views

Qualcomm CEO Steve Mollenkopf said he is “seeing improvement” in efforts to ease chip shortages that have caused disruptions across several industries, and that demand for older chips is easier to respond to. Demand has soared for chips in recent months, with panic buying further squeezing capacity and driving up costs of even the cheapest components of nearly all microchips. “There’s an ability for the market to respond more quickly to some of the older nodes than the newer nodes, so depending on the product, you may be in a position to get some improvement,” Mollenkopf said, speaking via videolink at the China Development Forum in Beijing on Saturday. Speaking in the same panel, president and CEO of Micron Technology Sanjay Mehrotra said the chipmaker would aim to increase its supply in line with the growing demand for the company’s products.

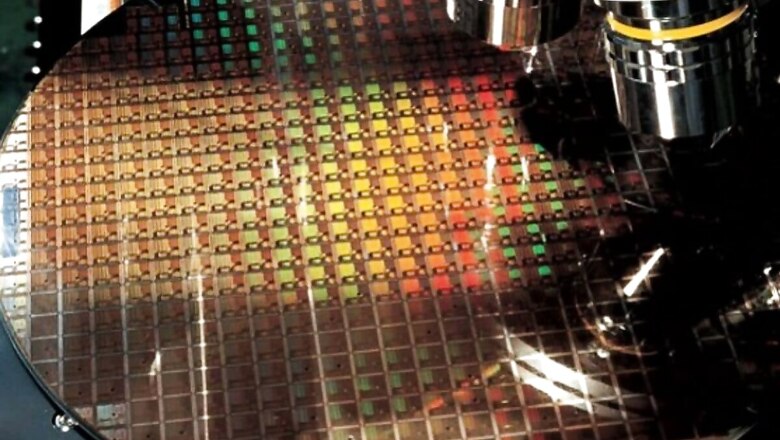

The shortages of semiconductors are impacting everyone. In India, there are incredibly long waiting times being quoted by dealerships if you walk in now to book a new car—even longer if the car is very popular and in high-demand. If you aren’t able to get your hands on a new Sony PlayStation 5 or Microsoft Xbox Series X or Series S gaming console, that’s also because there are very few chips to work with. Smartphone makers including Apple have said that sales of new phones have been impacted by the shortage of components. Qualcomm, the world’s largest chipmaker for smartphones and mobile devices, had also said earlier that the industry’s reliance on a handful of semiconductor manufacturers is hurting businesses.

There isn’t any one reason for why we are in the midst of a global semiconductor scarcity. Yet without doubt, things started to unfold as soon as the COVID pandemic rolled into town. As the world locked themselves indoors, with remote working and remote education becoming the way of life, the demand for laptops, PCs, phones, tablets and peripherals such as monitors, modems and Wi-Fi routers, printers, webcams and work from home (WFH) accessories saw a global surge in demand. Computing device makers were struggling to keep up, at least in the initial few months of last year, and there are still some gaps in the product lines with limited availability of certain products.

“The shortage in the semiconductor industry is across the board,” Qualcomm’s CEO Cristiano Amon, had warned in February that it isn’t just a shortage of the newest or the fastest chips, but every chip that’s being used in tech products, appliances and cars. As the pandemic shut everything down around the world, a lot of companies scaled back on production in the first few months of 2020. They cut orders. These included tech and automobile companies, many of whom didn’t foresee the demand return to normalcy, as it happened. More so in the case of auto companies, because demand bounced back much sooner than expected. In some cases, such as computing devices and home appliances, not just a normalcy but significantly higher demand. This left them with a major backlog to catch up to, as they tried to buy enough components and raw materials to get their own production lines working at full steam. Everyone’s queueing up again, but there aren’t enough components to go around. The problem that happened was—in case someone cut orders in the first half of 2020 found themselves at the back of the queue once they discovered that the consumer spending is back again, since other tech and health companies took the orders they vacated.

(With inputs from Reuters)

Read all the Latest News, Breaking News and Coronavirus News here

Comments

0 comment