views

Stay quiet about winning the lotto.

Resist the urge to talk about winning the lottery. Don't tell anyone you have won until after you actually have the money. However large the sum, your life is going to change pretty drastically, and it takes a while for your newly minted circumstances to sink in. So relax, take a deep breath, and don't blabber. You want to keep your privacy for as long as possible. It’s okay to tell your spouse or immediate family if you really trust them, but it’s also okay to play this one close to the chest and let them know after the money is in your account. Don’t tell any friends and don’t post anything on social media about hitting it big. Outside of following the requirements about claiming the ticket, do not rush anything. Take your time, go slow, and think through each move you take methodically.

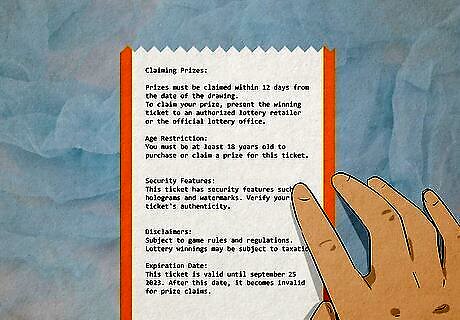

Read the instructions on the lottery ticket.

There may be unique rules about how you claim your prize. Instructions will be on both the lottery ticket and on the ticket agency's website. You wouldn't want your earnings to disintegrate on a stupid technicality, would you? Sign your name on the back of the ticket unless the rules forbid it or unless this would stop you from forming a blind trust to accept the money on your behalf. Make several photocopies of the front and back of your ticket, and deposit the original in a safety deposit box in a reputable bank.

Get a lawyer.

Legal support will help you avoid making a major misstep. You want to weigh your legal options regarding keeping bank accounts and dividing the winnings. Your lawyer will give you expertise and make sure you don't run into any legal pitfalls. Getting a lawyer is mandatory here. Legal help accomplishes three key things: It helps minimize your tax burdens or any mistakes you’ll make by violating lottery rules when claiming the prize. It helps defend your claim to the money and prevents family or friends from trying to access the money. It keeps you from making a major financial mistake while processing the funds and moving the money.

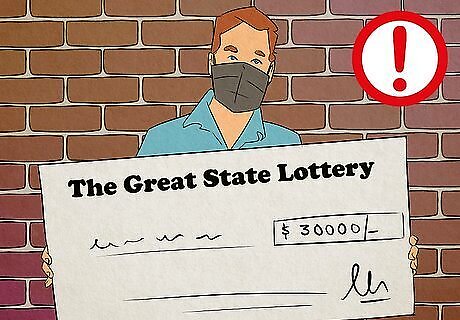

Claim your prize anonymously.

Protect your privacy and don’t make it public you won. In most states, you can choose to pick up the prize anonymously. If you can, do that. If you make your name and face public, and you will likely have interview requests from local news outlets. You may be able to protect your privacy in the way you choose to receive the winnings. Or, you may be able to use legal entities to help mask your identity. Think carefully about whether you want media attention. It's good fun to appear on the nightly news and become an instant celebrity, but that celebrity comes with a few inconveniences. Your friends may begin asking you for money. Your actions will be scrutinized. People will expect you to do certain things now that you are rich.

Ask your attorney about forming a trust.

A blind trust will help you hide your identity when collecting the money. Consider having your attorney form a blind trust before you collect your money. This will let you collect the money while maintaining your anonymity. You will be able to designate the power of attorney, and your attorney will help you iron out any other wrinkle you may encounter in the arrangement.

Estimate your tax burden.

Ask your attorney about how much you’ll owe in taxes. Two things are certain in life: Death and taxes. Well, you probably don't have to worry about death just quite yet, unless the shock of the prize has your heart feeling a little fluttery. But, yes, there will be taxes. Estimate that about half your winnings will go to pay taxes. And you may get double taxed on your win, first when you receive it but also if it moves your tax rate higher you will get a further tax demand at the end of the tax year. All lottery winnings are considered taxable income in the United States, regardless of whether they are received as a lump sum or in multiple annual payments. Holding the lottery winnings in a trust has some tax advantages because it avoids probate of the lottery proceeds upon the death of the winner and minimizes taxes on the estate. Translation: Trusts don't get taxed as much, so consider setting one up!

Form a partnership if the ticket was pooled.

If you bought the ticket with others, you’ll need a legal agreement. If you purchased the ticket as part of a group, you're probably going to need to have a major discussion and plan with your group. Consider the circumstances of tickets purchased jointly or by a group of individuals. Was there a verbal agreement to share the winnings? Can it be enforced under state law? Forming a legal partnership may be a better way to receive the winnings on behalf of all the partners rather than having one person receive the checks.

Hire an accountant and financial advisor.

This can be one person, separate people, or an entire firm. Contact a reputable accountant and/or financial advisor. You will want to do this before spending any money. They will help you weigh all possible options and give you the best possible counsel for managing your winnings. Your financial advisor will discuss with you a plan for how much money to spend versus to save, whether to invest your money and where, along with projections like when you can expect to retire. Consider a private bank and private banker just for your lottery and have the proceeds of your investing deposited in your regular savings account, moving the money to checking as needed. Set up a trust at your private bank for your children and grandchildren to draw from.

