views

X

Research source

We'll walk you through a multitude of ways to calculate the market value of a company in order to accurately represent its true value. We'll show you how to consider the company's market capitalization (its stock value and shares outstanding), analyze comparable companies, and use industry-wide multipliers to determine market value.

Calculating Market Value Using Market Capitalization

Decide if market capitalization is the best valuation option. The most reliable and straightforward way to determine a company's market value is to calculate what is called its market capitalization, which represents the total value of all shares outstanding. The market capitalization is defined as a company's stock value multiplied by its total number of shares outstanding. It is used a measure of a company's overall size. Note that this method only works for publicly traded companies, where share values can be easily determined. A disadvantage of this method is that it subjects the company's value to the fluctuations of the market. If the stock market declines due to an external factor, the company's market capitalization will fall even if its financial health has not changed. Market capitalization, because it relies on investor confidence, is a potentially volatile and unreliable measure of a company's true value. Many factors go into to determining the price of a share of stock, and thus a company's market capitalization, so it's best to take this figure with a grain of salt. That said, any potential buyer for a company might have similar expectations to the market and place similar value on the company's potential earnings.

Determine the company's current share price. The share price of the company is publicly available on many websites, including Bloomberg, Yahoo! Finance, and Google Finance, among others. Try searching the company's name followed by "stock" or the stock's symbol (if you know it) on a search engine to find this information. The stock value that you'll want to use for this calculation is the current market value, which is usually displayed prominently on the stock report page on any of the major financial websites.

Find the number of shares outstanding. Next, you'll have to figure out how many shares of the company's stock are outstanding. This represents how many shares the company are held by all shareholders, including both insiders, like employees and board members, and external investors like banks and individuals. This information can be found either on the same website as the stock price or on the company's balance sheet under "capital stock." By law, all publicly-held companies' balance sheets are available online for free. A simple search engine search will turn up any public company's balance sheet.

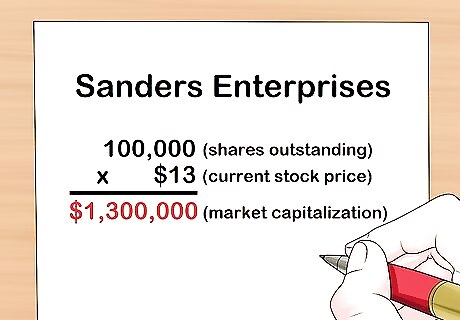

Multiply shares outstanding number by the current stock price to determine the market capitalization. This figure represents the total value of all investors' stakes in the company, giving a fairly accurate picture of the company's overall value. For example, consider Sanders Enterprises, a fictional, publicly-traded telecommunications company with 100,000 shares outstanding. If each share is currently trading at $13, the company's market capitalization is 100,000 * $13, or $1,300,000.

Finding Market Value Using Comparable Companies

Determine if this is the right valuation method to use. This valuation method works well if a company is privately held or if the market capitalization figure is deemed unrealistic for any reason. To estimate a company's value, look at the sales prices for comparable businesses. Market capitalization may be deemed unrealistic if a company's value is mostly held in intangible assets and investor overconfidence or speculation drives the price up way beyond reasonable limits. This method has several shortcomings. First, it may be difficult to find enough data, as sales of comparable businesses may be very infrequent. Also, this valuation method does not account for significant differences between business sales, such as whether the company was sold under duress. However, if you are trying to find the market value of a private company, your options are limited, and comparison is a simple way to get a rough estimate.

Find comparable companies. There is some discretion involved in choosing which businesses are comparable. Ideally, the companies considered should be in the same industry, be roughly the same size, and have similar sales and profits to the company you want to value. In addition, the sales (of comparable companies) should be recent so that they reflect more or less up-to-date market conditions. If you are determining the market value of a private company, you can use publicly-traded companies of the same industry and size for comparison. This is easier because you can find their market value by using the market capitalization method in a few minutes by searching online.

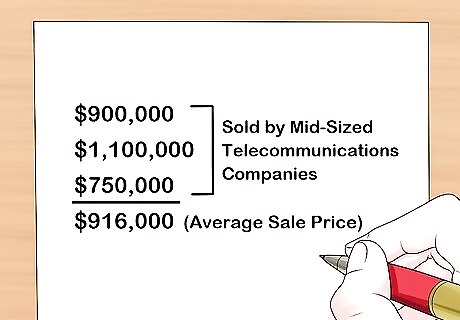

Create an average sale price. After finding recent sales of comparable businesses or valuations of similar, publicly-traded companies, average together all the sale prices. This average value can be used as the beginning of an estimate of the market value of the company in question. For example, imagine that 3 recent mid-sized telecommunications companies sold for $900,000, $1,100,000, and $750,000. Averaging these 3 sale prices together yields $916,000. This might seem to indicate that Anderson Enterprises' market capitalization of $1,300,000 is an overly optimistic estimate of its value. You may wish to weigh the different values based on their closeness to the target company. For example, if one is of very similar size and structure to the company being estimated, you may choose to assign a higher weight to this company's sale value when calculating the average sale price. For more information, see how to calculate weighted average.

