views

Creating a Business Plan

Decide on the products or services your business will provide. Consider your unique abilities, training, or experience. Then, ask yourself how you can use these skills to create a product or service that provides value to your potential customers. For example, let’s say you’re a trained graphic designer with experience in web design. You might use these skills to start a web-design business.Tip: When deciding what products or services to offer, consider if you want your career to be exclusively online or if you want to create physical products, such as arts or crafts.

Determine how much time you can spend on your business daily. First, decide if you want your business to be your full-time job or a part-time job. Then, consider how much time you have available in your day to dedicate to the business. Additionally, consider how much time the products or services you plan to offer will take to do well. Since it will likely take time for your business to become successful, it may be best to start out part-time. Some businesses may be more flexible than others. For instance, freelancing as a web designer or selling crafts may allow you to work when you want, while jobs like consulting may require you to work around a client’s schedule.

Do market research to find out if there’s demand for your product or service. Read about the current trends in the field you want to enter, and look at the number of possible competitors. Additionally, it’s helpful to survey your potential customers, either by phone or in person, to find out if they’d be interested in what you have to offer. This will help you determine if your business can fill a need that’s not currently being met. For instance, you might call local businesses to ask if they’d be interested in hiring a freelance marketing consultant to run their social media accounts. If you’re selling a product, you could show it off at a local market or to friends you think would be interested in it to see what type of response it receives. You don’t need to do marketing research to start a business, but it can help you increase your chances of success.

Make sure your products and services are a good fit for an internet business. Not all businesses can exist in as an online or home-based business. For instance, if your business requires you to meet with clients or do extensive manufacturing, you may not be able to do it out of your home. However, some businesses are easy to operate out of a home, such as the following: Accounting Financial planning Selling your own art, jewelry, or crafts Creating gift baskets Blogging Consulting Doing graphic design Offering editorial and writing services Being a virtual assistant Developing websites

Set a budget for starting and continuing your business. The costs of starting your business will vary dramatically depending on the specific type of business being offered. For example, a home-based online book store requires inventory that you need to purchase. Alternatively, a service-based business may require little start-up capital. Estimate how much money you’ll need to get the basic materials for your business. Additionally, there are a few general costs that are central to most online businesses, which you need to add to your budget: Website hosting – Chances are good your business will require a website. Web hosts are the services that keep your website up and running. They usually cost $7-$19 per month, depending on how much technical support they offer and the size of your site. Website design – This cost can vary because you can use an inexpensive template, build the site yourself, or hire a designer. You can create a basic site yourself or using a template for less than $100, but a designer may charge $1000-$5000. Shopping cart – If you are selling products and services that can be bought online, you will want an online shopping cart for your customers to put them in. You may be able to get a service that only charges you when you complete a transaction, but many services charge $5 per month. Email Marketing Service – Building an email mailing list is key to advertising your product and making money. The typical service costs about $20 per month. Materials costs – If you’re selling a product, this includes the cost of your materials to make them, as well as any manufacturing equipment you’ll need. If you are offering a service, this includes things like software or supportive services. Website maintenance and security – You'll need to make regular updates to your website, which may bring added costs. Additionally, you may need to pay extra to protect your client's data, especially if you're completing payment transactions.

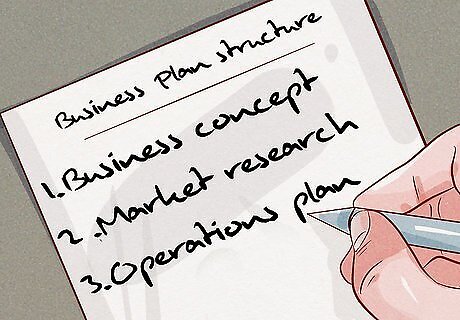

Write your business plan. A strategic business plan will help you stay on track to reach your goals, so even a small business needs a plan. Your business plan includes everything about your business, such as the following: Business concept: Describe your business and its structure, including the products or services you’ll offer. Additionally, briefly discuss the market for your business. Market research: Describe the market you are entering, including your major competitors, your target market, and the needs of your target market. Marketing plan: Explain how you plan to enter your market, how you will communicate with customers, and how you will distribute your product or service. Operations plan: Explain your day-to-day operations, including steps involved in the production of your product or service. Financial plan: Outline how you will finance your business, what your expected costs are, and how much estimated revenue you expect to make.

