views

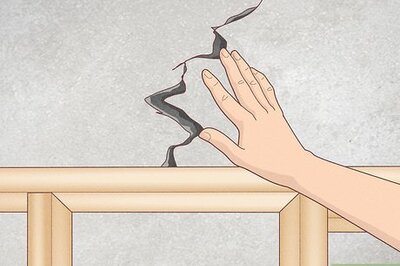

People opt for loans to fulfil a variety of professional and personal dreams. While repayment goes all smoothly if you pay back the amount with the applicable interest on time. However, a slight delay or some disagreement with banks may result in you facing a lot of pressure from loan recovery agents. The agents often resort to the humiliation of the borrowers and their families, intimidation, mental, and physical harassment to recover the money. The Reserve Bank of India has mandated strict guidelines for loan recovery agents, but these are often not followed.

According to the Reserve Bank of India, recovery agents can call borrowers only between 8 am and 7 pm. They should not send derogatory messages or physically/mentally harass the borrower. If such a situation occurs, borrowers must be aware of their rights and how they can file a complaint against recovery agents.

Here are some things borrowers can do if they face harassment by loan recovery agents.

- Borrowers must preserve records of all the messages, emails, and calls from the recovery agent to prove that they are being harassed. This will be important in filing a complaint.

- The borrower can approach their loan officer or the bank with all the evidence against the recovery agent. The lender may then take action against the agent.

- Borrowers can also go to the police station and file a complaint against the recovery agent. If the police does not provide adequate assistance, the person can file a civil injunction in court. This can allow borrowers to get interim relief from the bank and seek compensation for the abuse they endured. If the recovery agent tries to defame the character of the borrower, the person can file a defamation case against the agent and the lender.

If these methods do not provide any respite from the harassment, the borrower can approach the Reserve Bank of India directly. The central bank can bar the lender from engaging recovery agents in a particular region for a period. In case of persistent violations, the RBI may extend the duration and area of the ban.

The Reserve Bank of India has stated regulated entities are responsible for the actions of service providers like recovery agents. This applies to all commercial banks such as co-operative banks, as regional rural banks, asset reconstruction companies, and non-banking financial companies and all-India financial Institutions.

Read all the Latest Business News, Tax News and Stock Market Updates here

Comments

0 comment