views

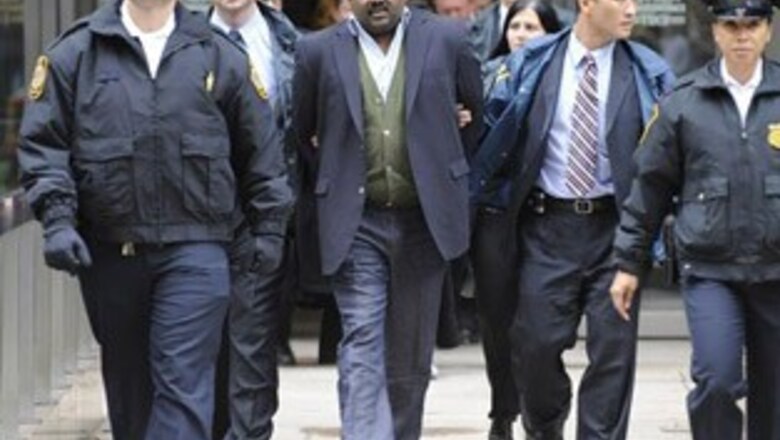

New York: Fourteen people were charged with fraud and conspiracy in a dramatic widening of an insider trading scandal that has ensnared hedge fund managers, top Silicon Valley executives and a bevy of white-shoe advisers.

In complaints that read like scripts for the TV series The Sopranos, investigators alleged suspects dropped off bags full of cash, used prepaid cellphones to dodge wiretaps, and used nicknames such as the Greek and the Octopussy.

"Some of the defendants--taking a page from the drug dealer's playbook--deliberately used anonymous, hard-to-trace, prepaid cellphones in order to avoid detection," US Attorney Preet Bharara told a news conference on Thursday.

"When sophisticated business people begin to adopt the methods of common criminals, we have no choice but to treat them as such," he added.

Federal prosecutors have alleged $40 million of insider trading profits from their investigation so far. The U.S. Securities and Exchange Commission has alleged $53 million of illegal profits in its own civil investigation. The SEC total includes some profits not reflected in the criminal probe.

The latest charges involve some of the same companies and individuals implicated in the Galleon Group insider trading scandal that broke three weeks ago. It was unclear whether the illegal networks were linked.

"People will probably ask just how pervasive is insider trading these days? Is this just the tip of the iceberg?" Bharara said. "We aim to find out."

In the largest branch of the investigation, Zvi Goffer, manager of New York-based trading firm Incremental Capital, was accused of leading an insider trading ring that netted $11 million.

Prosecutors said they had uncovered illegal profits of more than $20 million, on top of the $20 million that authorities say was pocketed by the Galleon Group.

The Galleon case is already the biggest hedge fund insider trading scheme in Wall Street history, and in Thursday's complaint one of the suspects admitted to years of insider trading apparently overlapping with his time at a former job at SAC Capital, perhaps the nation's best-known hedge fund.

Raj Rajaratnam, Galleon's billionaire founder, is accused of masterminding the operation. He lost a bid to have his $100 million bail reduced, though a U.S. magistrate judge agreed to ease his travel restrictions.

PAGE_BREAK

The Galleon case is turning into one of the biggest insider trading rings since the Ivan Boesky scandal of the 1980s led to the end of a gilded age for Wall Street and ultimately brought down Michael Milken's Drexel Burnham Lambert.

Investigators' aggression in the current probes contrasts with the years of failure to spot the Ponzi scheme masterminded by Bernard Madoff.

"The regulatory cops are saying in a very loud voice, 'We're back on the beat,'" said Michael Holland, founder of the money management firm Holland & Co in New York.

Prosecutors introduced a new group of suspects including Goffer, who previously worked at Galleon, and Michael Kimelman, an Incremental Capital co-founder and former Sullivan & Cromwell LLP merger lawyer.

A former Moody's Corp analyst, an executive with a wireless networking firm, and others were among those charged with leaking confidential information about takeovers and other activities.

Calls recorded by law enforcement officials were littered with nicknames, like "the Greek" and "the Rat," and jokes about getting information from a guy fixing a pothole. Targets were code-named "the Hilton Hit" and "the Apple."

"Someone's going to jail, going directly to jail, so don't let it be you, OK?" Goffer said according to a criminal complaint. "That's a ticket right to the (expletive) Big House."

Also arrested were Ropes & Gray LLP lawyer Arthur Cutillo; Craig Drimal, who worked in Galleon's office; Emanuel Goffer, Zvi's brother; Jason Goldfarb, also a lawyer; and David Plate, both also associated with Incremental Capital.

Investigators said Zvi Goffer, 32, identified as the Octopussy for his supposed ability to gather information, provided tipsters with prepaid cellphones to minimize the chances of getting caught.

He worked for almost all of 2007 at Schottenfeld, a New York-based broker dealer that has been tied to previous allegations of improper trading, investigators said. He then moved to Galleon in 2008, where he worked for about eight months before quitting to start Incremental Capital.

His scheme involved shares of network equipment maker 3Com Corp, telecom equipment maker Avaya Inc and drugmaker Axcan Pharma Inc, according to the criminal complaint.

Prosecutors also charged Deep Shah, a former Moody's ratings analyst, and Ali Hariri, a vice president at wireless networking chipmaker Atheros Communications Inc, with leaking confidential information.

The government said Shah, 27, lives in India. A spokeswoman for Bharara's office declined to say whether prosecutors would seek Shah's extradition.

Moody's spokesman Michael Adler said Shah had not worked at the company since 2007. Moody's will cooperate with investigators, and has "strict policies against divulging confidential information," he added.

Hariri, 38, was arrested in San Francisco. Atheros said it put him on leave pending the results of an internal probe into his alleged insider trading.

Another five individuals, who were previously charged, have pleaded guilty to insider trading charges, prosecutors said, including current or former executives of hedge funds S2 Capital and Spherix Capital LLC.

Also pleading guilty was Roomy Khan, a convicted felon and former Intel employee widely cited as a central cooperating witness in the Galleon probe.

Ali Far, the founder of Spherix, a California-based hedge fund, and Richard Choo-Beng Lee, its former president, have admitted to engaging in illegal insider trading for many years, according to their cooperation agreements.

In the case of Lee, the agreements suggest that he engaged in illegal insider trading while working at Steven Cohen's SAC Capital, a Connecticut-based hedge fund. SAC did not immediately return a call seeking comment.

At a hearing before U.S. Magistrate Judge Theodore Katz, bail was set for Cutillo, Drimal, Emanuel and Zvi Goffer, Goldfarb, Kimelman and Plate at between $100,000 and $500,000 each, with limited travel including the surrender of passports. The defendants were arrested in the pre-dawn hours.

Comments

0 comment