views

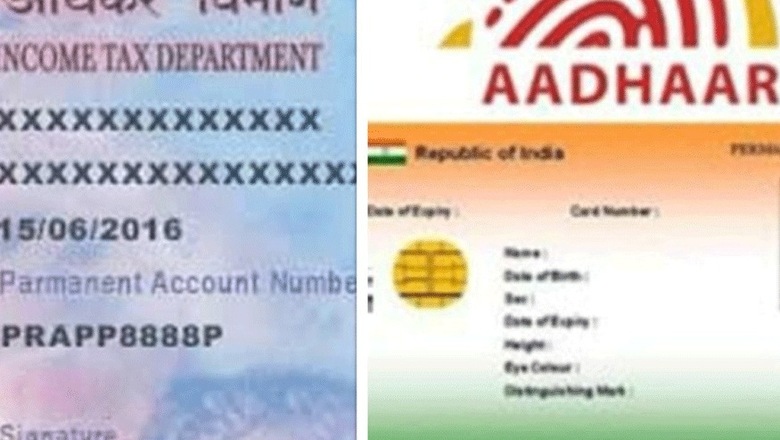

New Delhi: The deadline to link the permanent account number (PAN) with Aadhaar - the unique biometric identification number - ends tomorrow, March 31. The Income Tax (IT) Department has made it mandatory for taxpayers to link their PAN with Aadhaar card in order to file Income Tax returns (ITR) for the assessment year 2019-20.

The department has on its website – incometaxindia.gov.in – listed various ways for the income tax assessees to link their Aadhaar with PAN. Some of these facilities are e-filing income tax portal and through ITR and SMS service.

Here is how to link the two:

1. Aadhaar number is a 12-digit personal identification number issued by the Unique Identification Authority of India (UIDAI) and PAN is a 10-digit alphanumeric identification number issued by the Income Tax Department.

2. The Aadhaar card number can be linked with a PAN card number online through the Income Tax Department’s e-filing portal: incometaxindiaefiling.gov.in. For this, the user is required to click on the ‘link Aadhaar’ option on the portal’s homepage to proceed. On the following page, the user can submit a request to link the two personal identification numbers by entering details such as full name along with PAN and Aadhaar.

3. The Income Tax department has also provided the option of SMS for linking the two. The user is required to send an SMS to 567678 or 56161 in the following format: UIDPAN

4. A request to link Aadhaar number with PAN can also be registered in the application to obtain a PAN card or apply for any changes in one’s information on the PAN card.

5. An individual can also submit a request to link Aadhaar number with PAN while filing the income tax return (ITR) online (e-filing). The link of e-filing is available on the websites of NSDL - tin-nsdl.com and UTIITSL - utiitsl.com, as well as the income tax e-filing portal.

Comments

0 comment