views

Requesting a Credit Report Online

Visit the Equifax website to obtain your report online. Visit https://www.equifax.com/personal/credit-report-services/free-credit-reports/ to get your credit report. Click "get started" to begin.

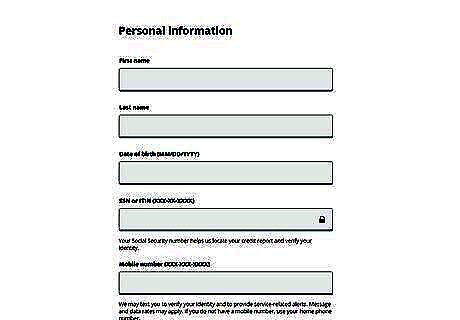

Provide your personal information and verify your identity. Fill out the form by providing your full name, your date of birth, your address and phone number, and your social security number. Equifax may ask you for more specific information to verify your identity, such as a previous address or how much your monthly mortgage payment is. Create a free account with Equifax to streamline the process. When you create an account with Equifax, you won't have to provide all of the same information, just update anything that has changed. You'll also get 2 additional free credit reports each year.

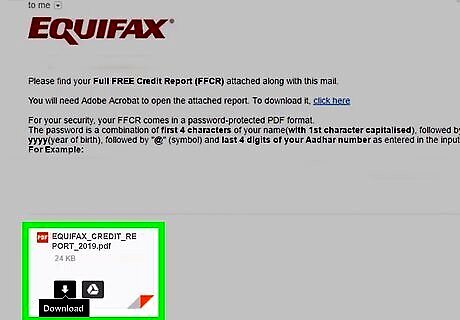

Get your report instantly. Once you've finished filling out all of your information, you'll be taken to your credit report instantly. You can download and save your credit report for your future reference. You can also monitor any requests you've submitted, freeze your credit, and get fraud alerts online.

Talking to a Representative on the Phone

Call Equifax to have a report mailed to you. Speaking with someone over the phone can help walk you through the process of requesting a credit report. To talk to an Equifax customer service representative, call (877) 322-8228. This might be a good option if you are confused about any of the information Equifax requests for a credit report.

Provide the necessary information to the representative. The customer service representative will ask you for your full name, your date of birth, your address and phone number, and your social security number. The representative might ask you for additional information to confirm your identity, such as a previous address or how much your monthly mortgage payment is. You may have to provide more information than you would online to prove your identity over the phone.

Wait 15 days to get your credit report in the mail. If you request a credit report over the phone, you will automatically receive your full report within 15 days by mail. If there are any issues processing your request, you may get a follow-up call. Make sure that you give the representative a current address where you can receive your report.

Sending a Request through the Mail

Send a request through the mail to receive a hard copy of your report. Requesting a report by mail takes longer than requesting a report online or by phone. However, it can be more secure. If you have concerns about filling out private information online or giving it over the phone, you may want to send a request by mail.

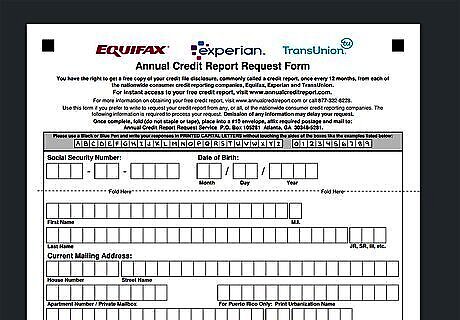

Download a request form and fill it out completely. You can find and print the request form at https://www.annualcreditreport.com/manualRequestForm.action. Fill out each field completely to ensure that there won't be any difficulties processing your request. The form will ask for your full name, your date of birth, your address and phone number, and your social security number. Make sure to print your information clearly using blue or black ink.

Mail your request to Equifax headquarters. Make sure that every field is completely filled out and you are using the correct postage before you mail it. After you mail your request, you should get your credit report in around 15 days. Mail your request to: Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281 If Equifax needs more information to confirm your identity, a representative may call you at the number you provided on the form.

Taking Precautions with Your Credit

Request a credit report every 12 months. You are entitled to a free credit report from Equifax, as well as TransUnion and Experian once a year. It's a good idea to keep track of your credit score from all 3 credit reporting companies. Knowing your credit score can help you make decisions about applying for loans or mortgages and keep track of any suspicious activity.

Be wary of unofficial websites offering free credit reports. In some cases, a third-party service will offer "free" credit reports and then ask you to enroll in a paid membership. In the worst case, predatory sites can use your information to steal your identity. Only request your report through http://www.equifax.com or http://www.annualcreditreport.com to be sure that you are getting an official credit report.

Submit a dispute if something in your report is wrong. If you see activity on your credit report that doesn't look right, contact Equifax to file a dispute. Equifax will look into the issue and update your report within 30 days. You can submit a dispute at https://www.equifax.com/personal/credit-report-services/credit-dispute/ Make sure that the credit cards on your report are cards that you opened in your name, all of the loans in your name are ones you personally took on, and your public record information looks right.

Request to freeze your credit if your identity has been stolen. A credit freeze prevents others from seeing your credit report. You can place a freeze on your account while you are disputing the identity theft and getting your accounts back in order. You can temporarily or permanently lift the freeze at any time. You may have to pay a fee to freeze your credit, depending on where you live. If you request a freeze through Equifax, you also need to request a freeze through Experian and TransUnion.

Comments

0 comment