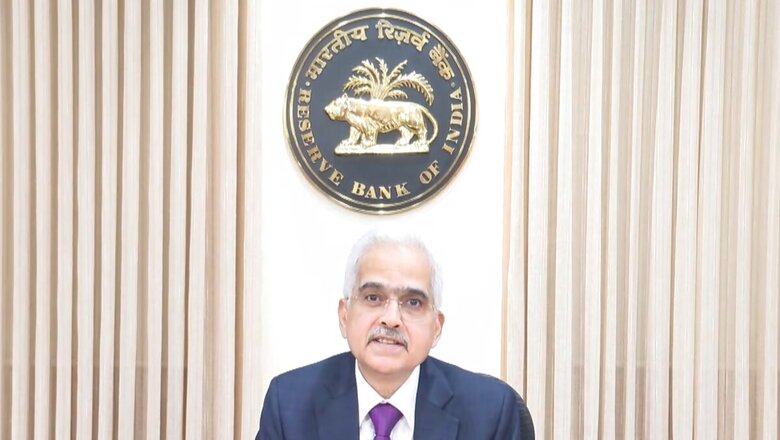

UPI, Sovereign Green Bonds, RBI Retail Direct Scheme App: Key Announcements By Shaktikanta Das Today

views

RBI Governor Shaktikanta Das on Friday said the RBI MPC has kept the repo rate unchanged at 6.5 per cent for the 7th time in a row. He projected the FY25 GDP growth at 7 per cent, while forecasting FY25 CPI inflation at 4.5 per cent. Apart from these, he also took several measures regarding sovereign green bonds, Retail Direct Scheme, and liquidity coverage ratio framework, etc. Here are today’s top decisions by Das.

Trading of Sovereign Green Bonds in International Financial Services Centre (IFSC)

RBI Governor Shaktikanta Das on Friday said a scheme for investment and trading in Sovereign Green Bonds in the IFSC will be notified shortly. This will facilitate wider non-resident participation in these bonds.

RBI Retail Direct Scheme – Introduction of Mobile App

The RBI Retail Direct Scheme was launched in November 2021. Das said the RBI now proposes to launch a mobile app for accessing the Retail Direct portal. This will be of greater convenience to retail investors and deepen the G-sec market.

Review of Liquidity Coverage Ratio (LCR) Framework

The RBI governor said a need has arisen to undertake a comprehensive review of the LCR framework for banks. A draft circular will be issued shortly for stakeholder consultation.

“Technological developments have enabled bank customers to instantly withdraw or transfer money from their bank accounts. While improving customer convenience, this has also created challenges for banks to deal with potential situations when, due to certain factors, a large number of depositors decide to instantly and simultaneously withdraw their money from banks. The developments in certain jurisdictions last year demonstrated the difficulties it can create for banks to deal with such situations,” Das said.

Dealing in Rupee Interest Rate Derivative products – Small Finance Banks

At present, Small Finance Banks (SFBs) are permitted to use only Interest Rate Futures (IRFs) for proprietary hedging. It has now been decided to allow SFBs to use permissible rupee interest derivative products. This will allow further flexibility to SFBs for hedging their interest rate risk and enhance their resilience.

Enabling UPI for Cash Deposit Facility

Deposit of cash through Cash Deposit Machines (CDMs) is primarily being done through the use of debit cards. Given the experience gained from card-less cash withdrawal using UPI at the ATMs, it is now proposed to also facilitate deposit of cash in CDMs using UPI. This measure will further enhance customer convenience and make the currency handling process at banks more efficient.

UPI Access for Prepaid Payment Instruments (PPIs) through Third Party Apps

At present, UPI payments from Prepaid Payment Instruments (PPIs) can be made only by using the web or mobile app provided by the PPI issuer. It is now proposed to permit the use of third-party UPI apps for making UPI payments from PPI wallets. This will further enhance customer convenience and boost adoption of digital payments for small-value transactions, Das said.

Distribution of Central Bank Digital Currency (CBDC) through Non-bank Payment System Operators

The CBDC pilots are currently in operation with increasing number of use-cases and participating banks. It is proposed to make CBDC-Retail accessible to a broader segment of users by enabling non-bank payment system operators to offer CBDC wallets. This will also facilitate testing of the resiliency of CBDC platform to handle multi-channel transactions.

The RBI’s monetary policy committee on Friday decided to keep the repo rate unchanged for the seventh time in a row, at 6.5 per cent. This is in line with the analysts’ expectations. The monetary policy stance continues to be ‘withdrawal of accommodation’. RBI has also kept the FY25 GDP projection at 7 per cent. It projects CPI inflation for 2024-25 at 4.5 per cent.

Comments

0 comment