Determine if lump sum or annual payments are best.

Annual payments are safer but less efficient than lump sum. Taking annual payments will allow you to make a year or two of potentially bad financial decisions while you learn the ropes of the best ways to manage your money. However, it’s usually better to take the lump sum if you want to maximize your returns. Due to inflation, taking the lump sum and investing it early is more efficient than taking annual payments where the value decreases over time. However, each option is perfectly viable.

Spend a few bucks enjoying life.

Give yourself a modest initial spending spree to scratch the itch. Lottery winners who go bankrupt often go crazy buying houses and cars in the initial stages of having their winnings. Sock away the rest of your winnings so you can live on the interest and dividends. It's probably not the most attractive proposal, but balance out your short-term interests with your long-term goals. No one ever regretted having saved money in the long run.

Use gifts and donations to minimize your tax burden.

Family and friends can help you reduce how much you’ll pay. Lottery winners can make a gift of their winnings, up to the annual exclusion limit, without incurring gift tax liability. Making gifts to charities also has advantageous tax implications for lottery winners. A good way to help your loved ones is to pay off their debt, helping them long term instead of just gifting them in the short term. Think about giving to charities that you feel strongly about, or organizations that are in need. Make sure you know their work is reputable and not invented yesterday. Make the recipients of your gifts sign confidentiality agreements. This will keep them from revealing the disclosure of your gift for at least five years.

Keep your job, if possible.

Consider not quitting your job just to maintain normalcy. You may be wealthy; however, you will need something to keep you busy and keep you from spending all of your newfound riches. Try working part-time or taking a leave of absence. Now is the perfect time to explore that career you always wanted. Whether it's being an artist, franchise owner, or high school teacher, pursue the job you really want now that you have the means and some time to explore. Consider going back to school. If you love learning and the satisfaction that comes along with knowledge, think about enrolling in classes that interest you. You don't need to get into Harvard. A simple community college will do, as long as you're giving your brain a workout. Consider taking financial classes, they can help you understand the reports from your team of financial advisors.

Pay off your debts.

Get rid of your mortgage, student loans, and credit debt. Now that you’ve got your lottery winnings, you can pay off any debt that you’ve been holding! Just wipe out your debts to save on any future interest payments. Go through your credit and personal accounts to pay everything off. You’ll sleep so much better at night!

Invest in stocks, bonds, and real estate.

Make your money grow by putting it to work. You know that saying, "You need money in order to make money." Well, that statement still applies, and guess what…you have money. You have a chance to make a significant amount of money merely by investing. It's not iron-clad, but it's a good way to make sure your money isn't just wasted or sitting there "not working for you." Remember, if your investments are not producing more return than inflation then in real terms the "purchasing power" of your money is actually shrinking. Diversify your portfolio, but have a cap on risky investments. Consider safer routes, such as fixed-income products like T-notes or municipal bonds. Ask your local credit union if they need another volunteer board member. Learn the financial ropes. If you're in the US, remember that the US government only insures each bank account up to $250,000, which means that you shouldn't have more than $250,000 in each bank account if you want to be safe. Invest money that isn't in a bank account in the bond or stock market.

Don’t flaunt your wealth.

Keep a low profile and don’t trust brand new faces. Keep your old friends close. You already trust them and know that they're there for the long haul. Try not to be flashy or attract any unwanted attention.

Spend your money wisely.

Buy smart to avoid running out of money over time. You may have enough money to buy an island and create a micronation, but you still have to run that micronation. Consider the additional expenses involved before buying anything. Think before you buy a house. How much will property taxes be? How much will utilities be? How much will I spend on upkeep? Consider also that the value of a house often fluctuates with the market. Think twice before you buy a fleet of Porsches. Cars lose half their value as soon as you drive them home from the dealership. Expensive cars require expensive maintenance, and foreign cars have tariffs slapped on them by governments.

Spread the wealth, but don’t pay for everything.

Treat your family to something special if you’d like, but don’t overdo it. If they were there for you long before you were a lottery winner you may want to treat them to something special. But you are under no obligation to relieve any of their financial duress if they have any. Remember that your family can help you. As a rule of thumb, spend no more than 20% of your earnings on friends and family members.

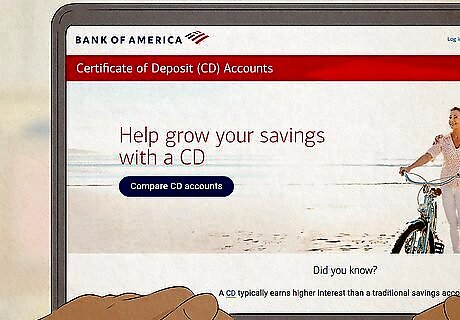

Build CD ladders to help your savings earn more.

You can buy up to $250,000 in cash deposits (CDs) at any bank to have them remain insured by the FDIC. Buy the current highest interest-bearing CD for the shortest term possible and roll or repurchase at a higher rate until you can find a better rate of return. Do this at varying intervals to create a “ladder” that’s always rotating you into competitive rates. Your bank will help you do this.

Comments

0 comment