Determine Market Value Using Multipliers

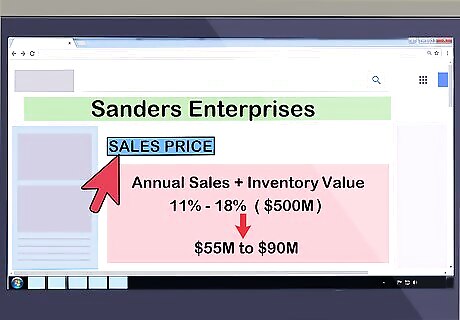

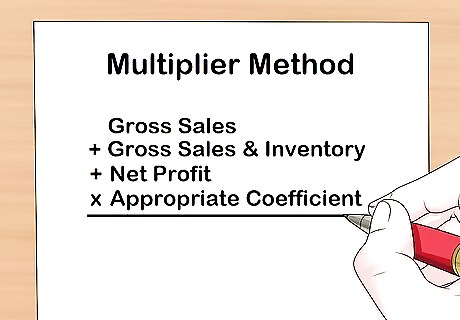

Determine if this is the right method to use. The most appropriate method for valuing small businesses is the multiplier method. This method uses an income figure, such as gross sales, gross sales and inventory, or net profit, and multiplies it by an appropriate coefficient to arrive at a value for the business. This type of estimate is best used as a very rough, preliminary valuation method because it ignores many important factors in determining the actual value of a company.

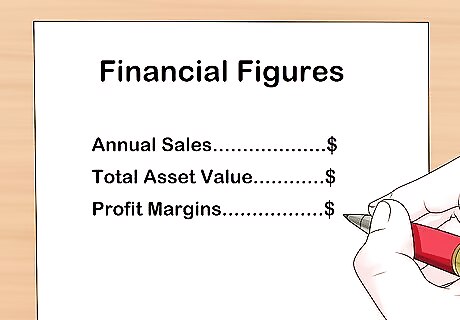

Find the necessary financial figures. Generally, valuing a company using the multiplier method requires annual sales (or revenues). Having a sense of the company's total asset value (including the value of all its current inventory and other holdings) and profit margins can also help in value estimation. These values are typically available on a publicly-traded company's financial statements. However, for a private company, you will need permission to access this information. Sales or revenues, along with commissions and inventory expenses if there are any, are reported on a company's income statement.

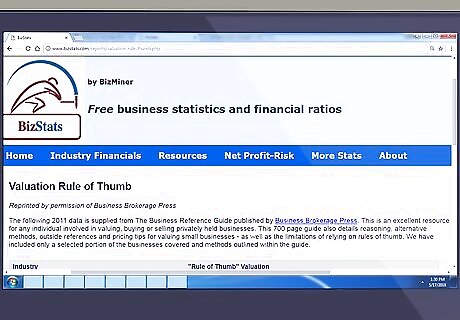

Find the appropriate coefficient to use. The coefficient used will vary based on the industry, the market conditions, and any special concerns within the business. This number is somewhat arbitrary in nature, but a good figure to use can be obtained from your trade association or from a business appraiser. A good example is BizStat's valuation "rules of thumb." The source of the coefficient will also specify the appropriate financial figures to use in your calculation. For example, total annual earnings (net income) is the common starting point.

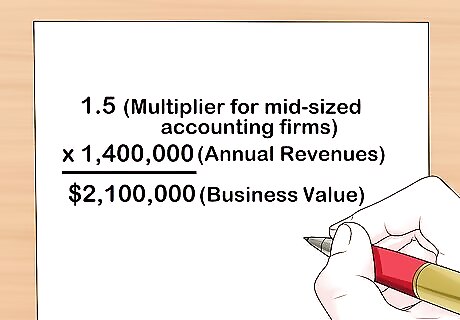

Calculate the value using the coefficient. Once you find the financial figures needed and the appropriate coefficients, simply multiply the numbers to find a rough value for the company. Again, keep in mind that this is a very rough estimation of market value. For example, imagine that the appropriate multiplier for mid-sized accounting firms is estimated at 1.5 * annual revenues. If Anderson Enterprises' total revenues this year are $1,400,000, then the multiplier method yields a business value of (1.5 * 1,400,000) or $2,100,000.

Comments

0 comment