Registering Your Business

Determine the legal structure of your business. This will have implications for how you file taxes and how much you will need to pay. Most small businesses are sole proprietorships which are the easiest to set up and require the least paperwork. If you are considering another legal structure, you may wish to consult a lawyer who specializes in internet law and who can help you pick the structure best for you. Sole proprietorship – A sole proprietorship is owned and run by one person, and there is no legal separation between the individual and the business. As a result, all profits, losses, debts and deeds of the business are your responsibility. This is an easy option for a home business. Partnership – A partnership means 2 or more people share ownership. Typically, a lawyer helps negotiate a partnership agreement. Each individual partner is liable for the full debts of the business but share profits, losses, or liabilities. You might choose a partnership if you want to work with someone else. Limited liability company (LLC) – To start an LLC, choose a name and file articles of organization with your state, which requires a fee. LLC owners pay taxes on their profits through their individual income tax returns and have to pay self employment tax, but they’re protected from personal liability for the decisions and actions of the company. Corporation – This is an independent legal entity owned by shareholders. To register your corporation, choose a company name and file articles of incorporation with your state. You will also need to register with the IRS and get a tax ID. Corporations file taxes separately from their owners. It’s best to speak with a lawyer or accountant to see if this form of business will benefit you. This structure is generally not appropriate for smaller businesses. S Corporation – This is an independent legal entity owned by shareholders, like a typical corporation, except that to avoid double taxation, profits and losses are passed through to the owners’ personal tax returns, instead of the company paying taxes.

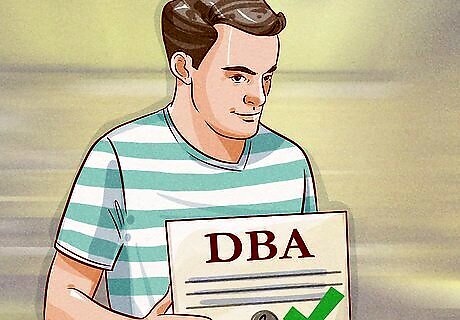

Register your business name with your state government, if necessary. A DBA (Doing Business As) is needed whenever you are doing business under a name other than your own. If you are working as an independent contractor under your own name, you don’t need one. If your business has a name other than your own, you will need to register that name as a DBA. Registering a DBA name is typically done through your state government or county clerk's office. Since the procedure for registering varies between states, it is wise to search the specific requirements of your state online beforehand. The registration process typically only takes a few minutes to complete. Keep in mind that a DBA name is still required if you are starting a corporation.Tip: A DBA is typically useful for sole proprietorship, since not using a DBA name means that your business name will automatically default to your personal name.

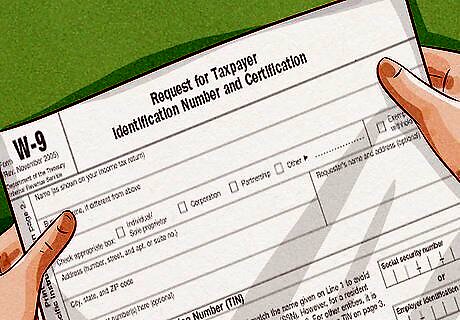

Determine if you need to get a tax identification number for your business. Corporations that must file tax returns will need one, as well as partnerships, which don’t file taxes, but do have to file business information annually with the IRS. While the IRS does not generally require a tax ID number for sole proprietorship, as you can use your Social Security number instead, you will need a separate tax ID if the following apply: You have employees. Your company will be responsible for half their payroll taxes, and must thus have a tax ID with which to pay them. You file employment, excise, or alcohol, tobacco and firearms tax returns related to your business. You withhold taxes on income other than wages paid to a non-resident alien. You have a Keogh plan (a tax-deferred pension plan for self-employed individuals or unincorporated businesses). You are involved with trusts, estates, real estate mortgage investment conduits, non-profit organizations, farmers' cooperatives, or plan administrators.

