views

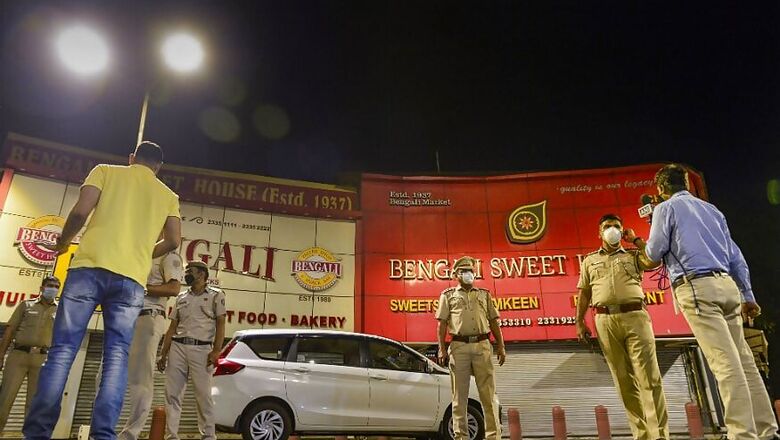

Two former employees of Lakshmi Vilas Bank have been arrested for their alleged involvement in misappropriation of fixed deposit receipts worth Rs 729 crore of Religare Finvest Limited, police said on Friday. In a statement, the Delhi Police said that Pradeep Kumar (57), who was the regional head of Delhi Region and controlled business of northern and eastern areas, and Anjani Kumar Verma (48), a former assistant vice president RMG- Corporate Credit Group at Janpath Branch, have been arrested by its Economic Offences Wing.

“Kumar and Verma were holding senior positions in Lakshmi Vilas Bank and in collusion with promoters of REL (Religare Enterprises Limited) — Malvinder Mohan Singh and Shivinder Mohan Singh — deliberately did not complete the formalities which are mandatory for loan transaction to benefit the promoters/ accused of RHC Holding Limited and Ranchem Pvt. Limited by extending loan to the entities which the promoters/accused persons used to square off their liabilities,” the police said in the statement. The police said a probe was initiated after Manpreet Singh Suri of Religare Finvest Ltd (RFL) had filed a complaint against Malvinder Mohan Singh, Shivinder Mohan Singh and their companies RHC Holding Ltd., Ranchem Pvt. Ltd, and Lakshmi Vilas Bank Ltd. (LVB) and its then directors/employees.

RFL is a group firm of REL which was earlier promoted by the Singh brothers. The Singh brothers were arrested and are still in judicial custody, but further investigation was carried out in the matter to ascertain the role of officials of Lakshmi Vilas Bank, the police said.

According to the police’s statement, the complainant alleged that in November 2016, RFL had placed an amount of Rs 400 crore in two fixed deposits (FDs) with LVB. These FDs were created by RFL for short-term tenor with intention to keep them free from all and any encumbrance. Thereafter, in January 2017, RFL had placed an additional amount of about Rs 350 crore in another couple of FDs with LVB. These were short-term FDs and were renewed by RFL from time to time till their maturity date in July, 2017, it stated.

“However, on July 31, 2017, RFL was shocked to receive an email from LVB with accounts statement with respect to RFL’s current account. RFL discovered that LVB had credited the proceeds of the FDs to RFL’s current account and subsequently debited from RFL’s current account cumulative amount of Rs 723,71,50,920 without any prior intimation to RFL,” the police said. “It is further alleged that LVB cheated RFL and misused its public shareholder money entrusted with LVB in its capacity as RFL’s banker, thus causing wrongful loss to the complainant company to the tune of Rs 729 crores approximately,” the police also said in the statement.

Dr O P Mishra, the Joint Commissioner of Police (EOW), said that after preliminary probe, a case was registered on September 23, 2019 under sections 409 (criminal breach of trust by public servant, or by banker, merchant or agent) and 120 B (Punishment of criminal conspiracy) of the Indian Penal Code and an investigation was taken up. The officer said, “During investigation, grave irregularities and flouting of rules and regulations by officials of Lakshmi Vilas Bank Ltd in sanctioning of loans were noticed.”

Comments

0 comment