views

Hyderabad: The Reserve Bank on Friday said liquidity tightening measures will be rolled back only after stability is restored in the forex market as volatility hurts growth.

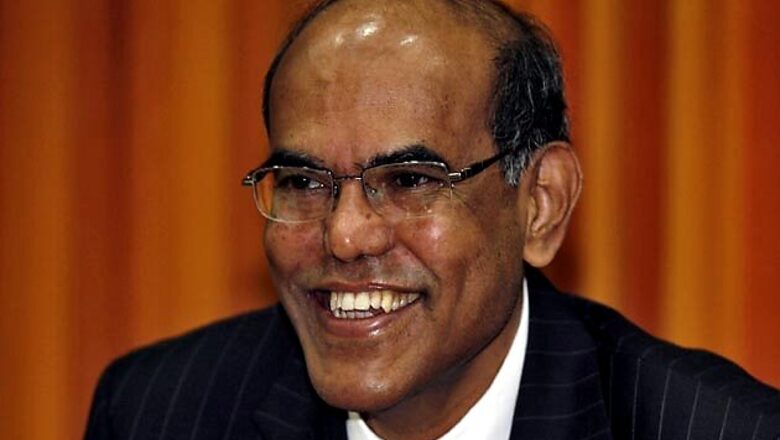

"We will roll back these (liquidity tightening) measures only after we determine that stability has been restored to the foreign exchange market," RBI Governor D Subbarao said while addressing an award function Hyderabad.

In order to rescue the declining rupee, Reserve Bank and market regulator Sebi had imposed various restrictions on the futures market by way of raising the margins and limiting the positions that market participants can take.

RBI, Subbarao said, had also prohibited proprietary trading in forex market by banks to curb undue speculation in rupee which was resulting in the volatility of the exchange rate.

In RBI's view, he said, "undue volatility of the exchange rate is harmful for growth and stability and such volatility should be curbed".

The rupee, which had touched life time low of 61.21 against a dollar on July 8, was trading around 60.80 on Friday. In order to contain Current Account Deficit (CAD) and arrest value of declining rupee, the RBI last month had raised the cost of borrowing for banks and reduced availability of funds to curb speculation in the forex market.

RBI did not roll back these measures in its first quarter monetary policy which was unveiled earlier in this week. Prime Minister Manmohan Singh and Finance Minister P Chidambaram had said that the measures announced by the RBI were not indicative of firming up of interest rates in the long-term and would be withdrawn once stability was achieved in the forex market.

Comments

0 comment