views

The 27th WAIPA World Investment Center conference is on in New Delhi. Invest India, the National Investment Promotion and Facilitation Agency, and the current President of the World Association of Investment Promotion Agencies (WAIPA), is hosting the four-day event.

The conference aims to unite global stakeholders in investment promotion and innovation for collaboration and knowledge exchange among IPAs, international organizations, academia, the private sector, and startups.

On Wednesday, Union Minister of Commerce & Industry Piyush Goyal is likely to launch an Experience India Centre (EIC) showcasing the best of India’s offerings across services, technology, and products through virtual reality, augmented reality and interactive screens. India has been a magnet for foreign investments for over a decade now, with successive governments helping streamline FDI inflows. Especially in the past decade, India has grown into a major investment destination.

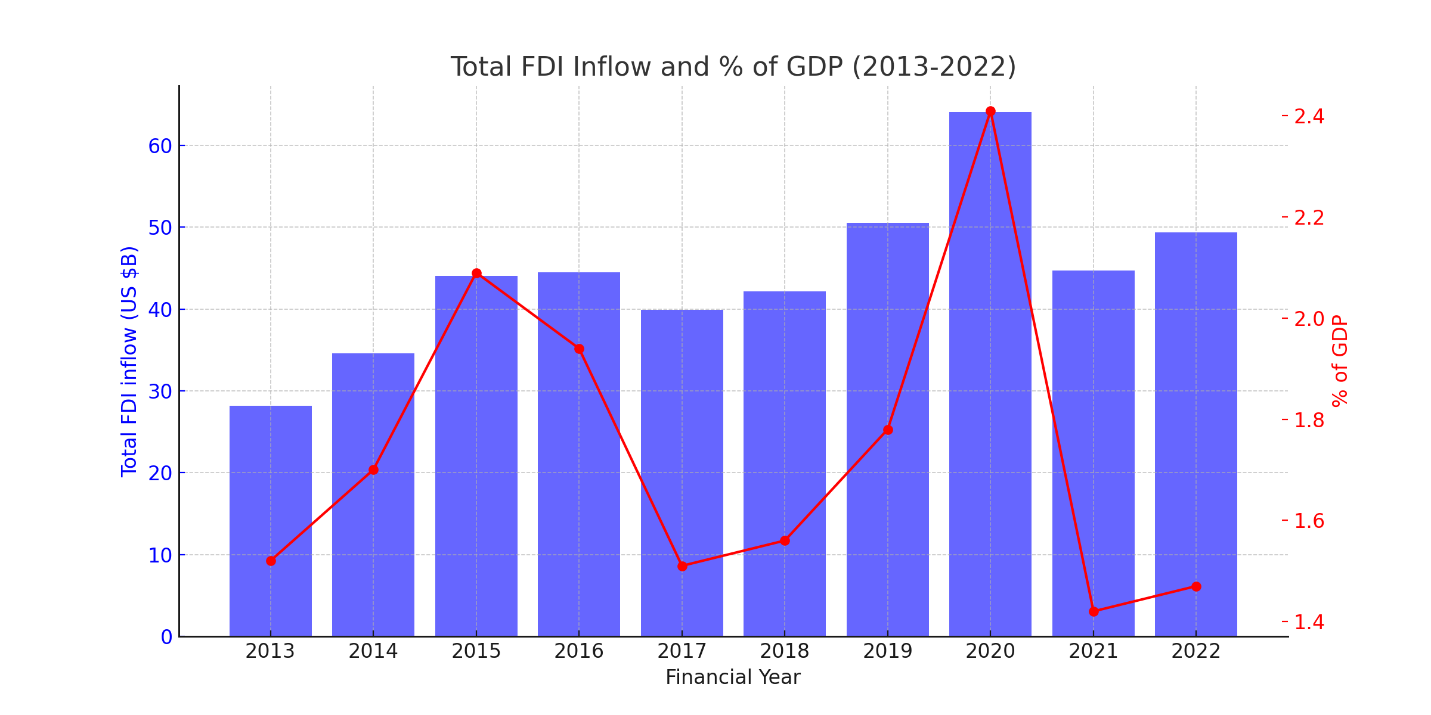

A Decade of Increasing FDI Inflows

Since 2014, India’s FDI inflows have almost doubled. According to the 2023 United Nations Conference on Trade and Development (UNCTAD) World Investment Report, India continues to attract global investors and is recognized as a preferred destination.

