views

Registering for a Permit

Contact your state's tax authority. Sales taxes are collected by your state's department of revenue. Search online for the department's website, which typically will have information on how to register for a sales tax permit. You may also be able to drop by a local office if you want to speak to someone in person about registering your business to collect sales tax. You can also get help from the Small Business Association. Go to https://www.sba.gov/tools/local-assistance/districtoffices to find the district office in your state.

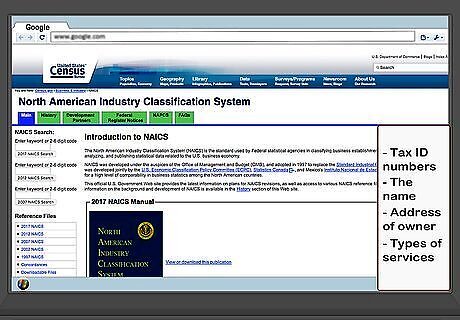

Gather information needed to register. The sales tax application requires basic information about your business, including your tax ID number, the names and addresses of owners, and the types of goods and services you plan to sell. The application in most states also requires you to provide the appropriate North American Industry Classification System (NAICS) code that applies to your business. You can find your code by searching on https://www.census.gov/eos/www/naics/.

Complete your registration application. You can typically download a paper application from the website of your state's tax authority. In most cases, you can simply complete an online application and submit it through the website rather than filling out the paper forms. For some types of goods, such as alcohol and tobacco, you will have to fill out additional forms and collect additional taxes. The names or numbers of these forms will be listed on the main application form.

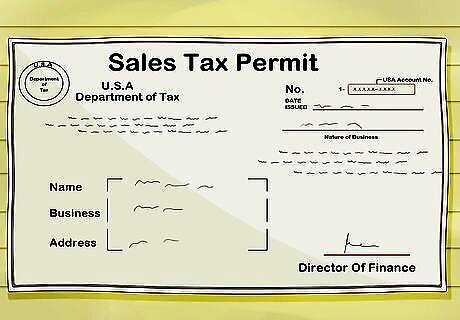

Receive your permit. After your application is processed, your state will issue a tax permit for your business. You usually cannot start conducting business until you've received this permit. Check the processing time for your state. It may be as short as a few days, but in some states it can take 2 or 3 weeks. The state will determine how often you need to report and pay sales taxes. If the period isn't specified with your permit, you'll typically report on a monthly or quarterly basis.

Set up a bank account for sales tax. The easiest way to keep up with the sales tax you collect and make sure the money is available to send to the state is to keep collected sales tax in a segregated bank account apart from your payroll and operating accounts. Many banks offer accounts specifically for this purpose for their business customers. Ask at the bank where you have your operating or payroll accounts set up. When you collect sales tax, you're doing so on behalf of the state – that money does not technically belong to the business. Some states require segregated bank accounts for businesses that underpay or fail to pay their sales tax on time.

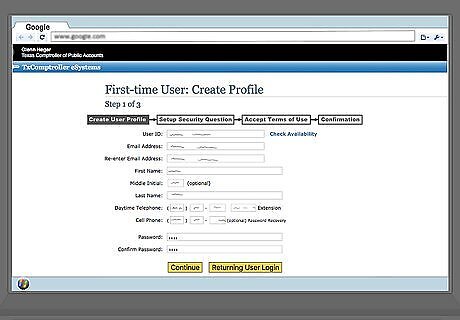

Register for online filing. Many states now require businesses to file sales and use tax reports and payments electronically. The easiest way to do this is to set up an account on the payment website of your state's tax authority. Most states also offer the ability to file over the telephone without having to register for an account. However, filing this way may be limited, and won't give you access to additional services, such as the ability to amend a return.

Collecting and Reporting Sales Tax

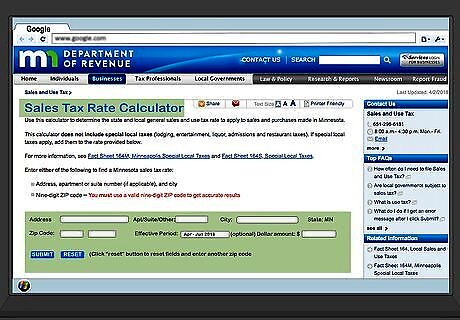

Determine the appropriate tax rate. In most states, you'll collect local as well as state sales tax from your customers. Depending on where your business is located, this may involve city and county sales tax. Most states have an online calculator you can use to accurately compute the sales tax you need to collect. Search on the website of your state's department of revenue. You'll enter the zip code of your business and it will provide a breakdown of the tax you need to collect from your customers.

