views

Buying a house is perhaps one of the biggest decisions in your life. Besides the pride associated with home ownership, Indians view property as a source of wealth creation for the family and future generations. Hence, property has always been considered very valuable.

With land being scarce and a burgeoning population, investors have put in money in multiple properties in anticipation of high appreciation driven by increase in demand for housing. The expectation has always been that real estate prices can never fall. The recent stagnation in residential real estate prices, accompanied by a fall in certain cases, has shattered that myth. This should be reason enough for you to think twice about your next real estate investment.

When you evaluate any investment, you need to keep two things in mind. Capital appreciation and income generation. Capital appreciation is the return you make on selling the asset. The second is income that the asset generates when you own it.

The examples of capital appreciation are when you buy and sell stocks, bonds, property or gold, while income generation are dividend from stocks, interest or coupon payments from bonds and rent from property. Assets like gold and art do not generate income and hence act as a pure store of value.

However, when it comes to real estate, people often become the victim of "greater fool theory"-- there will always be someone who would be willing to pay the higher price. Blinded by expected appreciation, they completely ignore the rental values that they can derive while holding on to the property.

Given the current slowdown seen in the realty sector over the past couple of years, the guaranteed super-normal appreciation may look shaky. But you can certainly consider income generation while making an investment, which is more likely to be under your control. Here, the rental yield plays an important role.

Rental Yield

Rental yield is one of the most quoted and often used indicators when assessing a property’s investment potential.

Simply put, rental yield on a property is the annual rate of return when it is rented. For instance, the rental yield on a property worth Rs 1 crore, let out at Rs 50,000 per month (Rs 6,00,000 per annum), is 6% per annum.

We at BigDecisions take a look at the recent rental yield figures of the major cities across India to understand how much a property will fetch in terms of investment.

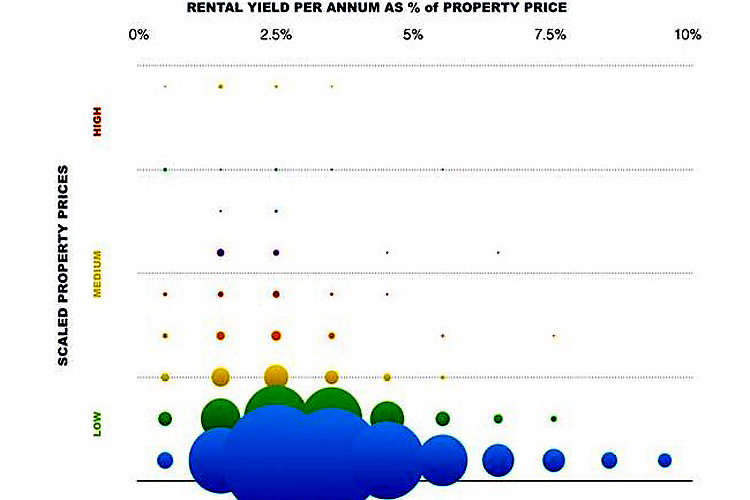

Our study based on a sample of approximately 10,000 users (shown below), indicates an inverse correlation between property rental yield and prices across the country.

The Methodology

On X axis, we have rental yield (%)= monthly rent* 12*100/property price, while Y axis is the property price.

Since the price of property depends upon the location and cost of living in a particular city, and there is no absolute scale to measure the ‘expensiveness’ factor (pan-India), we normalized the price range for comparison purpose.

For example, a Rs 2-crore property in Hyderabad could make to luxury apartment list, while a similarly priced house in Mumbai could be ‘affordable’ by the upper middle classes.

To scale property prices by each city, we used a commonly used normalization model called the ‘min-max’ scaling: Scaled Property Price = (P-min)/(max-min)

Findings

1) Average rental yield at 2-4%: The average rental yield across India hover in the range of 2% to 4%, with some pockets generating returns of around 6%. For cities like Ahmedabad, Bangalore, Chennai and Hyderabad, the average annual rental yield stands at around 2-4%, while Coimbatore’s is in the range of 1-3%.

In metros-- Delhi NCR, Kolkata, Mumbai, though the average rental yield works out to around 2-3%, there are certain areas showing 6-7% returns. Hence, before buying a property, it is important to consider the city as well as the location.

2) Low-cost properties generate better returns: Our study shows that relatively lower priced properties generate better rental yields as against costlier ones in upscale markets. Thus, for investment purpose, if you want to put in say Rs 5 crore in the property market, then you would be better off if you invest it in 5 different properties worth Rs 1 crore each than investing in one worth Rs 5 crore.

In effect, being aware of rental yields, to ensure that your real estate investment actually holds true, will help you offset any disappointments later.

(Author Kankana Roy Choudhury is Head of Content at BigDecisions.com. Launched in early 2013, BigDecisions.com is a financial services advisory platform that helps middle income Indians with their big financial decisions using transparent data backed tools, videos and written content ensuring they're not always dependant on experts for advice. By combining hard to get information with easy to use tools, it empowers individual users regardless of whether their objective is to do away with intermediaries while making product purchase decisions or to just be better informed)

Comments

0 comment