views

X

Research source

Calculating Taxes Owed

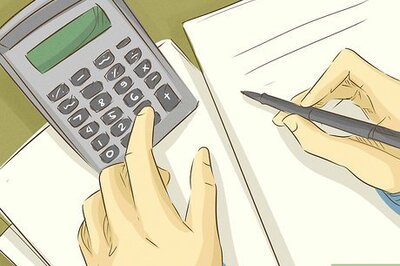

Determine the estate's gross value. The amount of state estate taxes owed is based on the estate's gross monetary value. To find out how much an estate is worth, you must get appraisals for non-monetary assets. Assets typically are valued based on their actual or fair market value at the date of valuation. In some cases, you may be able to use a general valuation date of six months after the death, rather than specific dates for each asset. To accurately assess the value of estate assets, you must get real estate appraisals, business appraisals, or brokerage statements as necessary depending on the types of assets in the estate.

Locate the estate's assets. States treat property differently for estate tax purposes if it is located in another state, and typically provide a credit if the estate has already paid state estate taxes in another state for property located there. This is particularly true if the deceased person owned real estate in another state that also has an estate tax. Typically states allow a credit for estate taxes paid in other states for assets located in that state. The same calculations and credits apply for personal property located in another state. For example, if the deceased person lived in Massachusetts but had a vacation home in Rhode Island that was part of the estate, the estate would be entitled to a credit for estate taxes paid on the vacation home in Rhode Island. Personal property located in Rhode Island, such as a boat and a car, also would potentially be subject to Rhode Island estate tax. If Rhode Island estate tax was paid, the estate would be entitled to a credit for those amounts on the Massachusetts estate tax forms. However, keep in mind that if property is located in a state that does not have a state estate tax, the estate still may owe estate tax on that property in the state of the deceased person's residence.

Contact your state's department of revenue. Each state has its own estate tax forms and procedures. You can find out this information by calling or visiting the website of the applicable state's department of revenue. You will need to find out whether estate taxes are owed for the state in which the deceased person was a resident as well as any state in which the deceased person had property. Even if the deceased person resided in a state that does not have a state estate tax, the estate still may owe state estate taxes on property held in another state that does have a state estate tax.

Consider consulting an attorney or tax expert. As executor of an estate, you may already have an attorney or financial professional working with you – particularly if the estate includes significant assets. If you don't, an attorney can help you ensure taxes are filed correctly and you don't over- or underpay. Look for an attorney who specializes in probate or trusts and estates, and who has experience with state estate taxes. If the deceased person has property in several states, you may want to talk to attorneys or tax professionals in each state to properly assess the estate's state tax liabilities.

Find the adjusted taxable estate. The adjusted taxable estate is a dollar figure similar to your adjusted gross income that you find on your income taxes. Generally, this is the monetary value of all the assets of the estate, minus allowable deductions. The state department of revenue typically will have information on its website that can help you determine what expenses and other amounts can be deducted from the gross value of the estate. State estate taxes typically are only assessed on estates with a gross monetary value over a specific threshold amount. Thus, any value under that amount is excluded for the purposes of calculating the adjusted taxable estate. Deductions also include funeral expenses, the costs of administering the estate, and debts of the deceased person such as mortgages or outstanding bills.

Locate the adjusted taxable estate on the state estate tax table. Each state produces a table applicable for each tax year that determines how much state estate tax is owed for a given adjusted taxable estate, or the rate at which that tax should be computed. You typically can find the appropriate table on the state department of revenue's website. Make sure you're using the table that applies to the year you will be filing the state estate tax return. Threshold amounts and tax rates may vary significantly from year to year, especially if a state is in the process of phasing out its estate tax. The table may indicate a flat amount of tax owed for estates up to a particular amount, and then a percentage rate for amounts in excess of that amount. In that case, you'll have to calculate the appropriate amounts and add them together to get the total tax owed.

Submitting Forms and Payments

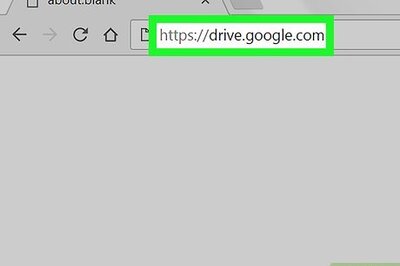

Download the appropriate forms. State estate taxes typically must be reported using a specific form that differs from the standard state income tax form. You can download these forms from the website of the state department of revenue. The form typically also comes with instructions. If you're filing estate taxes on your own, make sure you read these instructions thoroughly before you begin filling out the form. You may want to check the website of the state department of revenue for a phone number you can call if you have any questions regarding which forms you need to complete and file.

