views

Using Fundamental Analysis

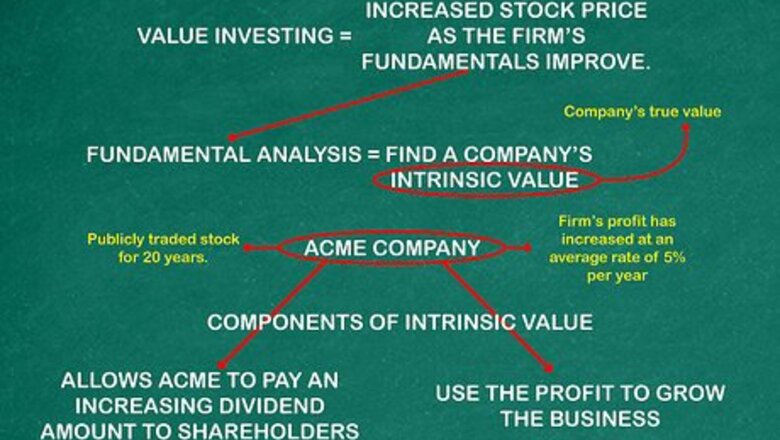

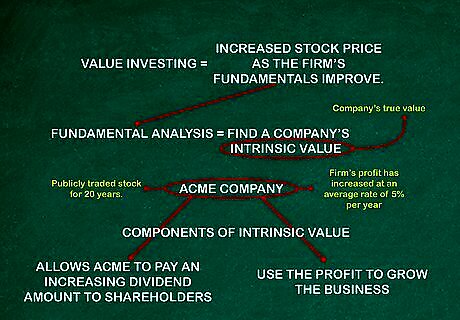

Use the value-investing concept to make decisions about stocks. The goal of value investing is to purchase stocks at a lower price than their true value. The value investor expects to be rewarded with an increased stock price as the firm’s fundamentals improve. Fundamental analysis considers the financial performance of a company. The goal of this analysis is to find a company’s intrinsic value. Intrinsic value is a company’s true value, based on the firm’s ability to generate profit and cash flow. For example, Acme Company has been a publicly traded stock for 20 years. During that time, they increased sales at an average rate of 15% per year. Because of growing sales and smart decisions about expenses, the firm’s profit has increased at an average rate of 5% per year. Therefore, Acme’s performance provides value to investors in two ways. First, the growth in profits allows Acme to pay an increasing dividend amount to shareholders. Second, Acme can keep some of the profits and use those dollars to grow the business. The fundamental investor believes that the financial results will eventually be reflected in the price of the stock.

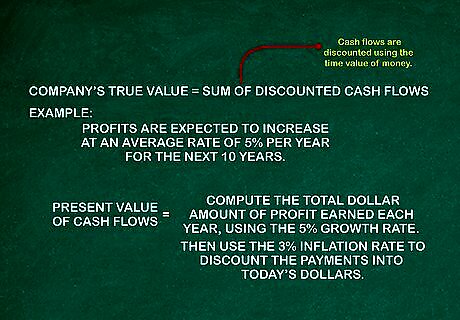

Analyze a company’s discounted cash flows. Fundamental analysis states that a company’s true value is the sum of its discounted cash flows. Investor perceptions of a business impact the stock’s price. However, the fundamental analysis asserts that a stock’s value should be based on these cash flows. Once the company collects cash from its sales and pays its bills, any remaining cash represents profit. The cash flows are discounted into today’s dollars using the time value of money. The time value of money assumes that cash flows received in future years will be worth less, due to inflation. Consider the Acme example, assuming the firm’s profits increase at an average rate of 5% per year for the next 10 years. Also assume that the inflation rate will be 3% per year for 10 years. To compute the present value of the cash flows, first compute the total dollar amount of profit earned each year, using the 5% growth rate. Next, discount those future profits into today’s dollars using the 3% inflation rate.

