views

Finding Repo RVs

Check a bank’s repo list. Ask your bank or credit union if they allow you to view their repo list. Look at this list to view and bid on the vehicles the lender has repossessed and is looking to sell, which may include RVs. Note that the benefit of using this option is that you can finance the RV through the bank directly, and often with low or 0% interest rates. On the other hand, the downside is that lenders typically don’t spend the money to clean or fix up repossessed vehicles before selling. If you’re interested in a repo RV sold directly from a lender, ask how the vehicle was repossessed. An RV turned in voluntarily is typically in much better shape than one that had to be seized from an uncooperative owner.

Buy from a repo reseller. Check out auctions held by resellers of repossessed RVs, which is the most common and popular way to buy them. Check out resellers’ websites and local ads for to view and bid on their options or find out the location of an in-person auction. Note that the advantage of buying from a reseller at auction is that they fix up the vehicles well, and are more interested in moving a high volume of inventory than marking up the starting price. Just beware of those that charge a “viewing cost” or any other unnecessary upfront charges. Take note that it can be difficult to find quality RVs in a very large inventory of vehicles in all different conditions. Stay away from any that don’t have a title with them or the reseller claims the title is “in transit,” as it can be nearly impossible for you to claim ownership without one.

Try buying from a dealer. Try a used RV dealer to check out the repossessed RVs they’ve purchased at auction and fixed up. Note that this method doesn’t offer as much savings on RVs as others do, but buying from a dealer eliminates the bidding process and may give you more options for financing and warranties. Consider the advantages of buying repo RVs from a dealer. Dealers purchase these RVs at auction and will then do a good job of cleaning them up, replacing some items, and even doing minor repairs, so the RVs are in better shape when sold. Know that the downside is that dealers will hike up the price on the repo RVs that they’ve fixed up. Unless you can spot a problem and are a savvy negotiator, you’ll end up paying about the same price as any other used RV.

Researching and Inspecting an RV

Check the rest of the market. Check out other auctions or reseller’s websites to look at common prices, especially for RVs of a similar make and model or similar condition to one you’re interested in. Be wary or prepared to negotiate on starting bids or asking prices that seem much higher than others in the market. Consult the NADA Guide for the RV model you’re interested in to find out the low value for the specific make and model. Make sure a seller isn’t asking a rate that’s higher than its true value, and that you’re prepared to bid no more than it’s really worth. Consider that you want to pay less for a repo RV than you would if buying a regular used RV from a dealer or a private seller, especially if you don’t have a lot of information about the vehicle. Considering all the unknowns about the previous owner, the risk to you warrants a significant price reduction.

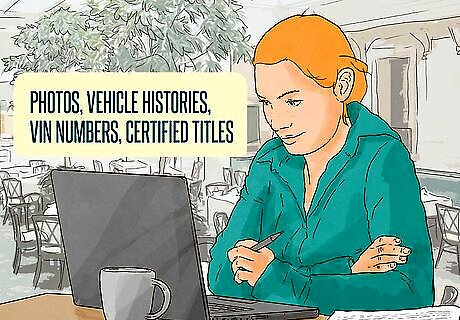

Research the RV. Determine whatever information you can about an RV you’re interested in from a lender, reseller, or dealer. Then do any additional research you need to to find out if you’re getting a fair price and a good value considering the risk and quality of the vehicle. Look for sellers that provide photos, vehicle histories, VIN numbers, and certified titles. The more information provided upfront the better, as it usually means the RV is in better shape, you can do better research, and you are closer to getting it road-ready. If there are known repairs that need to be made on an RV, get a quote from an auto repair shop for the estimated amount it would cost to fix them, and factor that into your budget and considerations.

Inspect the RV thoroughly. Determine when and for how long you are able to inspect a repo RV you’re interested in, and look it over thoroughly for possible damage. You might be able to schedule an appointment in advance, or view a unit along with the public before the start of an auction. You may even be able to test-drive a motorhome or truck camper. Bring along an experienced mechanic or an RV expert to your inspection if you can. Get the fullest assessment possible about the car’s conditions and possible problems so you know exactly what you’re bidding on or buying. If you are buying a repo RV from another state and can’t inspect it in person, hire an independent inspection service or trusted mechanic to look at the RV for you.

Bidding On and Obtaining an RV

Know your budget. Use your knowledge from the given vehicle information, your inspection, and your research to come up with an amount you will not go over when bidding on the RV you want. Then place your bid or multiple bids up to a price no higher than this amount. Pay attention to the starting bid given by the seller as well, and start your bidding at or just above this price. If you bid online, you may be able to set a maximum bid and enable absent bidding, allowing the system to bid for you up to your max amount.

Understand the terms and conditions from the seller. Review all contracts, terms, and conditions provided by the bank, reseller, or dealer regarding the bidding process and sale of an RV. Make sure you read any instructions and disclaimers carefully so you understand what you’re obligated to. Some resellers will require that you meet with a broker to ensure that you understand the terms of sale or the auction process before you can make a bid or offer. Know that in general, you are bound to the sale of a repo RV once you place a bid on it, and the sale is “as is.” This means that any issue or problem you find after the sale cannot be disputed, even if it wasn’t documented by the seller. The sale is final, and without warranty.

Pick up your RV and make it street legal. Receive your RV whenever you have outbid other bidders, made payment, and signed necessary documents. Just like any other car or trailer, you need to ensure that it can legally be driven in your state before you can enjoy using it. Re-title the vehicle in your name, get it insured, registered, and any other repairs or replacements done in order to make it street legal. Check with your state or county if there are any additional steps you need to take for an RV in particular. If you bid on an RV from a bank’s repo list, you may need to wait to find out if your bid was accepted after they compare with other offers. Only then can you perform an inspection of the unit before you sign the final paperwork, make payment, and take the RV home.

Comments

0 comment