views

X

Research source

Creating a Trial Balance Sheet

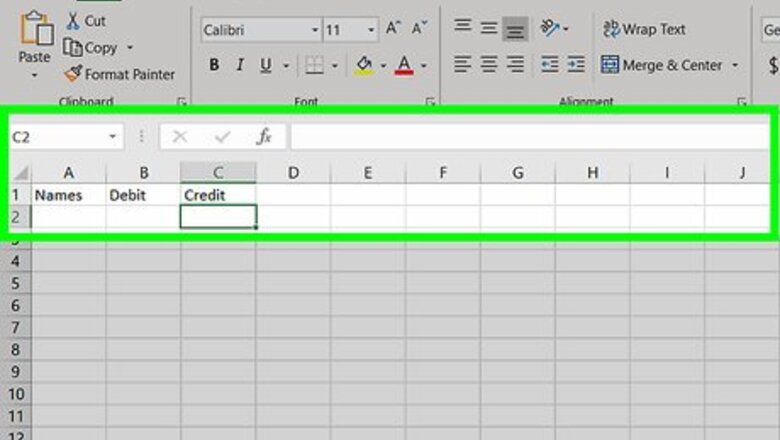

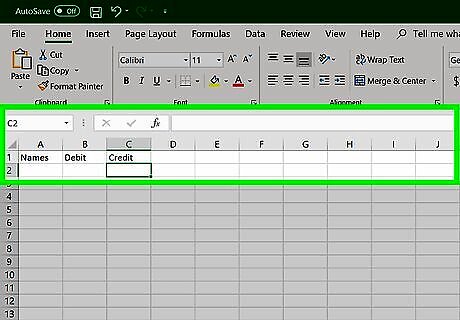

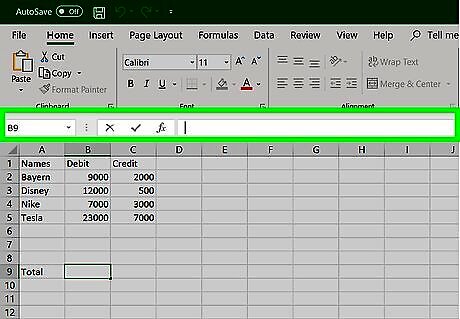

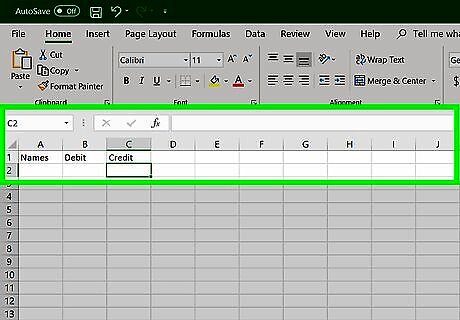

Open a spreadsheet with 3 columns. Use the first column for the names of the various temporary accounts. Title the second column "debit" and the third column "credit." Each account will have its own row. Title your spreadsheet "Trial Balance" with the date. You might also include additional information, such as the period of the accounting (annual, quarterly, or monthly).Tip: If you use accounting software, it will automatically generate a trial balance sheet based on the information in your ledger account. However, it's important to understand how to create one manually so you can correct any errors in the automatically generated report.