Gather supporting documents. Typically you must include appraisals and other ownership documents that show how you arrived at the figures for the monetary value of the estate. You also may need documents to prove what property is included in the estate and the location of that property. The state department of revenue typically will have a list of the documents you need to provide, either on the website or in the instructions that accompany the tax forms. At a minimum, you must have copies of all ownership documents for the estate and the most recent appraisals, which typically must have been conducted after the person's death. You also typically need recent statements for estate investment and bank accounts that were included in the will – that is, those that do not have a direct beneficiary listed with the bank or investment company holding the account. In addition to the will, you also typically must provide a copy of the death certificate.

Complete the state estate tax forms. Each state estate tax form requires you to provide information about the deceased person and their estate, including the total monetary value of the estate property, any deductions taken, and the taxes assessed. You typically must include the federal employer identification number (EIN) for the estate – not the Social Security number of the deceased person. If you don't already have an EIN for the estate, you can get one immediately and free of charge by visiting the IRS website and providing some basic information about the estate. You also must provide the name, residency, and Social Security number of any attorney or executor for the estate. The return includes schedules and tables for calculating the appropriate estate tax. You typically must file any schedules or worksheets you completed along with the form when you file.

Include a copy of the federal estate tax return. Most states that require a tax return for the purposes of assessing state estate tax also require you to include a copy of the federal estate tax return you filed on behalf of the estate. Keep in mind that since states may require estate tax for estates of smaller value than those subject to federal estate tax, you may not have been required to file a federal estate tax return. On the other hand, if you were required to file a federal estate tax return, you always must file a state estate tax return if the deceased person was the resident of a state that has an estate tax, or owned significant property in a state that has an estate tax.

Send all documents and payment to the designated address. Typically the tax return form and all other required documents must be sent together with payment to a specific address for the state department of revenue. This address will be listed on the department of revenue's website and the instructions for the estate tax form. Make a copy of your forms before you send them to the state department of revenue, so you have them for the estate's records. Check to ensure that you've sent copies of all necessary documents, not originals. Typically you must send paper forms, rather than filing electronically, and include payment in the form of a check or money order. States usually require payment to be drawn from an estate account, not from your own personal account. Check the deadline for filing and make sure you're sending the return and supporting documents before the due date. State departments of revenue usually look to the postmark date to determine whether the deadline has been met. Incomplete returns or returns without required supporting documentation may not be considered received by the due date, and could subject the estate to interest on late tax payments.

Requesting an Extension

Download the appropriate application. All states that collect estate tax provide a deadline by which the executor or other estate representative must file the state estate tax returns, typically less than a year after the person's death. If you believe you will be unable to file state estate taxes by the due date, get the forms and instructions for an extension as soon as possible – don't delay thinking you'll get it done in time and wind up being late as a result. If you were required to file a federal estate tax return for the estate, you typically are required to provide a copy of your federal estate tax return along with your application for an extension.

Review the acceptable reasons. Typically if you need an extension for filing state estate taxes, you must demonstrate that there is a valid reason you need more time, one that is accepted by the state department of revenue as justifying an exception be made to the usual deadlines. Most states won't grant an extension for longer than six months from the final due date for the state estate tax return. You may be eligible for a longer extension – even up to several years – if you can demonstrate that paying the state estate taxes would cause the estate to suffer undue financial hardship.

Make an estimated payment. In most states, similar to extensions for filing regular income taxes, requesting an extension to file estate taxes does not excuse you from making some estimated payment, even if it is only a portion of the total due. Some states require that you make an estimated payment in full. When you file the return, you will note the estimated payment made. If it was greater than the amount actually owed, the estate is entitled to a refund. If it was less, you must remit payment for the additional amount when you file the return or face penalties and interest. In other states, interest is incurred from the due date for any unpaid amount, regardless of the amount of the estimated payment you made. In some states, such as Massachusetts, making an estimated payment that is less than 80 percent of the total tax due voids the extension and results in penalties and interest on unpaid taxes dating back to the original due date. Check the payment due with an extension carefully to make sure you are avoiding penalties and interest to the extent possible.

Submit your application before the due date. As with regular income taxes, any applications for an extension to file state estate taxes must be filed before the taxes are due if you want to avoid additional penalties and interest. Keep in mind that as executor you owe a fiduciary duty to the estate. Failure to file state estate taxes, resulting in fines and interest charged to the estate, is a breach of that fiduciary duty.

Comments

0 comment