As this report by forbes reveals, 2020 saw one of the highest FDI inflows into the country.

UN’s World Investment Report reveals that in 2022, India ranked third globally in terms of foreign direct investment (FDI) for new greenfield projects.

Here’s a look at some more key numbers:

- India ranks in the top 100 for Ease of Doing Business.

- FDI in India has consistently grown since 2014-15, reaching $953.143 billion in the last 23 years.

- The last 9 years represent nearly 65% of the total FDI, totaling $615.73 billion.

- FY 2021-22 recorded the highest annual FDI inflow at $83.57 billion.

- FY 22-23 sees a total FDI inflow of $70.97 billion, with FDI equity at $46.03 billion.

- Top 5 countries for FDI equity inflows in FY 22-23: Mauritius (24%), Singapore (23%), USA (9%), Netherlands (7%), Japan (6%).

- Top 5 sectors attracting FDI Equity Inflow in FY 22-23: Services (16%), Computer Software & Hardware (15%), Trading (6%), Telecommunications (6%), Automobile Industry (5%).

- Top 5 States receiving highest FDI Equity Inflow during FY 2022-23 are Maharashtra (29%), Karnataka (24%), Gujarat (17%), Delhi (13%), and Tamil Nadu (5%).

Upward trajectory of the economy

India stands out as the globe’s fastest-growing major economy, driven by strong private consumption and investment. A decade of significant foreign direct investment underscores confidence in India’s enduring growth prospects, supported by a young population and rising urban household incomes.

Since 2014, India’s GDP has witnessed a continuous ascent, solidifying its position as a robust economic force. The steady rise in GDP reflects the nation’s sustained growth momentum and economic vitality.

India’s remarkable economic rise is projected to surpass Japan by 2030 and potentially secure the position of the world’s second-largest economy by 2075. The annual GDP growth in India, averaging 6.21 percent from 2006 to 2023, hit a peak at 9.10 percent in 2022.

The country’s GDP is likely to grow from 6.4% in 2023 to 7% in 2026, and is projected to be the fastest-growing emerging market globally, according to a report released by S&P Global.

Attracting the biggest and the best

International conglomerates are drawn to India’s expanding domestic market, driven by the rise of the country’s middle class. Furthermore, recent economic reforms in India have substantially improved the business environment, reducing regulatory complexities, streamlining compliance procedures, and attracting increased foreign investment.

- Apple strategically established India as a key manufacturing hub, aligning with its China+1 approach, leading to record-breaking FY 2023 revenue of US$5.9 billion, reflecting a remarkable 48% annual growth.

- In February 2023, Singapore Airlines purchased a 25.1 percent stake in the Air India group for $267 million.

- Micron Technology has announced a total proposed investment of US$2.75 billion, on its semiconductor testing and assembly facility in Sanand, Gujarat.

- American multinational semiconductor company AMD inaugurated its largest global design center, the Technostar research and development campus, on November 28, in Bengaluru, as part of a US$400 million investment over the next five years in India.

The Indian startup atmosphere has also benefitted. India, ranking as the third-largest global startup ecosystem, houses over 95,000 startups, a significant surge from 350 in 2014, including 115 unicorns. Foreign investments have played a crucial role in shaping India’s startup landscape, constituting more than 85% of total funding.

- In October 2022, Byju’s obtained $250 million from its lead investor, Qatar Investment Authority (QIA).

- In August 2022, the ed-tech unicorn upGrad raised $210 million in a funding round led by ETS Global, Kaizen Management Advisors, and Bodhi Tree, valuing the company at $2.25 billion.

At the core of India’s growth story is its immense consumer base of 1.4 billion people, fueling both domestic consumption and investments. According to a Brookings Institution report, the global middle class expanded by over one billion people from 2015 to 2022, with India contributing 380 million, surpassing even China’s addition of 350 million.

Manufacturing Boom: Key Sectors

India is on track to become a manufacturing powerhouse for the world as was the vision behind Make in India. Foreign manufacturers are increasingly investing in India for its cheap labour costs, domestic consumption and a horde of policy changes which has removed almost 39,000 regulations, digitized compliance procedures, relaxed restrictions on foreign investment, modernized bankruptcy and labor laws, and eliminated retroactive taxation.

There are 6 major supersectors driving Indian manufacturing:

Automotive

- There has been an FDI inflow of $33.77 billion in the industry from April 2000 till September 2022 which is around 5.48% of the total FDI inflows in India during the same period.

