views

Completing the Transaction

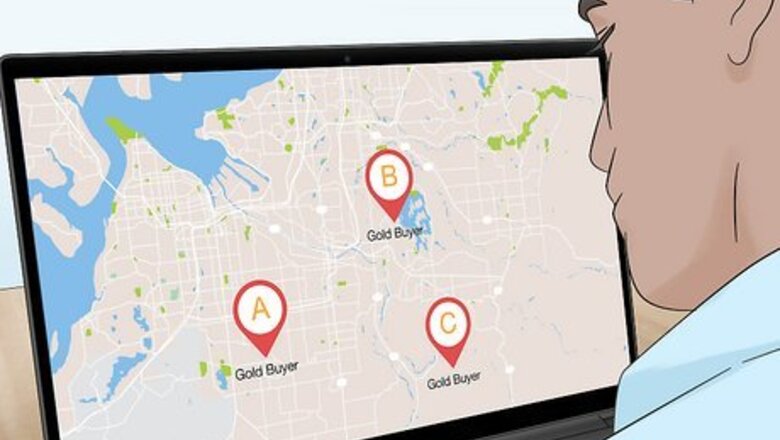

Compare prices from various buyers. You'll want to get the best bang for your buck. Doing a simple online search of gold buyers in your area should provide multiple businesses. There may not be a large degree of variation between the buyers because of the spot gold price, but give each a call and find out what they are currently offering. The US Mint does not necessarily get involved in the pricing, but they do provide a handy tool that allows you to find local buyers/sellers. There are many other exchange sites that keep track of precious metal (i.e. gold, silver, platinum). Just search online and there is a wealth of resources. Be aware the spot gold price may be the current price, but many dealers charge a premium to buy the gold.

Lock in your sell price. Because the price of gold fluctuates so rapidly, once you find the right location to sell your gold, you'll need to move quickly to lock in the price. Waiting too long could cause your gold coins to lose significant value. Some require a simple online form to be filled out with the various details.

Sell your gold coins in person. Once you establish a plan to do business with a local dealer, they may require nothing more than a phone call to lock in a sell price. They'll likely want to weigh your gold in person and verify the clarity of the coins. However, selling gold in person has a few disadvantages. There is no guaranteed assurance your gold will not be substituted with something less valuable, but similar looking. Selling gold by hand will likely incur a higher premium. Gold insurance scams are common, and premiums are developed to overcome the scams.

Sell your gold coins online. Online dealers provide a fairly straight-forward method of selling gold coins. Most have nothing more than a few steps to complete before shipping the gold. Check the following steps and you'll likely be well-prepared: Register for an account on the respective website. Call their trading department for a current price. Talk with their specialist regarding your gold coins' value Determine if there is a minimum amount to sell in order to do business with them.

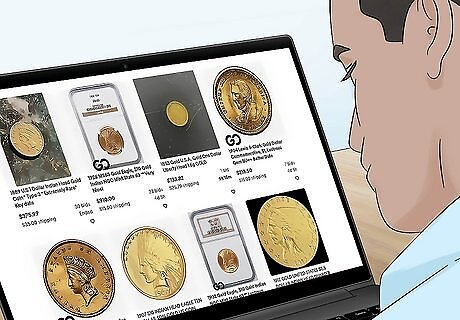

Sell your gold coins on an auction site. You can put your gold coins on auction sites like eBay if you'd like to see if someone is willing speculate and pay a little more. Depending on the auction site, there may be a registration process, but some simply require the completion of an online form and submission of a photo of your gold.

Finish your sale. Once you've figured out all the details on your coin, the method of selling, and negotiated the price, it's time to get paid. Some gold exchanges will allow you to fill out a form with routing number and checking account number for an ACH transfer. You may even be asked to provide a voided check for ACH transfers. Buying and selling gold is often done with cash, however, so be prepared to work without credit.

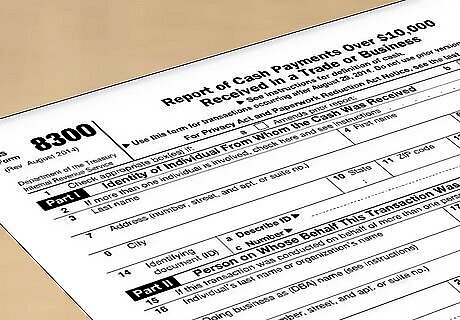

Pay taxes on your sale. Depending on the amount of gold coins you sell at one time, there may be tax implications. In general, the 1099-B form needs to be used when selling at least 25 of any of the following coins: Gold 1oz Maple Leaf Gold 1oz Krugerrand Gold 1oz Mexican Onza.