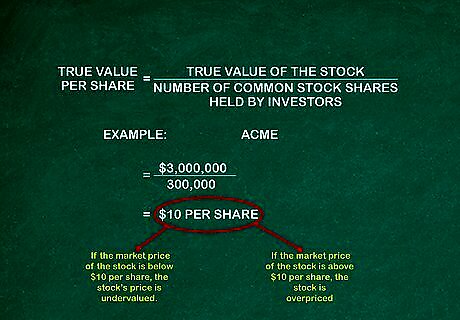

Apply the discounted cash flow method to analyze a stock’s price. The future cash flows generated by company profits are all discounted using the time value of money. The sum of those cash flows is the true value of the stock. The Formula: true value of the stock divided by the number of common stock shares held by investors equals the true value per share. Why It Works: Calculating a value per share allows the investor to compare the stock’s true value to the current market price. How to Interpret Price vs. Value: If investors push the market price of the stock below the true value, fundamental analysis states that the stock is undervalued. Investors should buy the undervalued stock. For Example: The future value of Acme company’s earnings is $3,000,000 and Acme has 300,000 common stock shares held by investors. The true value per share is ($3,000,000 earnings) / (300,000 shares) = $10 per share. If the market price of the stock is below $10 per share, fundamental analysis states that the stock’s price is undervalued. On the other hand, a market price above $10 per share indicates that the stock is overpriced.

Applying Technical Analysis

Go over the technical analysis method. Technical analysis does not consider the financial performance of a company. The profits and cash flow of the business are not considered in this analysis. Technical analysis considers statistics related to the market activity of the stock–buys and sells. This analysis uses the stock’s historical change in price and the stock’s trading volume. Trading volume refers to the number of shares of a stock that are traded each day. A technical analyst believes that historic trends in a stock’s price can be used to predict a future change in the stock’s price. Technical analysts also believe that changes in trading volume can be used to predict a change in a stock’s price.

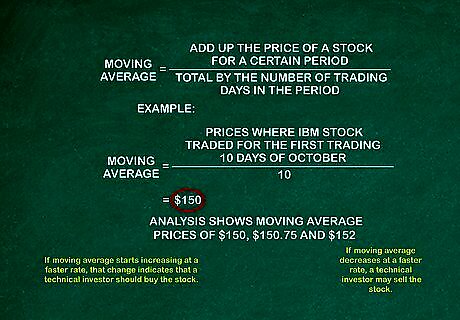

Use a stock’s moving average in price to determine a market trend. Moving average simply adds up the price of a stock for a certain period and divides that total by the number of trading days in the period. Moving average is a statistic used to chart a trend in a particular stock’s price. If the moving average increases at a faster rate, that change indicates that a technical investor should buy the stock. If the moving average decreases at a faster rate, a technical investor may sell the stock. The trend is considered broken when the stock price reverses the moving average line. For example, you add up the prices of IBM stock for the first 10 trading days of October, then divide the total by 10. The average price is $150. You then repeat the calculation each trading day (weekdays when the stock market is open). On October 11th, you calculate the moving average for the prior 10 trading days, including the 11th. Drop the first day and add the 11th day to maintain a ten day average. Each day’s moving average calculation will be slightly different. If your analysis shows moving average prices of $150, $150.75 and $152, you can conclude that, over time, the trend of the stock price is slowly increasing.

Research the price of a stock using trading volume. Trading volume refers to the number of shares that trade during a specific period of time (Day, week, month). Trading volume results are usually combined with other types of analysis to make a decision about buying or selling a stock. Most technicians consider price movement without volume as having little value. Assume that IBM’s common stock normally trades 100,000 shares per day. If the number of shares traded increased or decreased sharply, that may be an indication of a trend. Say, for example, the trading volume increased to 150,000 shares per day and the stock’s moving average began to increase sharply. The increases in both of these technical indicators may present a signal to buy the stock. Increasing volume with an upward trend indicates accumulation, while increasing volume with a downward trend means liquidation. If the trading volume increased and the moving average declined sharply, that may indicate a downward trend for the stock. The technical analyst may conclude that more people are selling the stock, due to the increase in trading volume and the price decline.

Technical analysts also consider short interest as well as support and resistance levels. These additional considerations help them to determine buying or selling opportunities. Short interest measures the total number of shares of a stock that have been sold short without being covered or closed out. A high short interest is a red flag. Support and resistance levels refer to price levels beyond which the price of an asset will not go in a certain direction.

Comments

0 comment