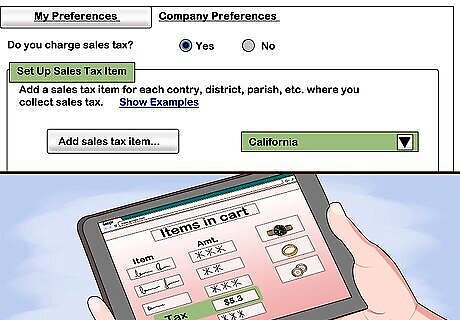

Set up your point-of-sale (POS) systems to collect taxes. For most businesses, POS systems have taken the place of the traditional cash register. These systems record all the information about your sales electronically. Some systems will calculate the tax rate automatically based on the information you provide about your business. However, you should still double-check this rate with your state's department of revenue to make sure you're collecting the appropriate amount. If you sell goods or services online through an established platform, such as Etsy, there is a POS system built in that you can configure to collect sales tax when appropriate.

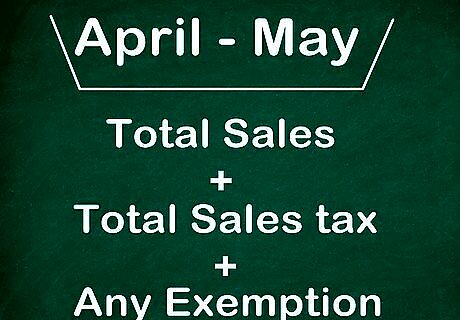

Gather information about the taxes you collected. Before you report your sales taxes, you'll need a summary of the sales you've made during the reporting period and the amount of sales tax you've collected. If you made any sales that were tax exempt, you typically must also include a description of those sales along with identifying information for the tax-exempt customer. Most POS systems will generate a summary for dates you specify that you can use to complete your sales tax reporting forms.

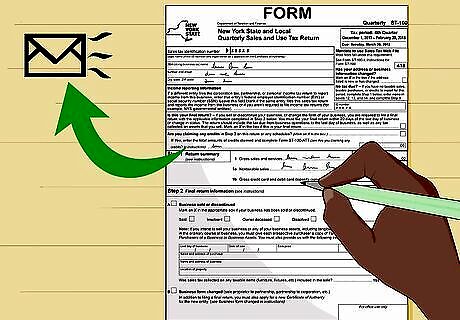

Complete the appropriate form. Your state's department of revenue will have the required forms on its website for you to report the sales tax you've collected. In most states, you can also provide the information through an online tax portal. You must file a report with your state's department of revenue when due, regardless of whether you had any taxable sales for that period. For example, suppose you report quarterly and your store was closed for the month while you were remodeling, so you had no sales. You still must file a zero-sales return. Your due date depends on how frequently you have to report sales taxes. Refer to the website of your state's department of revenue and set reminders for yourself of the due dates. Don't rely on the state to remind you.

Provide payment in full for sales taxes collected. Once you've completed the reporting form, you are expected to remit the full amount of sales taxes you've collected. Most states offer a several methods of payment. If you have a segregated bank account for sales tax, the easiest method is to enter the account and routing number for that account. You can then set up an electronic funds transfer (EFT) transaction for the sales tax you collected.

Maintaining Adequate Sales Records

Keep detailed daily records of all sales transactions. For every day you are open for business, you should have a complete daily log that records each sale made that day and the amount of sales tax collected for those sales. If you use a POS, you can generate daily, weekly, and monthly summaries of sales within that system. Reconcile these records with your bank accounts on a daily or weekly basis, and transfer the appropriate amount to your sales tax account. Sometimes, certain components of items are taxed while other components are not. Try to be aware of what items may carry an extra tax.

Retain copies of invoices and receipts. For all receipts or invoices that you give to your customers or clients, you must also have a copy in your business records. If you use a cash register, keep all of your register tapes. Generally, the customer's receipt should list the subtotal for goods and services, followed by the amount of tax collected with the tax rate, and then the total charged to the customer.

Conduct regular audits. On a quarterly or semiannual basis, reconcile your sales records with your bank accounts and other records to confirm that you are reporting and paying the correct amount of sales tax. If your audit turns up a discrepancy, you may need to file an amended return. Contact your state's department of revenue to find out how to do this. Most POS systems can be programmed to run audits automatically. You may also want to hire an accountant or bookkeeper to oversee the audit process.

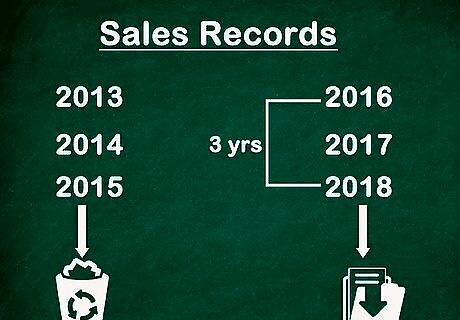

Hold records for at least 3 years. Your sales records must be available for inspection by your state's department of revenue in the event of a tax audit. In most states, returns are subject to audit for 3 years. Measure the 3-year period from the date the tax return was due. Collect all records related to that tax return and file them together. Write the date 3 years out on the file or box so you'll know when those records can be disposed of.

Comments

0 comment