views

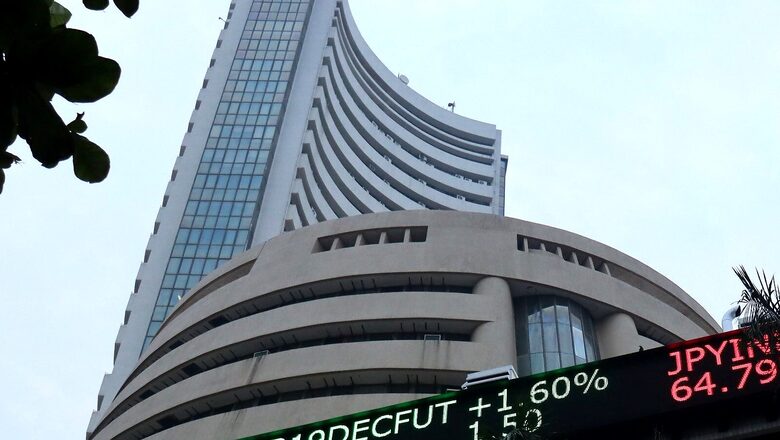

The Indian equity benchmark indices ended in red on Friday for the forth session in a row dragged by losses in index heavyweights like HDFC Bank, ICICI Bank, HDFC Bank, Tata Consultancy Services (TCS), Bajaj Finance and Bajaj Finserv. The Sensex fell as much as 575 points to hit an intraday low of 58,551 and Nifty 50 index briefly dropped below its important psychological level of 17,500. The market is expected to trade bit choppy next week as certain factors are going to guide the market next week.

“The domestic market remained in the consolidation phase throughout the week as the market lacked major positive domestic cues to withstand the negative pressure from global markets. Worries over the US debt ceiling crisis along with an uptick in yield and crude oil price created concerns in the global market. Continued worries over the Chinese economy also added pressure on Asian equities. Eurozone inflation has hit its 13 years high level of 3.4% in September owing to high energy costs. India’s core sector output accelerated by 11.6% in August compared to 9.9 per cent growth in July while the Manufacturing PMI rose to 53.7 in September from 52.3 in August owing to improving demand conditions,” Vinod Nair, head of research at Geojit Financial Services.

“Auto sales numbers from major manufacturers showed a decline in September sales mainly due to semiconductor supply shortage, however, expectations are high on festival season. On the domestic sectoral front, IT and banking witnessed consolidation ahead of the Q2 result while PSEs, Metals and Pharma gained momentum,” Nair said.

Covid-19 Number and Vaccination

With overall COVID-19 cases dipping in the country and the vaccination process going in at full pace, the economy is going to rebound at much faster pace than before and this is going to boost the investors spirit on the Dalal Street. And this would be one of the key driving factor for the markets.

RBI Monetary Policy

This is also one of the most important factors that are going to influence the course of market in the next week ahead. The Reserve Bank of India is scheduled to announce its bi-monthly monetary policy on Friday, October 8. The central bank is expected to maintain its accommodative stance to maintain adequate liquidity in the system and to support economic activity. Also, it will be important to listen to the commentary of RBI Governor Shaktikanta Das.

Q2 Earnings

India Inc will officially kick off the earning season for September quarter as the largest IT player Tata Consultancy Services (TCS) will announce its Q2 results on Friday, October 8. Most of the projections are priced in by the market for the IT sector.

India’s service PMI

India ended the first half of the ongoing fiscal year with a decent number of positive news on the economic front. India’s service PMI is also due to be released next, in addition to this market composite PMI, Bank loan YOY growth will be released next week that is going weigh on the market.

Global Cues

In addition to domestic factors influencing the market, the Global market factor will determine the course of the markets. The global markets as of now have been quite volatile have been quite volatile recently, with some weaknesses. The biggest worry is inflation and signs of slowdown in China. Furthermore, the US market is also showing some signs of plateauing in growth. The market will have an eye on global data to get further direction.

Read all the Latest News , Breaking News and IPL 2022 Live Updates here.

Comments

0 comment