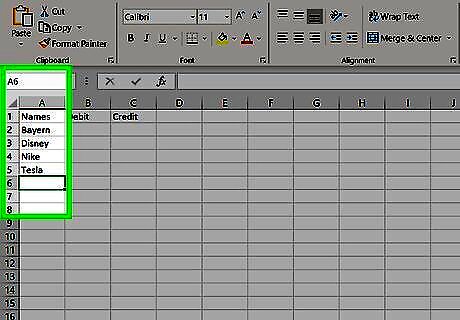

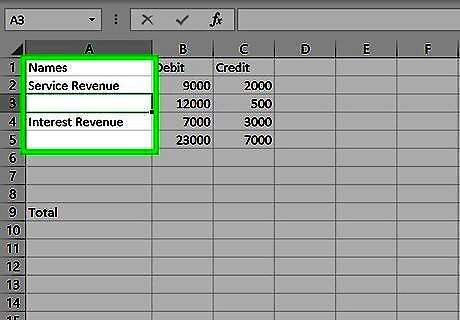

Enter each account in a row in the first column. Copy the names of the accounts from the general ledger account. Depending on the type of business, you may have account names such as "accounts payable" or "loans payable" in addition to a general "revenue" account. The order of the accounts is up to you. You may want to divide them into credit and debit accounts or list them in alphabetical order. If you're creating a trial balance sheet for a business, pull up old trial balance sheets to see how accounts were ordered in the past and use the same method. If there are multiple accounts of the same type, aggregate them for a single account line. For example, if you had multiple cash accounts, you would aggregate them into a single balance sheet line.

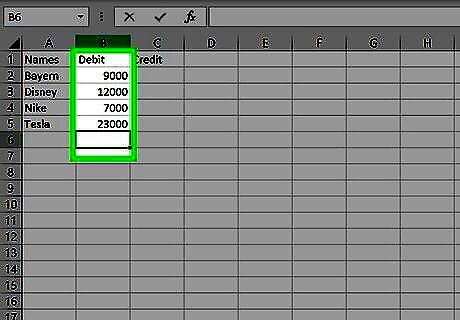

Place the account balance in the credit or debit column. Generally, the balances for asset and expense accounts go in the debit column. The balances for revenue, equity, and liability accounts go in the credit column. If the account has a negative balance, indicate this on your balance sheet by placing a negative sign ( - ) in front of the number. You can also put the number in parentheses. However, you do not move it to the other column.Tip: It generally doesn't matter how you represent a negative balance, as long as you're specific. However, make sure whatever method you use is recognized by your spreadsheet program as a negative value.

Add a total line at the bottom of the columns. Once you've entered all the balances in the appropriate columns, set up an equation at the bottom to total all the values in the debits column. Repeat the same process to get the total of all the values in the credits column. If the trial balance has been done correctly, the debits and credits should be the same. However, keep in mind that even if they balance there still may be mistakes in the books. For example, a transaction may have been entered into the wrong account. Any such mistakes would typically be uncovered and corrected during a routine audit of the books.

Closing Temporary Accounts

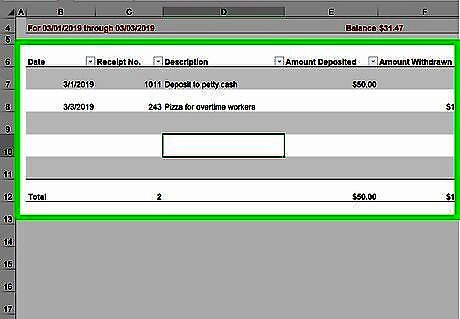

Total the balances of all temporary revenue accounts. Revenue accounts have a credit balance. However, not all accounts with credit balances are revenue accounts. Look at the titles of the accounts to determine which accounts to total. For example, you may have accounts titled "Service Revenue" and "Interest Revenue." Both of these accounts are temporary revenue accounts. If there is $36,500 in the Service Revenue account and $600 in the Interest Revenue account, your total revenue would be $37,100 for the accounting period.

