views

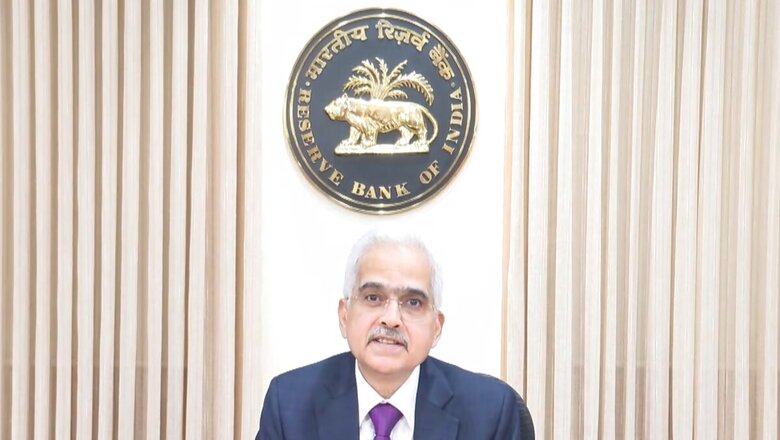

RBI MPC Decision: The RBI MPC decided to maintain the repo rate at 6.50 on April 5, 2024. This means there will be no immediate impact on real estate or home loan EMI. Since the repo rate remained unchanged, banks are unlikely to adjust their lending rates shortly. This translates to your EMI staying the same for now.

Also Read: RBI Announces Mobile App For Retail Direct Investors, Check Details About The Scheme

It’s important to note that the RBI’s decision might influence banks’ future actions on interest rates.

The impact might vary slightly depending on whether your home loan is on a fixed or floating interest rate. Fixed rates are not directly affected by repo rate changes during the fixed period. However, floating rates tend to adjust with changes in the repo rate.

Why No Change in EMI (For Now):

Adhil Shetty, CEO, Bankbazaar.com, said, “This decision has implications for banks and financial institutions, particularly concerning lending rates like home loan interest rates, which are linked to the RBI’s repo rate. A stable repo rate signals consistency in interest rates for borrowers, assuring homebuyers regarding steady loan interest rates, beneficial for both new loans and existing ones with floating rates. Stable interest rates not only enhance affordability for potential homebuyers but also foster consumer confidence, thereby sustaining demand in the real estate market.”

Atul Monga, CEO and Co-Founder, Basic Home Loan, said, “This move is meant to make sure the past rate increases of 250 basis points really work as intended. For people with home loans, this means things should stay the same for now, making it easier to manage their loans without worrying about sudden hikes. The RBI wants to ensure that the big changes in rates already made are properly felt in the economy. This could help keep the home loan sector stable and make planning easier for borrowers.”

Homebuyers To Benefit

Manju Yagnik, Vice Chairperson of Nahar Group and senior vice president of NAREDCO Maharashtra,”This move builds on the advantages of the earlier policy announcements by widening the advantageous conditions for homebuyers. As a result, those considering becoming homeowners can still benefit from low-interest rates on home loans. The RBI’s decision offers homeowners a significant benefit and much-needed relief in the face of rising housing costs.”

“Buyers are satisfied with a steady repo rate since it gives them another opportunity to purchase real estate at a good price. This decision sets a base for the housing sector’s long-term stability and expansion and boosts the optimistic attitude currently permeating the market. With the understanding that the market is in a favourable position to support their investment decisions, purchasers can move confidently through it,” Yagnik added.

Real Estate To Get More Push, Rate Cut Expected

Boman R Irani, President, CREDAI, said, “The central bank maintains the repo rate at 6.5% continuing a hawkish stance to keep inflation under check. However, with repo rates being an industry-agnostic subject, we hope to see lower repo/interest rates later this year which will provide an impetus to not just real estate and housing demand but across industries – compounding sectoral and economic growth. Having grown 8.4% in Q3 of FY 2023/24, a rate cut in the future will help sustain this economic momentum or even accelerate it – and we expect to see repo rates being reduced in Q2 of the new FY in the post-election phase.”

Pradeep Aggarwal, Founder & Chairman Signature Global (India), said, “The RBI has once again demonstrated great economic prudence and fiscal foresight by keeping the repo rate unchanged for the seventh consecutive time. A stable and predict repo rate lends credence and confidence to the average homebuyer who can be assured while taking home loans. This stability has a direct cascading effect on the growth of the real estate sector, which in turn contributes significantly towards India’s GDP and future growth prospects.”

Dharmendra Raichura, VP & Head of Finance, Ashar Group, said, “The MPC made the strategic decision to maintain the repo rate at 6.5%. This resolution extends favourable conditions for potential homebuyers, contributing to resilience and vitality in the real estate sector. Consistent home loan rates enhance consumer confidence, underpinning investment decisions and fostering an environment conducive to sustained development.”

Changes in interest rates affect the demand for real estate. Lower interest rates tend to stimulate demand as borrowing becomes cheaper, potentially driving up property prices. Higher interest rates, on the other hand, may dampen demand and lead to softer property prices.

Repo Rate Steady:

The repo rate is the rate at which RBI lends money to commercial banks. By keeping it unchanged, RBI signals it wants to maintain the current level of liquidity in the banking system. This stability often translates to banks holding off on immediate adjustments to their lending rates, which directly impacts your home loan EMI.

Potential Future Impact:

- Shifting Landscape: While the immediate impact is minimal, the RBI’s decision to hold the repo rate might change in the future. Factors like inflation or economic growth can influence future rate adjustments.

- Banks’ Individual Decisions: Even if the repo rate changes, banks have some discretion in setting their lending rates. They might not always fully pass on the change to borrowers.

If the repo rate decreases in the future, and your bank lowers its lending rates, you might be able to renegotiate your EMI with your lender. This could potentially lead to lower monthly outgo.

The MPC typically decides on key policy rates like the repo rate, which influences the interest rates charged by banks on loans. If the RBI cuts the repo rate, banks may lower their lending rates, including those for home loans. This could result in lower EMIs for borrowers, making it more affordable to purchase homes. Conversely, if the RBI increases the repo rate, borrowing costs could rise, leading to higher EMIs.

Comments

0 comment