Obtain the necessary licenses and permits to run your business. You may not need any special licenses or permits, but it helps to check. Otherwise, you may be fined or penalized for not having the correct documentation. For example, if you are offering accounting for financial services, you will need a license in most states. Check here to see you need a state permit or license: https://www.sba.gov/business-guide/launch-your-business/apply-licenses-permits You may also need a permit or license from your city or county, so check with your local government ot be sure. The best way to find out if your particular business requires any unique permits is to contact your city, describe your business, and inquire about any requirements. For example, many cities require "Home Occupation Permits", which enable you to operate a business from your home.

Register your trademarks and other proprietary information. Although you'll need to pay required fees, your ideas can help you make more money in the long-run. Additionally, they can give you an edge against your competitors, so make sure you protect them with a trademark or patent. You can register a trademark or patent through the U.S. Patent and Trademark Office. You can find the U.S. Patent and Trademark Office here: https://www.uspto.gov/trademarks-getting-started/trademark-basics It's best to work with a lawyer to protect your intellectual property.

Establishing Your Website

Decide if you want to hire a professional web designer or do it yourself. A professional can create a polished website, but their services can also be expensive. Consider what you can afford, as well as what you need your site to do. From there, you can decide if you want to use a template or hire a designer. If you have web developing skills, you might decide to just build the site yourself. Web designers build your site and take care of registering your domain name and selecting a web-host. The more you pay, the more input you will have in creating a unique site. The cost of web design varies depending on whether you use a solo developer in the US ($25-$100/hr), an offshore web company ($10-$40/hr), or an established US agency ($60-$200/hr). E-commerce sites typically cost more. To get around this, you can use your site for marketing but then link to a site like Amazon or Etsy to complete the transaction.

Select a web host if you’re building your website yourself. A web host provides the space and support services necessary to run your website. They own the physical servers that your site exists on. For instance, WordPress, Go Daddy, HostGator, Bluehost, and Wix are all web hosts. Research different web hosts before making your decision. Additionally, read client reviews to get a feel for how satisfied people are with each web host. Choose a company with good tech support. That means if your site goes down, you should be able to call someone to get answers. Since your business is dependent on being online, an issues need to be promptly resolved. Pick a site that backs up your website and provides technical patches automatically.

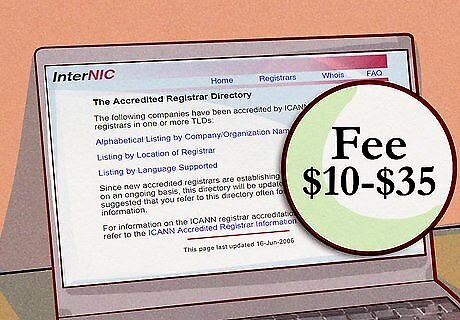

Register your domain name either on your own or through your web host. Your domain name is the web address of your online business. Domain names must be registered with the Internet Corporation for Assigned Names and Numbers (ICANN). You will pay a registration fee ranging from $10-$35 in order to register your name for a year. You will need to renew it annually at the same cost. However, most web hosts register your domain for you, so you may be able to skip this step. Check with your web host to see if they register your domain for you. This will be explained in your user agreement. If you plan to register your domain yourself, visit here: http://www.internic.net/regist.html

Decide how you will build your website if you’re doing it yourself. There are multiple options available for creating a website, and the option you choose will vary based on your web-design abilities, time, and level of quality demanded. Here are some alternatives: Use a template – Sites like WordPress, Square Space, and Wix all offer templates that help you build a professional-looking site. Some templates are free, while others carry an additional charge. Free business website services – Services like Moonfruit, Weebly, Qapacity, Jimdo, and Yola offer website construction where all you have to do is pick a format and provide content. Many are free, with inexpensive upgrades for premium services. Ask local or state business office for help – Many states will assist you in building a business website for free. Check here for a list of state business offices.

