views

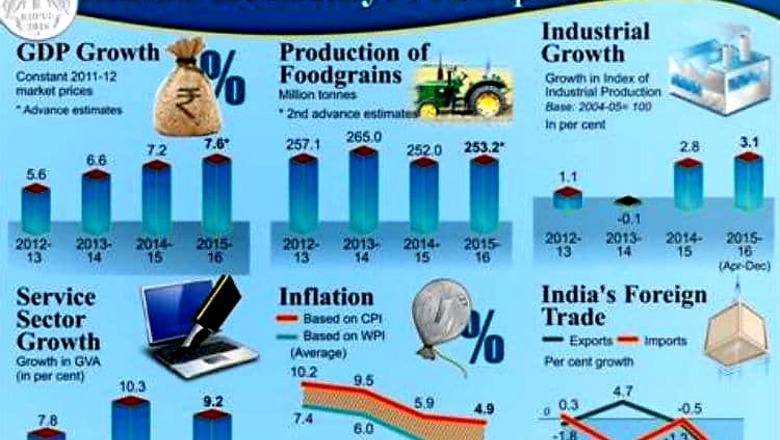

Indian economy is likely to grow between 7 and 7.5% in the fiscal year 2016-17, according to the Economic Survey tabled in Parliament on Friday. The survey has also projected 7.6% economic growth rate in 2015-16. But in a word of caution the survey warns that India's growth rate may be impacted if the world economy remains weak.

But there are several favorable domestic factors. The two factors which can boost consumption are increased spending from higher wages and allowances of government workers if the 7th pay commission is implemented and a normal monsoon.

On the other hand turmoil in global economy could worsen the outlook of exports, contrary to expectations oil prices rise would increase the drag from consumption and the most serious risk is combination of the above two factors.

According the survey the Union Budget and economic policy will have to contend with an unusually challenging and weak external environment. While presenting an optimistic picture of the Indian economy amidst the gloomy and volatile international environment, the survey claims that India stands as a haven of stability and an outpost of opportunity.

It says the country’s macro-economy is stable, founded on the government’s commitment to fiscal consolidation and low inflation. The survey underlines that India’s economic growth is among the highest in the world, helped by a reorientation of government spending toward needed public infrastructure.

Describing these achievements as remarkable, the survey emphasises that the task is now to sustain them in an even more difficult global environment.

Even the increase in wages recommended by the 7th Pay Commission are unlikely to destabilise prices and will have little impact on inflation. While the fiscal deficit of 3.9% seems achievable in 2016-17, it is expected to be challenging in 2017-18

The Centre is also likely to enhance bank recapitalisation from Rs 25,000 crore to Rs 30,000 crore. Four Rs - Recognition, Recapitalization, Resolution and Reform are required to comprehensively resolve the twin balance sheet challenge of Public Sector Banks and some corporate houses, says the survey.

The survey further states that the country’s performance reflects the implementation of number of meaningful reforms. Claiming that there is a sense that corruption at the Centre has been meaningfully addressed and which has been reflected in transparent auctions of public assets.

Foreign Direct Investment (FDI) has been liberalised across the board and vigorous efforts have been undertaken to ease the cost of doing business.

Stability and predictability has been restored in tax decisions reflected in the settlement of the Minimum Alternate Tax (MAT) imposed on foreign companies.

Major public investment has been undertaken to strengthen the country’s infrastructure. In the farm sector, a major crop insurance programme has been instituted.

The survey has highlighted creation of bank accounts for over 200 million people under Pradhan Mantri Jan Dhan Yojan (PMJDY), the world’s largest direct benefit transfer programme in case of LPG with about 151 million beneficiaries receiving Rs 29,000 crore in their bank accounts and the infrastructure being created for extending the JAM (Jan Dhan Aadhar Mobile) agenda to other Government programmes and subsidies.

However, the survey has expressed concern over approval of Goods and Services Tax (GST) Bill being elusive so far, the disinvestment programme falling short of targets and the next stage of subsidy rationalisation being a work-in-progress. It adds that corporate and bank balance sheets remain stressed affecting the prospects for reviving private investments. It further says that perhaps the underlying anxiety is that the Indian economy is not realizing its full potential.

The survey states that the country’s long run potential growth rate is still around 8-10% and realising this potential requires a push on at least three fronts.

First, India has moved away from being reflexivity anti-markets and uncritically pro-state to being pro-entrepreneurship and skeptical about the state. But being pro-industry must evolve into being genuinely pro-competition. Similarly, skepticism about the state must translate into making it leaner.

It emphasizes that the key to creating a more captive environment will be to address the exit problem which affects the Indian economy. Second, the Survey calls for major investments in health and education of people to exploit India’s demographic dividend to optimal extent. Third, it says that India cannot afford to neglect its agriculture.

Comments

0 comment