- In fiscal year 2023, the automobile sector in India saw an equity inflow from foreign direct investments worth approximately 1.9 billion U.S dollars.

- The automotive sector has been pivotal in the success of Make in India, with global carmakers like Renault, Suzuki, Honda, and Volkswagen establishing manufacturing bases in the country.

- The Automotive Mission Plan (AMP) 2026 aims to position the industry as the engine of Make in India, presenting a roadmap collectively decided by the Government of India and the Indian Automotive Industry.

- AMP 2026 targets for the automotive industry: Grow to $260-300 Bn (3.5-4 times the current value), contribute over 12% to India’s GDP, generate 65 million jobs, and increase exports to 35-40% of the total output.

Electronics System Design & Manufacturing

- The value of foreign direct investment inflow was approximately 3.6 billion U.S. dollars in fiscal year 2022, up from about 1.5 billion dollars in fiscal year 2015.

- The National Policy on Electronics (NPE) 2019 is a key initiative, positioning India as a global hub for Electronics System Design and Manufacturing by developing capabilities for core components.

- Goal of the NPE is to achieve a comprehensive economic goal by attracting $100 Bn investment, attaining a $400 Bn turnover, generating employment for 28 million people, increasing exports from $8 Bn to $80 Bn, and producing 1 billion mobile handsets by 2025.

- In July 2023, electronics maker Elista announced that it will invest Rs. 100 crore (US$ 12.1 million) in Andhra Pradesh to set up a manufacturing unit for Smart LED TVs, smartwatches, audio speakers, and large appliances.

- Foreign investors include Panasonic, GE, Mitsubishi, Qualcomm.

Renewable Energy

- India’s renewable energy potential is vast, with plans to derive 40% of energy from renewables by 2030.

- FDI In India’s Renewable Sector Surges 56% YoY to $2.5 billion in FY23. Foreign Direct investment (FDI) in India’s renewable energy sector stood at $838 million (~ Rs 69.2 billion) in the fourth quarter (Q4) of the financial year (FY) 2023, a 102% increase year-over-year (YoY) compared to $415 million (~ Rs 32.1 billion).

- Between April 2000 and December 2018, the total FDI equity inflow in the non-conventional energy sector was $7.5 Bn, which has allowed for the addition of 37.84 GW of capacity.

- The IFC, World Bank’s private sector arm, is helping Madhya Pradesh establish the world’s largest single-site solar project in Rewa, with a capacity of 750 MW.

- Major foreign investors included Gewwnko, Mudajaya Group Berhad, Orix, Ostro, Moserbaer.

Infrastructure

- FDI in construction development and construction activity sectors stood at US$ 26.23 billion and US$ 28.95 billion, respectively, between April 2000-September 2022.

- In January 2023, the Construction arm of Larsen & Toubro has secured orders for its power transmission & distribution and buildings & factories businesses to establish a 112.5MW Solar Power Plant in West Bengal and to construct a 600-bed super specialty hospital at Mumbai, respectively.

- Landmark projects like Bharatmala Pariyojana and others are transforming the road network, with significant progress in road construction.

- In December 2022, BHEL formed a consortium with Titagarh Wagons and is among five entities which have bid for the mega Rs. 58,000 crore (US$ 7 billion) contract to manufacture 200 Vande Bharat trains and maintaining them for the next 35 years.

Pharmaceuticals

- India is a major player in global generics, exporting nearly 50% of its pharmaceutical production.

- The cumulative FDI equity inflow into the drugs and pharmaceuticals industry in India from April 2000 to December 2022 was US$21.22 billion, accounting for nearly 3 percent of the total FDI inflow across all sectors.

- India’s pharmaceutical industry is currently ranked third globally for pharmaceutical production by volume and 14th by value. The country has a well-established domestic pharmaceutical industry, featuring a network of around 3,000 drug companies and approximately 10,500 manufacturing units.

- Major investors in India’s pharmaceutical industry are AstraZeneca, Dr. Reddy’s, GSK, Divi’s, Zydus, Novartis, Pfizer, Sun Pharma, Teva, Mylon, and Johnson & Johnson.

Food Processing

- The equity inflow of FDI in the food processing sector for the period of April 2021 to March 2022 was $709.72 million. The total FDI received in this sector was $11.51 billion.