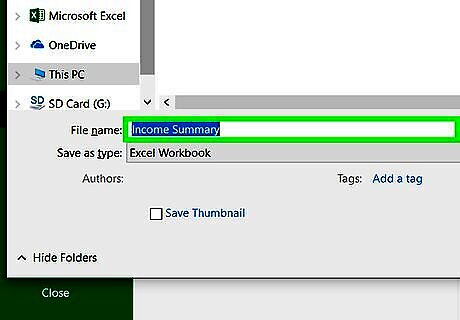

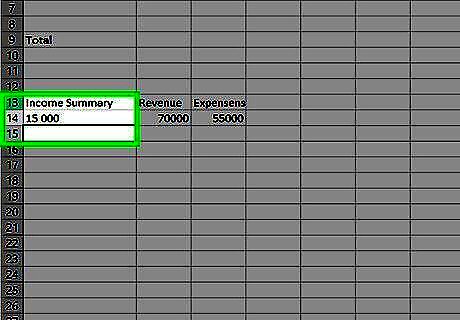

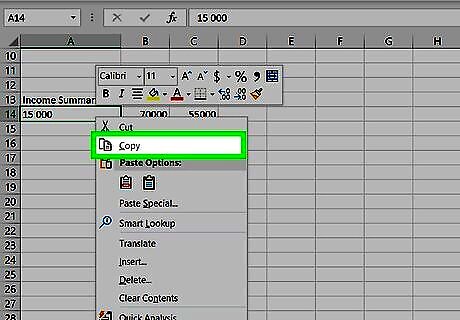

Transfer the total balance of all revenue accounts to Income Summary. Create a temporary account called "Income Summary." Zero out the temporary revenue accounts to close them, moving the balance to Income Summary. To return to the previous example, if you had $36,500 in Service Revenue and $600 in Interest Revenue, you would transfer $37,100 to Income Summary. The new balance of both the Service Revenue account and the Interest Revenue account would be zero.

Total the balances of all temporary expense accounts. Expense accounts have debit balances. These accounts typically will have names such as "Rent," "Salaries," and "Utilities." For example, if you had $20,000 in Salaries, $1,200 in Rent, and $500 in Utilities, your expense total would be $21,700.

Debit the Income Summary account for all expenses. Take your total expenses and subtract them from the total revenue you've already placed in your Income Summary. The amount left over (if any) is your income for the accounting period. For example, if you had $21,700 in expenses and $37,100 in Income Summary, you would end up with $15,400.Tip: The Income Summary balance is actually the net income for the accounting period, or all income minus expenses.

Completing the Accounting Cycle

Close Income Summary to the appropriate capital account. Move the balance of Income Summary to Capital or Retained Earnings, whichever title is used. Technically, you are debiting the Income Summary account and crediting the Capital account. The Income Summary account balance is now zero. If the balance in Income Summary was negative, you would subtract that amount from the Capital or Retained Earnings account.

Debit the capital account for any withdrawals. Withdrawals from capital may be in a Drawing account (for partnerships or sole proprietorships) or dividends (for a corporation). Any balance in these accounts represents money taken from the business by owners or shareholders. For example, suppose you have $100,000 in the Capital account and a Drawing account with $10,000. You would credit the Drawing account to zero it out, then debit the Capital account. The resulting balance in the Capital account is $90,000.

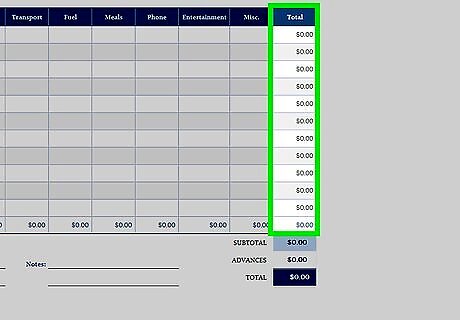

Draft a post-closing trial balance sheet. The post-closing trial balance sheet lists the balances of all accounts that weren't zeroed out in closing. Temporary accounts that were closed, such as Income Summary, are not included. There are 3 columns: 1 for account names, 1 for "Debit" balances, and 1 for "Credit" balances. Once you've copied the account titles, place the account balance in the appropriate column. Asset and expense accounts have debit balances, while liability, income, and equity accounts have credit balances. Create a total at the bottom of both the Debit and the Credit columns. The totals of the 2 columns should be exactly the same.Tip: Because accounting software requires accounts to balance before you can post them to the general ledger, post-closing trial balance sheets are only valuable if you're preparing accounting data manually.

Comments

0 comment