views

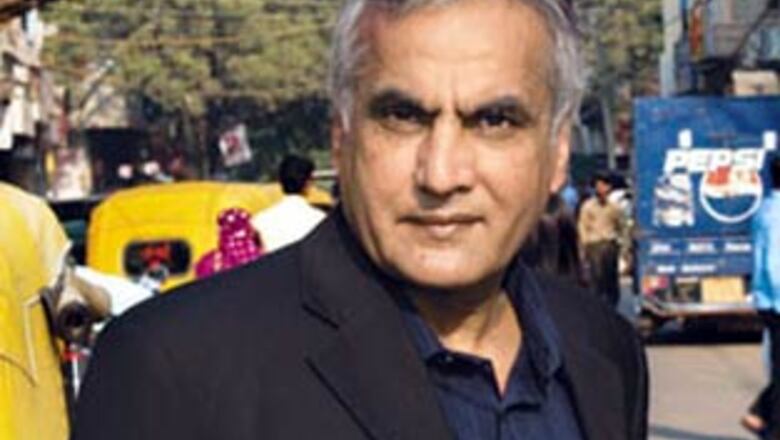

There are many stories about Ajay Relan. About his upstart days at Citibank in the late 1970s, about the creation of i-flex. However, the most interesting one is about how he is not Ajay Relan. This is how the tale goes.

As a successful private equity investor, Ajay Relan's name rings familiar, but many mistake him for a namesake from a wealthy line of family businessmen with presence in the automobile parts business. Like when the staff of an airline tried to use the other Relan's frequent flyer miles to upgrade his status.

"I have heard that story," says Relan, amused.

But this Relan's origins are more humble. His family migrated from Pakistan during Partition. Relan became one of the most successful private equity investors in India and rose to head the India operations of CVC International (CVCI), Citibank's private equity arm. The 55-year-old could have continued comfortably there, especially given the financial meltdown, but he chose differently.

STRIKING OUT ALONE

In May 2008, word spread that CVCI India would lose Relan. Thanks to Relan and his team, Jindal Steel had proven a money spinner and so had Suzlon Energy and IVRCL. With such impressive track, it seemed a good idea to launch a new fund. And Relan did just that with CX Partners. Relan was said to have left behind close to $10 million in unrealised compensation.

His peers can understand his sense of urgency. "When you are as old as Ajay is, you just want to get working on your next idea quickly. Money left behind is of little value," says former head of CVCI, William Comfort.

In July, when Relan set out on his own, the private equity industry was just coming off a brilliant run in India. None other than master fund-raiser Ashish Dhawan was saying that large institutional investors would not put any money in new funds. Rahul Bhasin of Barings Private Equity thought many existing funds would have a problem fulfilling their capital commitments. Such reservations did not apply to Relan, at least not then.

Within one month of leaving Citi, Relan had secured Morgan Creek Capital which decided to invest $100 million in CX Partners. Relan looked set to tap more investors. "Well, if there is one guy who can go out and raise some serious money then Ajay would have to be it," Dhawan had said in August. Relan had both the taste and the vintage on offer. He had overseen the investment of more than a billion dollars into India and had investments such as i-flex, IVRCL, Suzlon and Sasken that had made lots of money for CVCI. But still, Relan's target was ambitious: raising $1.1 billion. "That was the first thing that we changed after October," says Relan. Once Lehman went bust on September 15, the financial sector imploded. "We knew $1 billion would be impossible so we changed the size to $750 million. We figured that with a 50 percent decline in corporate valuations, the new $750 million would be equivalent to the old $1 billion," he says.

Even with that target, progress has been slow. Almost a year after he started the fund-raising, Relan has $220 million in capital commitments from seven financial institutions but his first close at $350 million is still a month away.

DARK CLOUDS

When Relan visited the US in November, what he saw wasn't promising. "It was just so bleak out there. Everyday would bring some bad news," says Relan. Fund-raising slowed to a crawl mostly on account of the 'denominator effect'.

Large financial institutions that put money in private equity funds have guidelines on how much they can invest in listed equity, private equity, real estate and debt — asset allocation percentages essentially. After the September crash, the values of all assets fell but not private equity. Why? Most of private equity money is put in unlisted firms and is usually valued only once every quarter. Every large institutional investor then saw the denominator shrink and numerator "private equity" remain constant and hence the percentage allocation to this asset class increased.

To solve the denominator effect, financial institutions sell part of their private equity holdings, often at a loss. California's pension is said to have sold off about 30 percent of its private equity holdings earlier this year. Harvard's endowment is reported to have sold $1.5 billion in private equity holdings. Naturally, no institution wanted to put money in new funds.

And then all hell froze over in November 2008 with the Mumbai terror attacks. "We had so many meetings planned for the first two weeks of December. All that vanished because everybody cancelled their plans," says Relan. No amount of reputation was going to change that. Relan was back to being in a start-up. The last time Relan had ever stared at a garden of unknowns was 13 years ago.

In 1995, when William Comfort, the head of CVCI, stumbled on him, Relan was no rookie. He had worked with Citicorp Services India Limited (CSIL, which later became e-Serve). From 1988 to 1991, he worked for Samba Capital. "Saudi Arabia was just building its airport and I learnt a lot about infrastructure lending. I was writing out cheques for a billion-dollar performance guarantee," says Relan. The assignment after that was a two-year stint with Swicorp.

"I was parachuted as a deputy GM in a bank in Tunisia, which wasn't doing well. After a year the bank turned around and that's when I left for CSIL," says Relan. That's the man Comfort picked. Relan's recognition at CVCI came when his name was taken with regard to i-flex.

Says Comfort: "Everybody thinks they can do venture investing and everybody makes mistakes. So I gave him a small amount — $25 million — to do that." The first fund had a few interesting investments like Polaris and Sasken but the big winner was i-flex. Legend has it that Rajesh Hukku and other co-founders of i-flex were planning to leave Citicorp Software Services (COSIL) to start a new venture. Relan convinced Citi to ask them to stay and spin off COSIL. That's how i-flex was born. For the Rs. 4 crore that Citi invested, it got almost Rs 4,000 crore on sale of its stake to Oracle. It is probably the best private equity investment ever for Citi.

"The best part about working with CVCI is that I got the chance to go through at least three business cycles. That's when I finally managed the courage to go out and try and manage someone else's money on my own account," says Relan.

Along the way he also built a team that has stuck together for almost a decade. "The cohesive team allowed Ajay to look beyond sector expertise and numbers to spot great management team. And people like Ajay. He is able to get their trust and confidence," says Comfort.

All that was not enough though in 2009, when institutions like Asia Alternatives Capital Partners, which has $950 million under management, were looking to invest in CX Partners. "Usually, 15-20 phone calls is what would be made but they made no less than 75 phone calls to various people about us over 60 days. They met each member to see if we shared the same purpose. All the better for us. I would much rather the investor was totally sure before he forks out his money," says Relan. There are reports that Goldman Sachs and a few family offices, too, are investing in CX. It is learnt that the company has seven investors as of now.

CX has so far raised $220 million. Relan's team is ensuring a three-month due diligence process before an investment. The amount of time spent on flights is almost the same. Earlier, it was to seek money. Now it is to invest it wisely.

Find this story in the July 3rd Issue of Forbes India.

Comments

0 comment