views

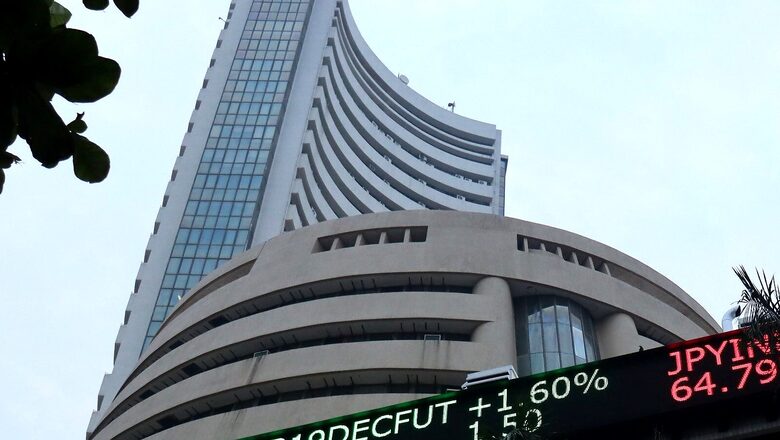

The Indian market on Wednesday opened in the negative territory. The Benchmark BSE Sensex was down 30.33 points, or 0.05 per cent at 58,266.58. On the other hand, the broader Nifty was down 1.60 points, or 0.01 per cent at 17,360. On NSE, Grasim with 2.13 per cent gain emerged as the top gainer, followed by IndusInd Bank, Bharti Airtel, HDFC Life and BPCL. On the other hand, Eicher Motor, Wipro, Infosys, Maruti, DivisLab were among the laggards. Sectorally, Nifty PSU Banks was the top gainer and Nifty Auto, Nifty IT, Nifty Pharma, Nifty Realty were trading in the red. On BSE, Arman Financial Services, Asian Tiles were the gainers and Aegis Logistics was the top loser. BSE Midcap rose by 0,59 per cent and BSE SmallCap rose by 0.57 per cent. On NSE, 26 shares advanced and 24 declined in early trade keeping the overall market breadth positive. On BSE, 14 shares advanced and 16 shares declined keeping the overall market breadth negative.

“Stock market experts are a confused lot now. By all matrixes of valuations markets are richly valued, even over valued, and ripe for a correction. But unmindful of valuation concerns, the market driven by liquidity and retail investor exuberance, is setting record after records. India is one of the best performing markets in the world. Consequently valuations have become excessive. MSCI India is at 80 percent premium to MSCI EM Index. In Warren Buffet’s famous words, “this is the time to be fearful” because greed is driving the market. Corrections are imminent but we don’t know when that will happen. The spike in the 10-year US bond yield to around 1.36 per cent is an indication that inflation may not be transitory as the Fed assumes. Traders may consider lightning positions and investors can book some profits and increase cash component in the portfolio. There are rumors of relief to the telecom industry. This may impart resilience to telecom stocks,” Dr V K Vijaykumar, chief investment strategist at Geojit Financial Services said.

In the banking pack, IDFC First Bank was the top gainer, its scrip rose by 1.40 per cent, followed by YES Bank with 1.38 per cent rise. On the flip side, AU Small Finance was the top loser. The Indian markets opened after taking mixed cues from the global market. In the US stock market, stocks indexes closed mostly lower though the tech heavy Nasdaq to reach another all-time high. Apart from the US stock market, Hong Kong’s Hang Seng index was up 0.16 percent, or 42.48 points, to 26,396.11. On the other hand in Japan, The benchmark Nikkei 225 index was down 0.34 percent or 100.87 points at 29,815.27 in early trade, while the broader Topix index edged down 0.20 percent or 4.11 points to 2,059.27.

“Benchmark Indices are expected to open on a positive note as suggested by trends on SGX Nifty. US stock indices mostly closed lower yesterday with solid gains seen in Apple, Facebook and other tech heavyweights’ companies. Asian markets off to a mixed start with Tokyo stock trading lower as investors sought to lock in profit after the recent rallies seen in the market. We can see some movement in EID Parry today as the company board has approved the setting up of a 120 KLPD Grain/Sugar Syrup/Molasses-based Distillery at the Company’s Sankili unit in Andhra Pradesh. Overall Indian indices look on a positive territory with regular foreign capital inflows, strong domestic data. On the technical front, 17450 may act as immediate resistance for Nifty 50 followed by 17,500 while 17,100 remains a crucial support for Nifty 50,” Mohit Nigam, Head – PMS, Hem Securities said.

Read all the Latest News, Breaking News and Assembly Elections Live Updates here.

Comments

0 comment