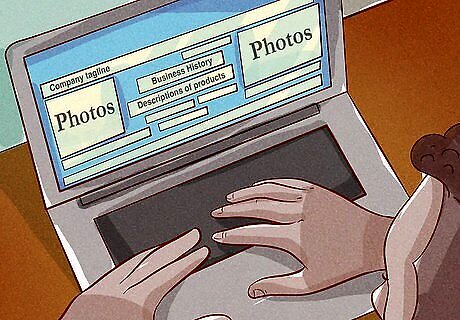

Organize your site and provide content. Whether you build your site yourself or use a designer, you will still need to create the content that fills the site. Your content will likely include: Photos and descriptions of products/services A company tagline or motto A business history and/or personal bio A blog Reviews from customers

Improve your website's placing in searches with search engine optimization (SEO). Search engine optimization will help your website to show up near the top of searches. You can hire a company to do it for you, or try some of the following on your own: Put keywords in the copy on your webpage. Think of words or phrases customers might use to search for your product, then use the Google Keyword Tool to find similar phrases. Include these phrases on your home page and throughout your site. Add links to sites your customers might be interested in. Links into and out of your site are another factor in how high you rank in search engines.#*Update your site regularly. This will push your website higher in the search rankings. Consider writing a blog twice a week, and use keywords whenever possible. If you can’t write a lot, add pictures regularly. Use website analytics such as Google Analytics to see the effectiveness of your website's search engine optimization.

Decide whether you want to use e-commerce software or have transactions handled by a 3rd party. A 3rd party site, such as Etsy, Shopify, or Amazon, may be easier to set up. Plus, these sites may provide more technical support. Alternatively, you can install an e-commerce platform directly on your website with services like Squarespace, Magento, Bigcommerce, Woocommerce, or Webs. These services are more powerful and customizable, but also require much more time and technical know-how. For most newcomers to internet business, a hosted solution is your best option. These services are easier to use and maintain, and work well for small purchases.

Make sure your website is polished and user-friendly. As you build your website, keep in mind that it serves two main purposes: to advertise your product or service and to facilitate sales. It should do both as simply and as clearly as possible. Here are the best practices for creating a professional site: The site is simple and looks professional. The site loads quickly and is viewable on all browsers and devices. The site is easy to navigate in order to find necessary information and purchase goods or services. The site features attractive photography, particularly if you are selling tangible objects that can be photographed. The site provides contact information, such as your phone number.

Marketing Your Business

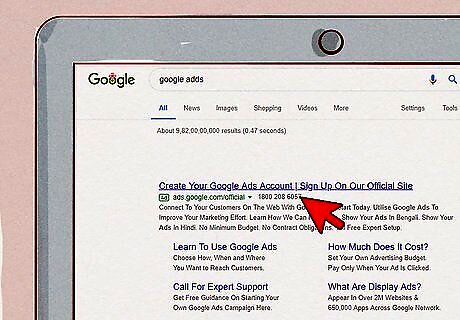

Explore pay-per-click advertising. Buying traffic is the quickest way to bring people to your site, and vendors will allow you to target specific geographical areas with keyword searches. Make sure you are targeting the right audience. Clicks cost you money, and if tons of visitors leave without purchasing your services or product, you can lose money. There are two major advertisers: GoogleAds – Your ads appear in the sidebar when someone enters certain search terms that you select. Facebook – Your ads appear in the newsfeed for an audience that you select according to location, sex, age, and interests. The more specific your audience, the more successful you will be.

