views

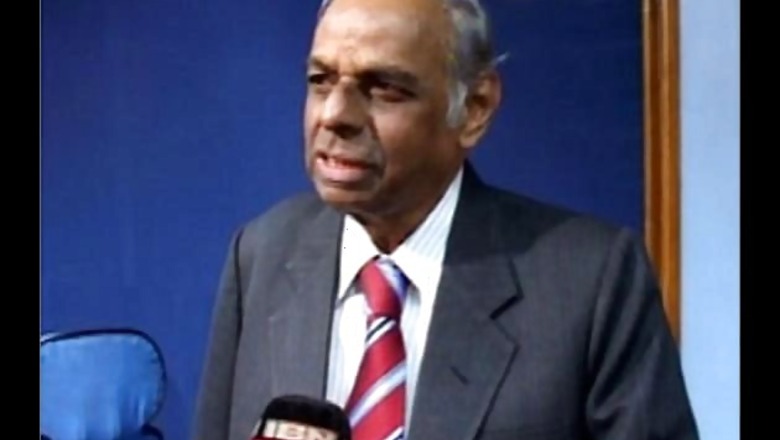

The Reserve Bank must continue its tight monetary policy until stability in the rupee value is achieved, Prime Minister's key economic advisor C Rangarajan said.

"The current stance of monetary policy has to continue until stability in the rupee is achieved. Thereafter, if the current trend in the moderation of wholesale price inflation continues, which is in fact expected, the monetary authorities can switch to a policy of easing," Rangarajan said while releasing the Economic Outlook for 2013-14.

The time frame for this is difficult to specify and much depends on stability in the foreign exchange markets, he said.

The rupee depreciated to 63.50 against the dollar on Thursday from 54.99 on December 31. Raghuram Rajan, who took over as RBI Governor on September 4, said that apart from monetary stability, the central bank has the mandate for inclusive growth and development as well as financial stability.

The Chairman of the Prime Minister's Economic Advisory Council (PMEAC) said "there is a big dilemma facing the RBI because controlling inflation, maintaining price stability, is one of the major objectives of the monetary authority."

It has to take into account the impact on growth and what is happening in the real sector, but the primary responsibility of price stability rests with the Reserve Bank of India, he said.

Rangarajan on Friday lowered the growth forecast for the current fiscal to 5.3 per cent from 6.4 per cent projected earlier. Inflation at the end of March is estimated at 5.5 per cent. If pressure on the rupee had not mounted, he said, the policy easing would have continued, he said.

"Therefore, the dominant factor influencing the monetary authority will be the stability in the foreign exchange markets and if the stability in the foreign exchange markets continues, it will give greater room for the monetary authorities to act," he added.

Comments

0 comment