views

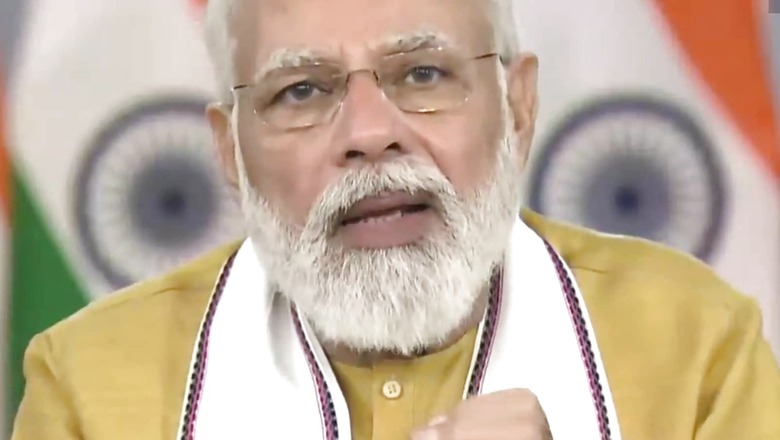

Prime Minister Narendra Modi on Friday unveiled two much-awaited schemes of Reserve Bank of India — the Retail Direct scheme and the Integrated Ombudsman scheme. These two schemes will make investments and lodging and addressing investment related concerns easier and faster. RBI Retail Direct scheme will allow you to invest directly in government securities. The Integrated Ombudsman scheme aims to simplify the process of redress of grievances easier.

“RBI’s Retail Direct scheme will enable small investors to participate in the government’s bond market for their financial security,” said PM Narendra Modi. “In this 21st century, the period of Amrit Mahotsav is crucial for the country’s development. We are confident that the Team RBI lives up to the expectations of the country,” he added.

“RBI has been leveraging technology and innovation for enhancing the efficiency of it services. RBI’s developmental role is focused on further deepening of financial inclusion and undertaking people centric initiatives,” said RBI Governor Shaktikanta Das.

1) What is RBI Retail Direct Scheme?

Investment in government securities set to become easier with new RBI Retail Direct Scheme. Now, retail investors can open and maintain their government securities accounts online with the RBI for free. There will be options to invest in central government securities, treasury bills, state development loans and Sovereign Gold Bonds scheme.

2) How RBI Retail Direct Scheme will Work

Government Securities are the debt instruments (bonds and tresury bills) issued by the Reserve Bank of India on behalf of the central government. Retail investors will have access to bidding in primary auctions as well as the central bank’s trading platform for government securities called Negotiated Dealing System-Order Matching Segment, or NDS-OM, said Reserve Bank of India.

3) How Risky are G-secs?

G-secs usually carries no credit risk because the central government is the borrower. However, G-secs are entirely risk-free instruments. G-sec funds carry interest rate risk. The price of G-secs is inversely correlated to interest rates. If the interest rates go up, the bond prices fall and vice versa. While investing in G-Sec funds, the investors must take into account of this interest rate risk.

4) Should you invest in RBI Retail Direct scheme?

“The launch of the RBI Direct scheme will enable investors to directly invest in central government securities, sovereign gold bonds, state development loans, etc. This is a positive initiative towards building more robust and inclusive financial systems. Simultaneously, it will enable individual investors to play out directly in risk-mitigated financial instruments and make elevated yields. This is also a step towards building a vibrant digital economy,” said Siddharth Maurya, Resource Specialist- Fund Management.

5) RBI had introduced a complaint management system (CMS) portal as one stop solution for alternate dispute resolution of customer complaints not resolved satisfactorily by the regulated entities, the banking regulator said.

6) ‘One Nation One Ombudsman’: Earlier, there were three Ombudsman schemes in India (i) Banking Ombudsman Scheme (ii) Ombudsman Scheme for Non-Banking Financial Companies and (iii) Ombudsman Scheme for Digital Transactions. Over 20 ombudsman offices of the Reserve Bank of India work on consumers grievance redressal process across the country. To make the alternate dispute redress mechanism simpler and more responsive to the customers of regulated entities, RBI integrated three Ombudsman schemes and adopted of the ‘One Nation One Ombudsman’ approach for grievance redressal.

7) Integrated Ombudsman scheme Explained

Under this new initiative, there will be a single point of reference for the customers to file their complaints, submit documents, track the status of their complaints. The customers would also be able to provide feedback based on their experience of using the portal, the central bank said. The Reserve Bank of India will provide a multi-lingual toll-free phone number for all the relevant information on grievance redress. It will also provide assistance for filing complaints.

8) How Integrated Ombudsman scheme will Benefit you

“The launch of One nation, One ombudsman scheme will act as faster resolving any grievances of customers. The helpline will, in addition to building trust and confidence, also reduce expenditure on both financial and human resources. It has been a long proposed move by the Central Bank, with the help of one centralised record keeping system in place. It will further help in providing all the relevant information on grievance redress and assistance for filing complaints. Moreover any such process that aims to bring transparency and take swift action on any violation has been in the favour of consumers,” said Rohit Garg, co-founder and chief executive officer of Smartcoin.

Read all the Latest Business News here

Comments

0 comment