views

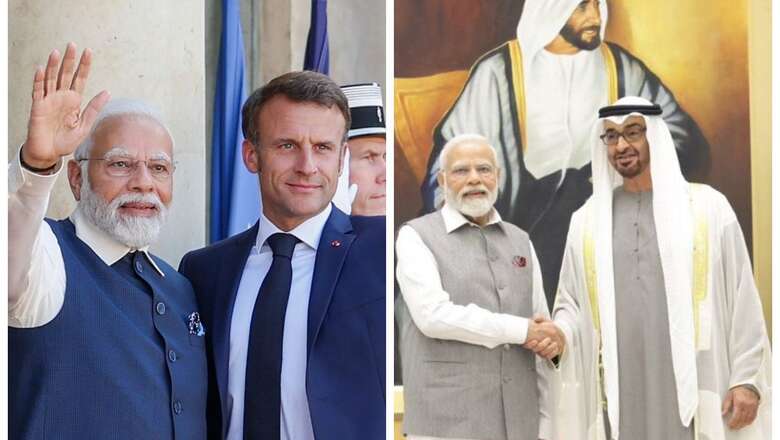

Defanging to de-risking global trade and currency deals for India is what Prime Minister Narendra Modi achieved in his visit to France and the United Arab Emirates (UAE) last week. Agreements concluded during Prime Minister Modi’s visit not only make trade and currency deals more advantageous from the Indian perspective but also reflect the country’s growing confidence in shaping commercial partnerships across geographies. Otherwise, how would one explain taking United Payments Interface (UPI) and RuPay to France or for that matter, the UAE?

In his West Asia sojourn, the UAE and India’s decision to denominate bilateral trade in rupees and dirhams is again a big departure from dollar or euro-centric transactions. This is over and above bringing the UPI and RuPay to Abu Dhabi.

Currency, transactions at the retail level on Indian digital platforms to large rupee-denominated trade deals have been described by some analysts as the “de-dollarization” of the Indian economy. But, India’s latest thrust on the currency and trade front is more to do with its growing economic and investment muscle and acceptability rather than moving away from the US greenback or euro.

Indians visiting the Eiffel Tower in France by purchasing tickets in rupees may be a simpler way of presenting the implications of the latest agreements for hoi polloi. The deal involving Lyra of France and National Payments Corporation of India to become operative in September this year would mean much more than paying for tickets at tourist spots in rupees. The wider and willing acceptance of the Indian rupee in Europe is due to financial innovation making the Indian digital payments platform UPI secure and affordable across continents. The decision to link UPI with UAE’s Instant Payment Platform (IPP) makes the country’s digital payments foray wider and deeper in West Asia.

In fact, the deal between the Reserve Bank of India (RBI) and the UAE’s Central Bank allows for RuPay switch and the UAE switch interoperable. India’s structured financial messaging system (SFMS) will go to the UAE, thereby instantly recognizing Indian debit and credit cards.

The larger implication is that holding the Indian rupee by central banks and dealers, globally by value and quantity, will go up many-fold in a few years from now. Also, the internationalization of the Indian rupee is on the verge of becoming a hard reality. Rupee-denominated export and import of goods and services internationally will make the Indian currency more tradable, given the large ticket size of these transactions.

France and the UAE are not isolated cases in accepting rupee-denominated trade deals, UPI, RuPay or Rupee Switch. Singapore’s PayNow had done a deal with NPCI to embark on the UPI platform. It moved the Indian digital payments platform to South East Asia one step further.

In May this year, India and Russia had announced making payments easier through RuPay and Mir cards in both countries. UPI of India and Bank of Russia’s Faster Payments System are being linked to making seamless real-time transactions in rupees and roubles a reality, apart from dealing with financial messaging systems.

Non-Resident Indians (NRIs), businessmen, tourists and students in ten countries including Australia, Canada, the US, Oman, Qatar, Saudi Arabia and the United Kingdom among others could either receive or send money once their domestic bank accounts are linked to their international phone numbers.

As per independent consultancy Price Waterhouse Coopers (PwC), one billion rupee-denominated transactions per day are estimated to happen in the next two years through UPI and RuPay network. Already, over 73 percent of non-cash transactions in India have gone digital on UPI.

Over 18 countries have either opened or are in the process of opening Vostro accounts to settle trade deals in rupees or their respective local currencies moving away from the US dollar, euro, UK pound or any major international currency. The latest to join this jamboree is Indonesia whose finance minister, Sri Mulyani Indrawati, firmly stated in Gandhinagar that bilateral trade will happen in rupees and rupiah. Bangladesh went one step further and began trade settlements in Indian rupees. This was limited to the US dollar till last week.

India’s trade, valued at US $1.6 trillion in the last year, seems to have shaped the country’s strategy on cross-border currency deals and rupee transactions. Indian strategy of gaining acceptability for the rupee is, however, distinctly different from China’s ‘wolf worrier’ investment and loans strategy to gain dominance.

Significant progress made by India on the rupee’s acceptability and trade transactions cannot however sidestep the challenges in making it part of the reserve currency basket. The current strategy adopted by the RBI and the Indian government has the potential to deliver, notwithstanding its limitations. Unless the rupee is increasingly used in current account transactions like investments and capital flows, internationalising the currency may hit a wall.

Secondly, as the RBI working group recommended, the rupee must get included in the Special Drawing Rights basket of currencies maintained by the International Monetary Fund (IMF) to hold its assets. Recalibration of Foreign Portfolio Investments (FPI) may have to be considered for hastening the path to internationalizing the rupee.

There has been serious discussion amongst BRICS countries to settle trade-related transactions within the group in local currencies. A conscious decision on the use of member countries’ currencies to square off trade deals would translate to the democratization of the economic world order.

For the stakeholders, a reduction in transaction costs limiting the foreign exchange risks and more safeguards to the trade deals will be accrued, apart from huge optimization in capital costs.

India, accounting for a modest two percent of global trade in value terms, limits the internationalization of the rupee. Similarly, there may be little to modest enthusiasm to denominate Indian debt globally in rupee terms instead of dollars.

Internationalizing the rupee and turning it into a currency in reserve is a long-haul project for which a firm foundation has been laid by the Modi government.

The author is Director & Chief Executive of non-partisan think tank, Centre for Integrated and Holistic Studies, based in New Delhi. Views expressed in the above piece are personal and solely that of the author. They do not necessarily reflect News18’s views.

Comments

0 comment