views

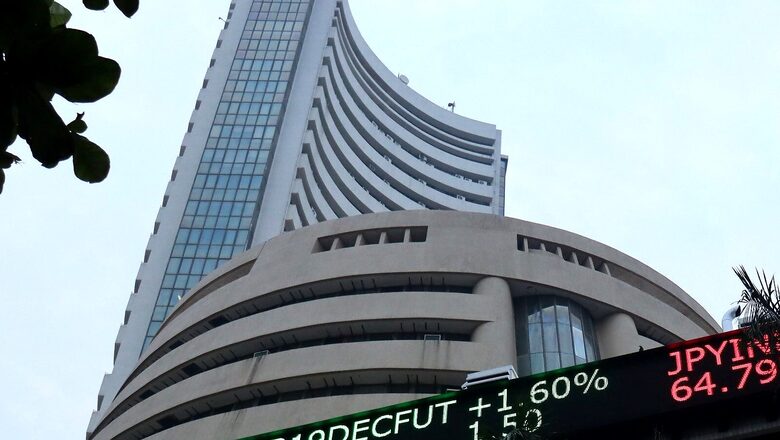

Sensex and Nifty, Indian equity benchmarks tumbled on Monday as rising number of Omicron Covid-19 cases had threatened the economic recovery across the world. Sensex dropped 1,434.03 points to hit 55,577.71 at day’s low while Nifty fell over 2 per cent to trade near 16,600-mark. Indian investors lost Rs 11 lakh crore as stock markets had continued to witness massive slump amid global selloff.

Bajaj Finance and IndusInd Bank were the major losers. Bajaj twins lost 4.3 per cent each while IndusInd Bank had shed 3.8 per cent. Axis Bank, SBI, Kotak Bank, HDFC Bank and HDFC were all down over 3 per cent each.In the broader markets, AU Bank and Bandhan Bank were the major losers, down 9 per cent and 6.3 per cent, respectively. Tata Steel was the other major loser in the Sensex 30 followed by Mahindra & Mahindra, NTPC, Larsen & Toubro, ITC, UltraTech Cement. Nykaa, PolicyBazaar, Tega Industries, Tarsons Products and seven others recently listed stocks registered a fresh all-time low on December 20. The BSE Midcap and Smallcap were down over 3 per cent each.

Global Market Crash:

Several parts of Europe had announced fresh lockdowns to prevent Covid-19 spread amid the emergence of Omicron variant. Netherlands had imposed a lockdown ahead of Christmas. The number of fresh Covid-19 cases reached 90,418 in the United Kingdom on December 19, after days of record highs. This rapid increase in Covid-19 cases have made investors jittery.

Equities in other Asian markets fell amid Omicron scare. MSCI’s broadest index of Asia Pacific shares outside Japan was down 0.9 per cent at the last count. Japan’s Nikkei 225 was down 1.7 per cent, China’s Shanghai Composite 0.8 per cent and Hong Kong’s Hang Seng 1.3 per cent. South Korea’s KOSPI was down 1.5 per cent and Singapore’s Straits Times 1 per cent.

The three main Wall Street indices fell last week amid Omicron scare. However, gains in technology stocks provided some support, limited the Nasdaq Composite’s loss at 0.1 percent. The S&P 500 and the Dow Jones ended 1 per cent and 1.5 per cent lower respectively on Friday.

Sensex Drops over 2%. What Investors Should Do Now

“Previous week saw a correction of almost 3 per cent due to several factors like rate hike by Bank of England, continuous increase in the number of Omicron cases worldwide and selling by FIIs. All sectors faced the heat of market correction which may continue for quite some time as suggested by the global cues. Although the coming week will see some good action in the primary market as five IPOs will make their debut and India’s largest cash management company CMS Info System will open its IPO subscription this week. On technical front, immediate support and resistance for Nifty50 is 16,700 and 17,250 respectively. In case of Bank Nifty the level of 35,000 and 36,450 will act as support and resistance,” said Mohit Nigam, Head – PMS, Hem Securities ahead of the market opening on Monday.

For investors, Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments said, “The lows of Friday was a ray of hope but the index has opened with a gap down this morning which cements the validity of a downtrend. The upside for the index is capped for the time being and every rally up can be used to short this market for a target of 16,400.”

Rupee Tumbled Too

“The rupee also dropped against the US dollar as the Omicron cases had threatened the economy. The US dollar was trading with small gains against the basket of currencies this Monday morning in Asian trade. Technically, if dollar Index trades above $96.50 levels, it could see a bullish momentum up to $96.80-$97.10 levels. Support zone is at $96.40-$96.12 levels. The Euro, the Sterling and the Yen was flat this Monday morning,” said Sriram Iyer, senior research analyst at Reliance Securities.

Read all the Latest Business News here

Comments

0 comment