- Online grocery retail in India has witnessed a Compound Annual Growth Rate of over 50% and is projected to grow from $10 billion to $12 billion by 2025.

- India is ranked 1st in milk production. Its overall contribution to global milk production is 23% growing at a Compound Annual Growth Rate of 6.2% to reach 209.96 MT in 2020-21.

- India is ranked 1st in milk production. Its overall contribution to global milk production is 23% growing at a Compound Annual Growth Rate of 6.2% to reach 209.96 MT in 2020-21.

Streamlining Foreign Direct Investments

As per the OECD FDI restrictiveness index, India’s FDI restriction levels have come down from 0.42 to 0.21 in the last 16 years. The government of India has worked tirelessly to create an environment that allows for easier access to certain sectors of the economy while barring entry those critical towards national interests.

Automatic Route for Simplification

- India offers an automatic route for FDI across various sectors, streamlining the investment process.

- Sectors eligible for the automatic route are those with higher FDI limits or those lacking specific security concerns.

Government Approval for Specific Sectors

- Certain sectors, especially those tied to national security or strategic interests, necessitate prior government approval for FDI.

- This approach allows control over sensitive areas while permitting foreign investment on a case-by-case basis.

Regulatory Oversight Entities

- Key government bodies, including DPIIT, RBI, and SEBI, regulate FDI in India.

- Stricter reporting requirements, in line with FEMA, ensure transparency in foreign investments.

Policy Revisions and Reforms

- The Startup India initiative provides incentives and tax benefits, stimulating growth in the technology and innovation sector.

- Simplified procedures like single-window clearance and GST implementation alleviate bureaucratic obstacles for businesses and foreign investors.

Factors Impacting FDI Inflows

- Crucial factors such as economic stability, regulatory environment, sectoral policies, political stability, and infrastructure influence FDI inflows.

Sector-Specific Terms and Constraints

- The Indian government permits FDI in designated sectors to attract capital, expertise, and innovation.

- Diverse FDI limits and entry routes in various sectors offer flexibility for foreign investors.

Examples of FDI Limits in Different Sectors

- Sectors like banking, insurance, agriculture, mining, defense manufacturing, civil aviation, pharmaceuticals, power exchanges, construction development, e-commerce, textiles, and tourism have specific FDI limits and entry routes.

Sectors Excluded from FDI

- Certain sectors, such as lottery business, chit funds, gambling, real estate business, and atomic energy, are restricted from FDI to address national security concerns and protect domestic interests.

Focus on Sustainability

Amidst all this growth, investment, and development, India has aggressively pushed for a sustainable development model.

- India aims to achieve 50% of energy from renewables, have 500 GW non-fossil-fuel energy capacity, reduce GDP emissions intensity by 46-48%, and lower carbon emissions by one billion tonnes by the end of this decade.

- Pradhan Mantri Awas Yojana – Urban (PMAY) employs sustainable and energy-efficient methods for housing, reducing approximately 12 MMT CO2 equivalent of GHG emissions.

- Atal Mission for Rejuvenation and Urban Transformation (AMRUT) is reducing over 49 MMT of CO2 equivalent GHG emissions while providing basic civic amenities.

- Public transport emphasis and operational metro lines in 18 cities are expected to reduce more than 12.65 MMT of GHG emissions, with additional construction in 27 cities.

- India aims to double the share of natural gas in the energy mix by 2024, mitigating 566 MMT of GHG emissions from 2014-15 to 2021-22.

- The National Hydrogen Mission targets annual production of 4 MT of Green Hydrogen by 2030, saving over Rs. 1 lakh crores in fossil fuel imports.

- Ethanol blending in petrol increased from 0.67% in 2012 to 10% in 2022, with a target of reaching 20% by 2025-26 instead of 2030.

- Despite a 60% increase in per capita energy demand in the last two decades, India’s energy use and emissions remain less than a third of the global average, with per-capita emissions at 1.8 tonnes CO2 equivalent in 2018, as per the World Bank.

India’s dynamic growth, extensive reforms, and commitment to sustainability make it a global economic powerhouse. With thriving sectors, a burgeoning startup ecosystem, and strategic initiatives, India is well-positioned for continued success and international collaboration. The nation’s focus on renewable energy, infrastructure, and environmental responsibility underscores its dedication to inclusive and sustainable development. As India progresses, it remains a beacon for global investments and partnerships, shaping a promising future.

Comments

0 comment