views

Considering Your Options

Speak to a financial consultant or broker. A financial consultant, investment manager, or investment broker will be able to look at your portfolio of assets and help you make an informed decision on how much you should be investing in an oil well. Investing in an oil well is usually a large investment ranging from $100,000 to over 1 million dollars USD.

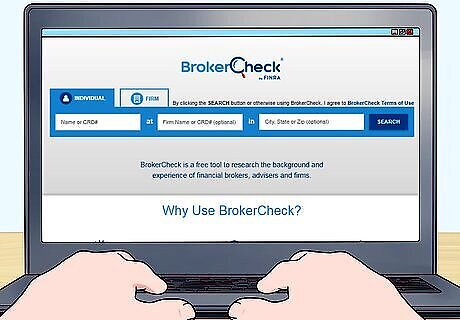

Find a broker who specializes in the sale of oil wells. Brokers must be registered with the Securities and Exchange Commission, or SEC, and must be a member of the Financial Industry Regulatory Authority, or FINRA. To check whether the broker you’re working with is licensed, visit https://brokercheck.finra.org/. A broker with experience in purchasing oil wells will be able to locate you offers and opportunities, as well as walk you through the purchasing process. The SEC is the governing body responsible for protecting consumers and regulating industries and businesses.

Look online for oil well opportunities instead of using a broker. Sites like https://www.plsx.com/ and https://www.crudefunders.com have listings of oil well projects that need an investment to get started. This can give you an idea of what investments exist and what offerings are available.

Look for opportunities with people you know to find good deals. If you have contacts or friends within the oil or gas industry, they may know of oil well offerings that are likely to be profitable. Make sure that you know your contact well, and that they have experience operating or investing in profitable oil wells in the past. They will be able to put you into contact with a broker that can give you more information on purchasing a profitable well.

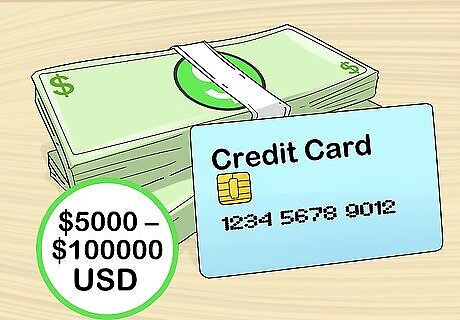

Make a small investment through a Direct Participation Program. DPPs exist for smaller investments from $5,000 to $100,000 USD. Investing through a DPP will give you partial ownership of the company and its physical assets. This means that you’ll receive a portion of its profits after it produces and sells oil from the well. Ask your broker about available DPPs and review your options with them.

Researching Your Potential Investment

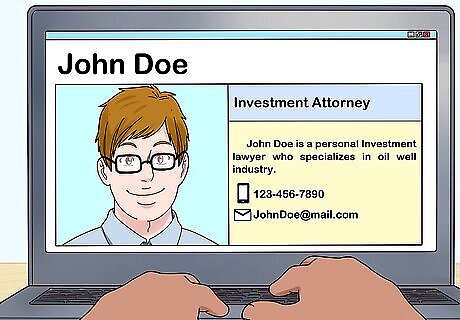

Hire an attorney. An attorney will help you with the investment process and perform due diligence on the company and its staff. Look online for a reputable and highly-rated attorney that has experience with oil well investments. If you already have an attorney on retainer, ask them to refer you to another attorney with oil well acquisition experience.

Do a full background check on the company. Search online for things like SEC filings, news articles, press releases, annual reports, and litigation history. Request a sales or investor brochure as well as access to their data room. If you’ve retained an attorney, you should get them involved in the process so that they can perform due diligence on the company. An oil well’s data room will include sensitive, confidential information on the company, which will help inform your investment.

