views

The digital payments space in India is about to get a bit more exciting, with WhatsApp Pay finally rolling out for the WhatsApp is now available for iPhone and WhatsApp for Android users in India. Mind you, you will need to have the latest version of WhatsApp installed on your phone for the WhatsApp Pay option to be available. WhatsApp Pay will use the unified Payments Interface (UPI), a real-time payments system supported by more than 160 banks in India. While WhatsApp Pay had been available to some users for an extended trial period for a while now, this is the official rollout of the payments service. WhatsApp Pay goes into battle against the likes of Google Pay, PhonePe and Paytm.

At this time, WhatsApp Pay is being rolled out for 20 million WhatsApp users in India, with expansion to enable the option for more users happening in a phased manner. This is being limited because NCPI, the National Payments Corporation of India, has implemented a cap that limits a single third-party payments app to handle a maximum of 30 percent of the total UPI transactions on a monthly basis. WhatsApp has more than 400 million users in India.

What is WhatsApp Pay?

You must have been using WhatsApp quite extensively to stay in touch with friends, family and colleagues. The same instant messaging app, owned by Facebook, now has the digital payments option as well. It is called WhatsApp Pay. This works with UPI, which means you can link it with your bank account and start making payments.

Will it work with my bank account?

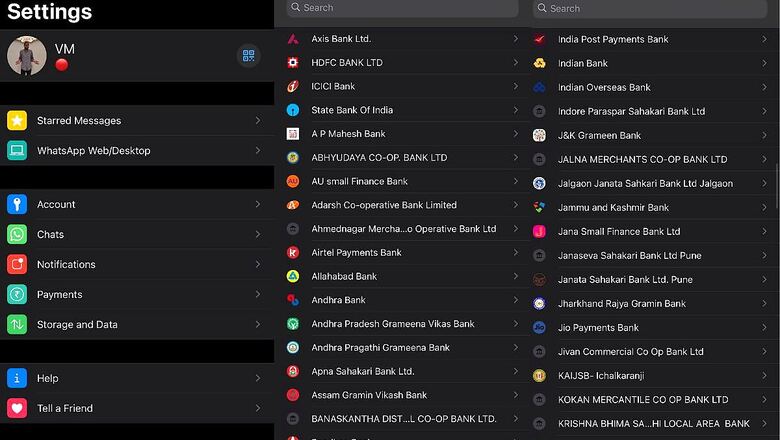

At this time, more than 160 banks are part of the UPI payment system in India. Chances are, your bank will very much be a part of this list. A quick glance through the WhatsApp Pay list of bank accounts shows us that the likes of Axis Bank, HDFC Bank, ICICI Bank, State Bank of India, Allahabad Bank, Airtel Payments Bank, Andhra Bank, Punjab National Bank, Paytm Payments Bank, RBL, Punjab and Sind Bank, Union Bank of India, United Bank of India, UCO Bank, Yes Bank and more.

Can I set up WhatsApp Pay on my phone?

Yes, you can. Two things you need to ensure though. First, update the WhatsApp on your phone. If you are using an Android phone, download the latest version, if not already, from the Play Store. If you are using an iPhone, head to the App Store to check for the latest version. Secondly, the phone that you are using WhatsApp on has to be working with the same mobile number that is registered with your bank account. For the UPI verification during setup, an auto-detect SMS will be sent to confirm the mobile number.

How do I send a payment to a contact?

Once you have WhatsApp Pay set up for UPI with your bank account, you can simply make payments to a contact from within the chat window. On Android, it will be the attachment icon while on iPhone, you will see a “+” icon near the chat text box. Tap that, and you will see a payment option. Enter the amount on the screen, add any comment if you want and make the payment. There will also be a payment card added to the chat window.

How do I receive a payment?

Pretty much the same method, by selecting the payment option in the chat window. On the screen that shows up where you will fill the amount, look for the tabs on the top of the window and select Request. By default, this screen is on the Send tab. Enter the amount there to send a request notification. A user who owes you money can simply tap that notification to make the payment from their WhatsApp Pay.

Do I need to get KYC done, just like my Paytm wallet?

No. In case of WhatsApp Pay, you do not need to get KYC done. KYC, or Know Your Customer, is a verification process to confirm the identity of the owner of a bank account or a mobile wallet used to make payments or keep money. Since WhatsApp Pay is linked to your bank account which will already be KYC compliant, there is no need for additional KYC when you set up WhatsApp Pay.

Read all the Latest News, Breaking News and Coronavirus News here

Comments

0 comment