views

Seoul/Helsinki: Dethroning Apple's iPhone could prove to be too big a bite for some of the old leaders of the cellphone industry, including LG Electronics, who are only now scrambling to catch up with their phones and services.

Nokia, Samsung and LG control 70 percent of the total handset market but their failure to stop Apple's roaring march in the smartphone market has hit their profits and is now raising questions about whether it is a fight they will want to continue.

Apple, which entered the handset industry only three years ago, makes one iPhone for every 13 phones Nokia sells, but it generates larger total profit from these fewer phones.

Following troubles of smaller vendors Motorola and Sony Ericsson, LG's phone unit bled a record loss in the second quarter.

Also, the value of Nokia's brand - one of its key assets - dropped 58 percent last year, according to a global study by market research firm Millward Brown.

And that may be just a start.

"None of them will emerge quickly from the trouble and it could get only worse before getting any better maybe in another year or so," said Greg Noh, an analyst at HMC Securities.

"As long as they fail to differentiate themselves, it'll continue to be Apple versus others and they have more difficult times ahead as competition will get only tougher with more producers joining the fray."

Smartphones account for around 20 percent of the broader handset market but the sector's 56 percent growth rate well outpaces a 10 percent expansion of overall handset market, according to Goldman Sachs, a key reason why the industry is attracting major vendors and companies across industries.

Last month, Hewlett-Packard Co sealed its $ 1.2 billion acquisition of Palm Inc, while many other PC makers, such as Acer, are trying to win a share of smartphone market on their own.

Too late for LG?

At the moment, LG, the world's No 3 handset maker, looks most vulnerable and could go down the road for restructuring as it warned that the company may report another record loss in the current quarter.

LG, which has not launched any hit smartphones so far, is pinning hopes on its Optimus One, due this quarter. But it may be coming too late to the party with a mid-priced phone that likely catches up to rivals but won't leave them in the dust.

"They risk getting caught between the low-end offerings from Huawei and the tier-1 brands. I'd argue LG has already fallen.

Now they are trying to pick themselves up," said analyst Geoff Blaber at British firm CCS Insight.

LG's faster-moving local rival Samsung, which has picked up Google's Android operating system, is the frontrunner among the three to battle iPhone, but both firms have to focus on improving their services offering.

"Still, Samsung and LG need to develop killer mobile services featured only for Samsung or LG which have competitive and similar points with RIM's email and Apple's App store," said William Lee, an analyst at Ovum.

Samgung Galaxy VS Nokia N8

Helped by new Android-based top model Galaxy S, Samsung rose to the No 5 position in the smartphone market in April-June - following Nokia, RIM, Apple and HTC - and is looking to win further share in coming months.

Nokia, whose profits and share price have dived, is now betting on the upcoming N8 smartphone, which could save the career of embattled CEO Olli-Pekka Kallasvuo.

Kallasvuo, for who Nokia is looking for a replacement according to industry sources, has promised N8 will have a user experience superior to that of any smartphone Nokia has created.

"Well, that's great, but what about the best experience versus your competitors? That's what matters and we just don't think that it's going to be enough," said Gartner analyst Carolina Milanesi.

Analysts polled by Reuters voted 5 to 1 for Galaxy S over similarly priced Nokia N8, helped mostly by its bright 4-inch touchscreen.

The N8 stands out among rivals with its 12 megapixel camera, but it has a slower processor than Galaxy S or the latest iPhone. It comes with a 3.5 inch touch screen.

"It's a very close call, but the Galaxy S just edges it at this stage. It arguably has a slightly cooler design, some good major specs, reasonable usability, relatively acceptable pricing and plenty of downloadable apps," said Strategy Analytics' Neil Mawston.

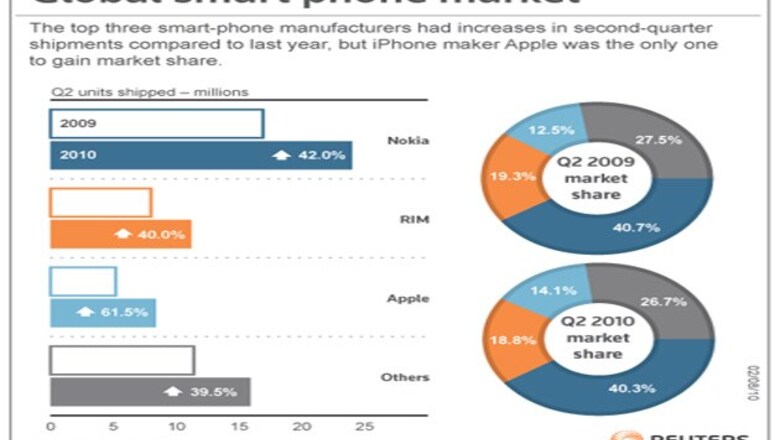

By sheer scale, Nokia still dominates the smartphone market with a 40 percent share, but on average its smartphones sell for less than a third of iPhone.

Hit by failing new top smartphones, its shares have dropped to roughly a third from in mid-2007 when the iPhone went on sale.

Comments

0 comment