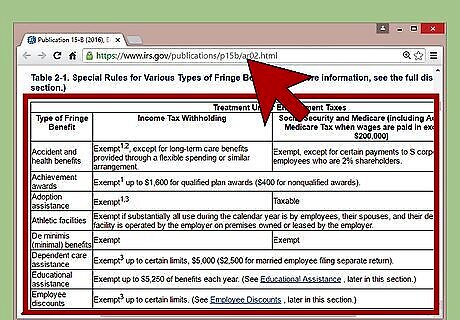

Find the fringe benefits that are excluded from taxes. Any fringe benefit provided to you (the employee) is taxable unless the Internal Revenue Code (IRC) specifically excludes it from taxation. The good news is that there are quite a few exclusions you can use. If a benefit is excluded, it will not be subject to federal income tax and will not be included on your W-2. A list of excluded benefits can be found on the Internal Revenue Service's (IRS) website and includes: Health benefits; Adoption assistance; Educational assistance; Stock options; Retirement planning services; and Many others.

Consider the limits of tax exclusions. Some exclusions have limits, and if you receive a benefit in excess of that limit, you will be taxed on the excess. These special rules are laid out on the IRS's website. For example: Achievement awards are excluded up to $1,600. Dependent care assistance is excluded up to $5,000. Meals are exempt only if they are furnished on the business's premises for your convenience. Moving expenses are exempt only if you would be able to deduct them had you paid for them.

Use the general valuation rule for fringe benefits you can't exclude. If you cannot exclude a fringe benefit you receive, you will have to put a value on it. In most cases, you will use the FMV.

Look for special cases. In some cases, you may not be able to use the FMV. The most common example of this is with employer-provided vehicles. If you have an employer provided vehicle, you may have to calculate the value of the benefit in one of the following ways: The cents-per-mile rule. Under this rule, you multiply the standard mileage rate by the total miles the employee drives the car for personal purposes. The commuting rule. Under this rule, you multiply each one-way commute (from home to work and from work to home) by $1.50. The lease value rule. Under this rule, you use a vehicle's annual lease value.

Add up all of your calculations. Once you have determined what benefits are excluded and what has to be valued, you will then add all of your benefit values together that cannot be excluded. This is considered the total taxable amount of fringe benefits.

Add the value of your taxable fringe benefits to your regular wages. When you do your federal income tax return, you will add your taxable fringe benefits to your regular wages; this total value is your taxable income and you can figure tax withholding based on it.

Comments

0 comment