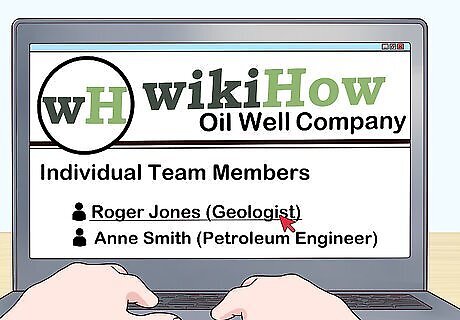

Research the staff running the well. The managers of the oil well should be experienced with a proven track record of working on other successful wells. The team should include qualified and experienced geologists, engineers, and operators. Research the individual team members and leaders online and see if there are any news articles or information on them.

Visit the oil well. Sometimes evaluating documents won’t give you a full picture of the well that you want to purchase or invest in. Take a trip to the oil well and visit it in person. Take notice of the site and the existing infrastructure or operations at the well. Look out for things that look sloppy or out of place. If their operations look like they aren’t well-run, consider investing in another well. You may also want to get a mineral and geological evaluation of the site to make sure that there’s oil in the area.

Ask the lead staff questions. Ask the staff about their production and operation processes, as well as their experience and past success with previous wells. If they seem like they are dodging questions or don’t have answers, it may be a signal that they are inexperienced and that it isn’t a good investment. Questions could include things like how long the company has been in business, the number of wells it's currently drilling, and whether their wells have produced oil in the past.

Talk to other investors. If the well is well-established, other investors can talk to you about their past returns and the investment process overall. This will cue you into how your investment process will be. Ask them if they have received royalties or returns and if there were any stumbling blocks during the investment process.

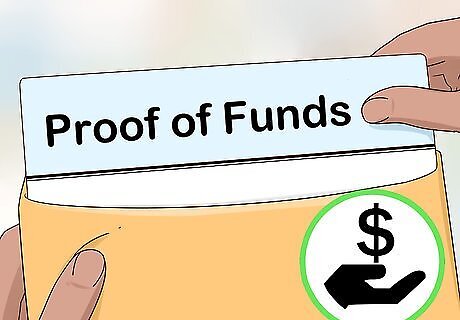

Request to see proof of funds raised. Before you invest, you want to make sure that there are other investors on board, unless you plan on purchasing the entire oil well outright. A proof of funds is a document that proves that other investors are on board.

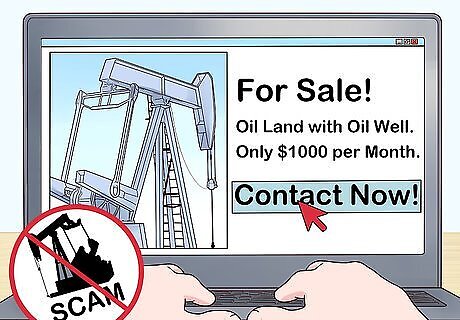

Be wary of scams and frauds. If you’ve fully evaluated the oil well, including visiting the physical location, you’ll have most of the information you need to know whether the oil well is a scam. Be wary of online offers or salespeople who dodge or ignore questions. Profitable oil wells want investors, but don’t need to invest a lot of money into sales or advertising. Contact your state securities commission and make sure that everything is legal before you invest. Beware of offers that are too good to be true, or ones that ask you to act quickly. Aggressive sales tactics are also a sign that the well isn’t or won’t be profitable.

Making Your Purchase

Consider negotiating for a lower purchasing price. Make a final evaluation of the deal and make sure that it’s a fair price and there’s a good chance it will be profitable. If you think that you can get a lower price for the well, or cut costs in any way, put in a lower offer than the asking price.

Speak to your attorney and/or financial advisor. Once you’ve set your mind on a particular company or oil well, have a final conversation with your attorney and financial advisor. Your attorney will help you draft the offer letter or will work with you during the transaction process. Your financial advisor can give you some final advice on the purchase and how it will affect your portfolio. They will also speak to the seller and finalize the transaction.

Finalize the purchase. Once the negotiations are over and you decide on a purchase price, talk to your attorney or financial advisor and transfer the funds to the sellers. You’ll have to read and sign a contract to finalize the deal. If you’re investing through a DPP, pay the funds to receive equity in the well. Make sure your attorney is present and explains the contract to you.

Comments

0 comment