Make contacts and establish affiliate sites. Find quality sites related to your business and ask if you can advertise on their site, in return for their advertising on yours. Affiliate sites bring high quality traffic that often translates into sales. As an example, if you are operating a business to teach English to non-English speakers, perhaps consider reaching out to a high-quality site that provides services to recent immigrants. Advertising through a site like that could bring in traffic for you, whereas by advertising on your site, their business could access your customer base.

Create a social media presence. Americans spend 1 out of every 7 minutes on social media, and this represents a tremendous marketing opportunity. Start by focusing on the platform your customers are most likely to be on and build a presence there. Create a Facebook page. Every business should have one, even if this isn’t your main social media outlet. Get on Twitter. You can use twitter to connect with customers and share information about your products or services. Use Instagram. Post photos of your products or photos related to the services you provide. Post videos on Youtube.com. Youtube can be an effective way to create content that can simultaneously work to market your services and to educate customers. For example, if you offer a membership-based site that provides investing advice to customers, use Youtube to create free advice content, which can then link to your product or service.Tip: Post on social media frequently, such as at least several times a week, and preferably once a day or more. Pictures are an easy way to do this. Also, keep followers up to date on new products, sales, and other business-related info.

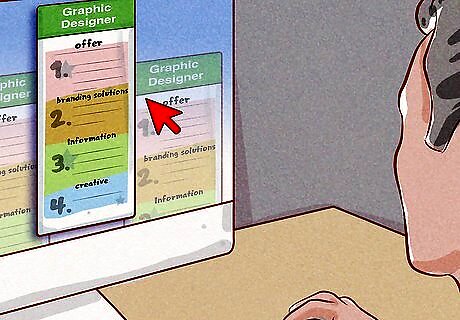

Publish an e-newsletter. A weekly or monthly newsletter is one of the best ways to use your email list. Make sure to provide value-added content that people want to read, instead of intrusive sales pitches. For example, if you are a graphic designer, offer helpful information about how graphic design and branding solutions can work to attract new customers. Consider writing a blog as a replacement or in addition to an e-newsletter. Every published blog post has the potential to increase your search engine ranking, therefore making it an excellent way to draw in new customers via the internet. As mentioned before, try to make your content useful, rather than a simple sales pitch. For example, if you offer computer training, you might review a newly released computer, or if you’re an accountant, you might discuss some new rules impacting this year’s taxes. Consider guest blogging. Contributing quality content to related blogs shows off your expertise and can bring people to your site.

Use press releases. A quality press will be picked up by major search engines and hundreds of websites and posting one is relatively inexpensive, typically $200 to $300. There are several wire services to choose from, including PR Newswire and PR Web.

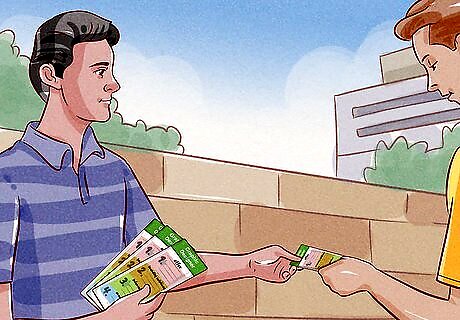

Promote your website in the real world. Mention your site to customers and friends, and make sure your web address is printed on everything, including your letterhead, business card, and any brochures you might have. Keep in mind that simply because your business is online does not mean you cannot benefit tremendously from traditional advertising methods, and this is especially true if your online or home-based business relies on or markets to local customers. A graphic design service, for example, can benefit tremendously not only from internet traffic, but also from relationships with local businesses and organizations. If your business fits this profile, consider taking out advertisements in newspapers or on radio, or attending local networking events related to your product or service.

Keep up with reviews on sites like Yelp and Kudzu. Good reviews are a great way to get business, and the best way to get them is to provide friendly, quality service and great products. However, you should also keep an eye out for negative reviews so that you can post your side of the story. Bill Gates Bill Gates, Businessman & Philanthropist Learn from challenges and failures.' "It's fine to celebrate success but it is more important to heed the lessons of failure. Your most unhappy customers are your greatest source of learning."

Comments

0 comment