views

X

Research source

Each state may calculate franchise tax differently. If you operate a business in Texas, you need to understand how to calculate and pay your franchise tax.

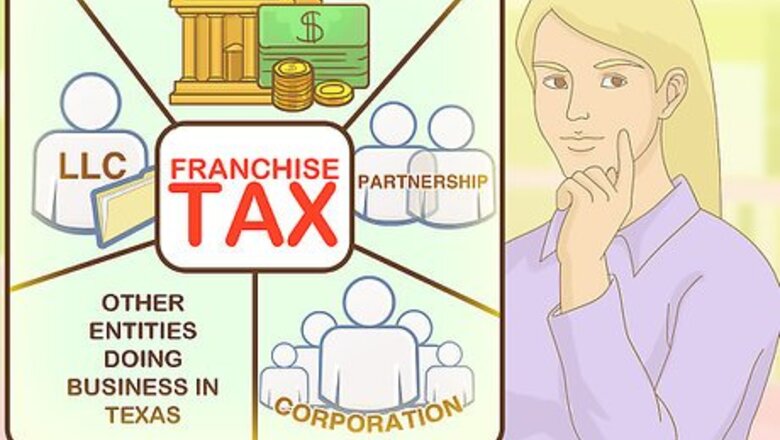

Determining Whether Franchise Tax Applies to You

Decide if franchise tax applies to you. Any “legal entity” that does business in Texas or that is chartered in Texas must pay a franchise tax. This includes: corporations limited liability companies (LLCs) banks and savings and loan associations partnerships (general, limited and limited liability) trusts professional and business associations joint ventures other entities doing business in Texas.

Determine whether your business is exempt. You may not have to pay a franchise tax if your business falls into one of the following categories: sole proprietors (except single-owner LLCs) some partnerships certain trusts or entities that are exempt under state or federal tax law.

Seek professional advice. If you are not sure whether your business entity is required to pay a franchise tax in Texas, consult a corporate attorney or certified public accountant familiar with the Texas tax laws.

Contact the Texas Comptroller of Public Accounts. This is the office in Texas that is responsible for assessing and collecting taxes. If you need further assistance determining whether the franchise tax applies to you, you can call a Taxpayer Services Line, dedicated particularly to franchise taxes, at 1-800-252-1381, between the hours of 8 a.m. and 5 p.m., Monday through Friday.

Calculating Your Franchise Tax Amount

Estimate your company’s “margin.” Begin with your company’s total revenue, and then subtract one of the following three categories. You will calculate the value for each of them separately, and then use the value that results in the smallest final figure. Subtract the cost of goods sold. For this to apply, your company must actually sell a product, not just services. This includes the cost of the raw materials and production labor. Subtract the compensation that the company pays to its employees. Certain benefits can be included, but there is a cap of $300,000 per employee. Subtract 30% of the total revenues. This method will generally apply to companies with low salaries and low product costs.

Estimate the tax. Using the lowest figure that results from the three subtractions, a company that is primarily engaged in wholesale or retail trade will pay a tax of 0.375%; all others will pay 0.75%.

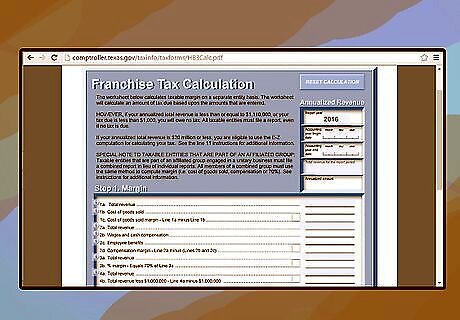

Use the Comptroller’s online tax calculator. For a more accurate measure, you can use the online tax calculator published by the Texas Comptroller of Public Accounts. You can find that calculator at http://comptroller.texas.gov/taxinfo/taxforms/HB3Calc.pdf.

Filing the Proper Tax Forms

File a Franchise Tax Report. The franchise tax report is your report to the state of your company’s annualized total revenue and calculation of the tax you are paying. Annual franchise tax reports are due each year by May 15. There are three different forms to select from: No Tax Due. You will report that you owe no franchise tax if annualized total revenue is $1,110,000 or less for all reports filed after Jan. 1, 2016. E-Z Computation Tax Form. You will use this form if your business has annualized total revenue between $1,110,000 and $20 million for reports filed after January 1, 2016. Long Form. You will use this form if neither of the other two forms applies.

File a Public Information Report. This form is required annually for anyone filing a franchise tax report, even if no tax is due. The business risks losing its operating status in Texas if this form is not filed.

File additional forms. In addition to one of the standard tax reporting forms and the Public Information Report, you may need to file one or more of the following. Affiliate Schedule. This form is required if you are filing as a combined group. Tiered Partnership Report. This form is required if you are filing as a tiered partnership. Common Owner Information Report. This form is required of some combined group filings. Payment Form. You will use this if you are paying a tax but not filing electronically.

Preparing Your Franchise Tax Report

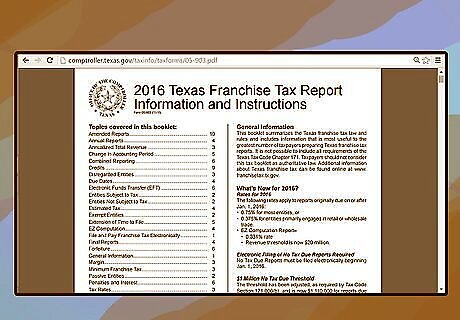

Use published materials. The Texas Comptroller of Public Accounts publishes an annual booklet of Franchise Tax Information and Instructions. You can find this at http://comptroller.texas.gov/taxinfo/taxforms/05-903.pdf. The booklet will walk you through the complete line-by-line completion of your tax reports.

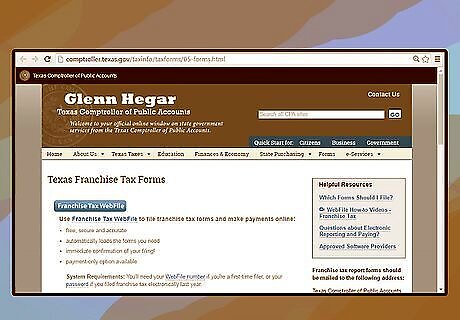

Select your reporting method. Texas accepts three different methods for reporting and payment: Approved Electronic Submission Software Providers. The Comptroller’s office has approved a list of providers that you may contact for assistance with completing your reports and submitting the final results. Each provider will charge its own fee for the services provided. WebFile. This is an electronic service that you can choose to use on your own to calculate your taxes and prepare and submit the final reports. Some entities are required to use this service, while others are encouraged to use it because it is quicker, cheaper and will save paper. Check this link, http://comptroller.texas.gov/webfile/required.html, to determine if your business is required to use electronic filing. Download and print the forms and mail them in with your payment. The forms you need are available online at http://comptroller.texas.gov/taxinfo/taxforms/05-forms.html. Select the appropriate tax year and print and complete the forms.

Submit your completed report. If you are using an electronic version, you will follow the instructions at the end of the form to electronically sign and submit your report. If using paper, you must sign the forms and return them by mail, along with the correct payment, to Texas Comptroller of Public Accounts, P.O. Box 149348, Austin, TX 78714-9348.

Comments

0 comment