Shipping Your Gold Coins

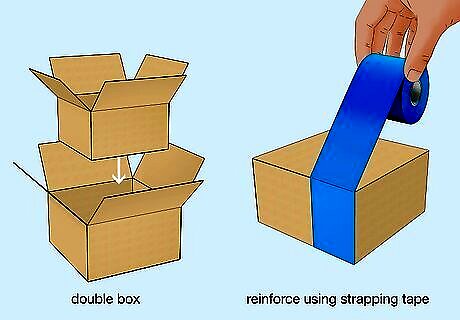

Package your shipment. Remove everything on the box that may indicate anything related to gold coins inside the box. A business name indicating gold, or anything related to bullion, is a clear indicator of the contents. Follow the steps below to ensure your package doesn't encounter any issues when sending out your gold coins: Double box - one inside another - in case the outer box rips/breaks. Use heavy-duty tape with nylon to cover every single edge and corner. Ensure the package is as secure as possible. Reinforce heavier packages with strapping tape. If the business with which you are dealing requires something extra, like a filled out form or a voided check, include it in the box where applicable.

Choose your method of shipment. There are several options when choosing how to send your coins. In general, the most secure method, discrete method possible is preferred. You may even be able to deliver it by hand. USPS doesn't have fuel or residential charges like UPS and FedEx, but that doesn't mean the price will be cheaper. Some sellers offer door-to-door services. An overnight shipping label will be sent to you, and pickup will be scheduled according to their schedule.

Include any shipping extras. Because gold is more valuable than the average shipment, and likely more prone to theft, you'll probably want to take some extra precaution when shipping your coins to ensure everything arrives to the buyer safely. Ensure you get a confirmation number. You will want to track the package, something also called delivery confirmation. Get insurance. Larger carriers offer loss or damage protection. Some, like UPS, offer up to $100 USD coverage for free. Based upon the declared value, you will have to make additional payment.

Researching the Gold Market

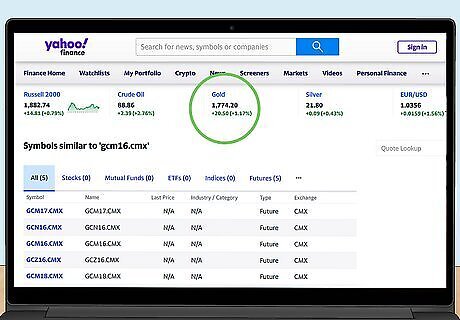

Research the spot gold price. The spot gold price is basically the current going price for gold if you were to try and sell your gold coins over the counter to someone. Typically, the gold is sold by ounce, gram, or kilogram. Check the price on a larger finance website. The basic gold ticker is GCM16.CMX, and everything about the current price, historical price, and various financial indicators like Simple Moving Average (SMA) is listed on most financial websites. Monex.com has current prices and charts, and has been operating for more than 40 years. Kitco.com is a more news-oriented site. You can get the latest prices as well as lots of recent news regarding the current price of gold.

Choose the gold coin to sell. Some gold coins are easier to sell than others, particularly depending on your location. Some have purity guarantees, and can even be added to retirement accounts. The rarer coins are more difficult to sell, because grading can be both difficult and debatable. Within the U.S., the Canadian Maple Leaf (24-karat) and American Eagle (22-karat) coins are the most frequently used. The American Eagle coin is guaranteed pure by the U.S. Mint. Outside the U.S., the Canadian Maple Leaf dominates. It's also easier to sell the South African Krugerrand and Austrian Vienna Philharmonic. The U.S. made a pure gold coin called the American Buffalo in 2006. It was intended to compete with the Maple Leaf, but it's not used as frequently.

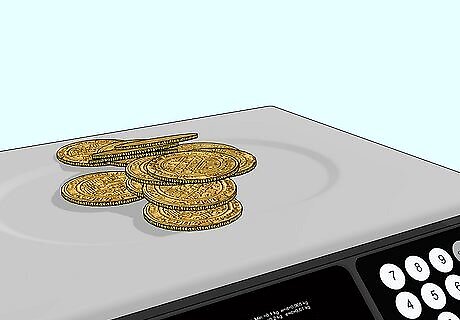

Determine the weight and value of your gold. Actual gold weight (AGW) of your coins is typically displayed in Troy ounces (i.e price per troy ounce). If the ounces aren't displayed, weigh the coin first. After it's weighed, you'll need to know the amount of non-gold metals inside the alloy. Once you know the AGW, multiply it by the gold price per Troy ounce to know the value of your coin. For impure coins, you'll have to break down the fraction included in AGW. For instance, if the coin were to weigh two ounces, and it was 50% pure, you'd have 1 Troy ounce AGW. Keep in mind a Troy ounce (31.1 grams) is not the same as a normal ounce (28.35 grams). If not specifically listed, you'll need to confer with a professional to determine the non-gold metals in your coin. Convert grams to AGW by dividing the grams by 31.1035. Some coins are standardized, and have the weight in Troy ounces displayed prominently.

Comments

0 comment