views

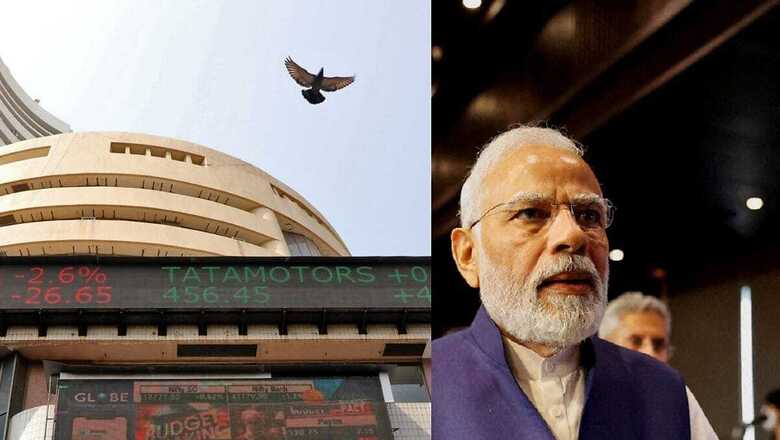

Investors do not expect India’s national elections to spark major volatility in the country’s stock market, unlike prior occasions, based on the low cost of insuring against a slide if Prime Minister Narendra Modi does not win a third straight term.

The Nifty 50, India’s main equity gauge, is trading at record-high levels amid surveys predicting Modi’s Bharatiya Janata Party (BJP) will emerge victorious in the elections that started on April 19 and runs through June 4, when results are due.

A month before that, the implied volatility of a put option with a strike price that is 10% below the current level of the Nifty 50 Index is at 18%-20% on the National Stock Exchange.

At this time in 2019, the implied volatility was 28%-30%, suggesting an investor had to pay much more to protect against an unexpected outcome — a BJP loss — that year.

Implied volatility is a key variable in options pricing. A lower number indicates investors are relatively more confident about the outcome of an event.

“I think there’s a high level of confidence that there will be stability in the Prime Minister’s office post the results declaration,” said Vikas Pershad, Asian equities portfolio manager at M&G Investments.

“The depressed volatility … to an extent, reflects complacency about the results. This time, it’s the least event risk that we have felt in 20 years.”

M&G manages nearly $400 billion in assets, per its website.

While opinion polls predict a BJP victory, they aren’t always accurate, like in 2004.

That year, the BJP’s unexpected loss to the Indian National Congress and its coalition partners sent the Nifty 50 plunging as much as 18%.

“A change of guard (this year) could lead to a correction in the short term, similar to what we saw in 2004,” Frank Benzimra, head of Asia equity strategy at Societe Generale, said in a note.

But right now, foreign investors are less worried about the outcome of the elections and more concerned about India’s relatively expensive stock market, he said.

The question, currently, is not if the BJP wins but the margin of victory. Opinion polls indicate the party and its allies will win more than 300 seats, comfortably higher than the 272 required for Modi’s return.

“I think if there were a number less materially less than 300, then that would be a huge shock to the market,” said M&G’s Pershad.

Comments

0 comment