views

In the first monetary policy committee (MPC) meeting after the presentation of the Union Budget 2021-22, the Reserve Bank of India (RBI) panel on Friday announced that it has kept repo rate, as well as the reverse repo rate unchanged while maintaining an ‘accommodative stance’.

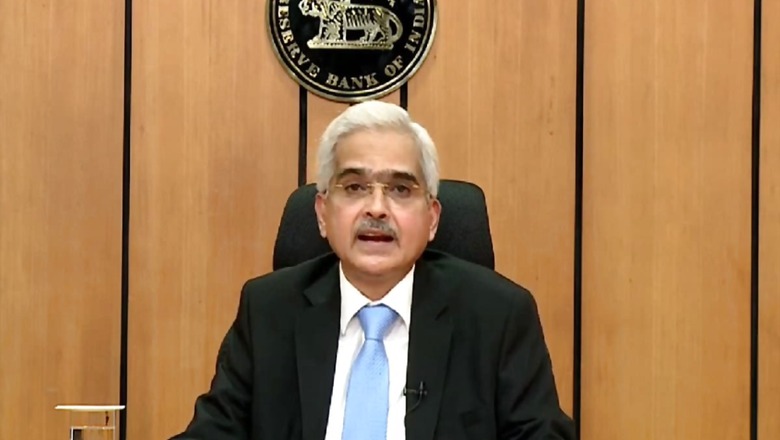

RBI governor Shaktikanta Das announced that the decision was taken unanimously and added that the repo rate was kept unchanged at 4 percent and the reverse repo rate at 3.35 percent. The RBI will be maintaining an accommodative stance “as long as necessary at least through the current financial year to the next year, Das announced.

The central bank also sees the upcoming financial year’s GDP growth at 10.5 per cent.

ALSO READ: RBI’s First MPC Decision After Union Budget 2021: Here’s What to Expect

This is the first MPC meeting after the presentation of the Union Budget 2021-22. The six-member MPC headed by RBI Governor Shaktikanta Das meets every two months to analyze the state of the Indian economy and inflation and address the monetary issues in the country. This month, it began the 3-day bi-monthly meeting on Wednesday, February 3.

The repo rate has been cut by a total 115 basis points since March 2020 to cushion the shock from the pandemic, following a 135 bps reduction since beginning of 2019.

Today was the fourth straight time that the central bank chose to hold rates, although falling inflation had given rise to expectations in some quarters that there could be a cut.

CPI inflation in December fell to 4.59 per cent, the first time in nine months that inflation came within the central bank’s comfort zone.

Centre’s gross market borrowing is estimated at Rs 12 lakh crore, Das said. Reserve money rose by 14.5 per cent year on year on January 29 led by currency demand; Money supply grew by 12.5 per cent on January 15, he added.

The central government and RBI have taken several steps to encourage retail investment in government securities.

Das announced that retail investors will now have direct access to participate in Gsec market both primary and secondary through RBI. It’s being called Retail Direct.

Till now, investing in government bonds directly was a cumbersome affair for individual retail investors. The only way to do so was through different Gsec or income funds, offered by asset management companies.

Read all the Latest News, Breaking News and Coronavirus News here

Comments

0 comment