views

Decide what kind of car you want.

The price you'll pay depends on the type and age of the car. If you want a brand-new car, you'll end up spending more money than you would on a used car. You'll also pay more if you want a car with all the latest tech and features. Make a list of things you're interested in, then shop online to get an idea of the market price for that type of car. Even if you've got your heart set on a new car, check out used ones as well. You can get a lightly driven car that's only a couple of years old and spend a fraction of what you would for a new car. You can also come up with the amount first, then see what's available in that range. For example, if you've decided you don't want to spend more than $10,000, search online for cars in that price range, then go from there.

Evaluate financing options.

Financing allows you to get a car now with less money upfront. Auto finance companies often pre-qualify borrowers, which means you can apply for a loan and see what kind of terms are available to you without dinging your credit. Search for auto financing online and get pre-qualified with several lenders so you can find the best terms. A larger down payment typically results in a lower monthly payment. That being said, there are many different ways to pay for a car, including buying it outright, financing it, or leasing it. Look at all the options so you can find the one that works best for you and your budget. Most people don't pay cash for a car—especially a new one. It's more common to finance your car and make a down payment, then make a monthly payment.

Open a savings account specifically for your car.

Contact your bank to open a new savings account. A separate savings account specifically for your car savings is the best way to keep track of your progress toward your goal. If you already have a checking account, the easiest thing to do is open a savings account with the same bank. In a savings account, your money will also earn a little interest, which makes this a better option than, say, stuffing cash in a piggy bank.

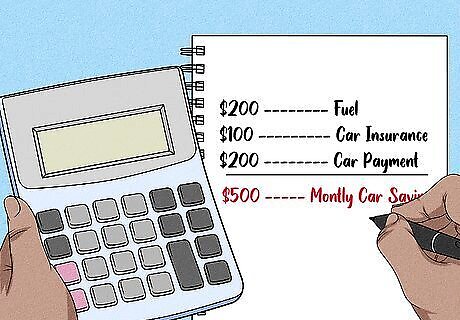

Budget an amount to save each month.

Start with an amount similar to the monthly cost of a car. There's little point in saving up for a car if you're not going to be able to maintain it once you get it, right? Whether you're financing your car or trying to buy something with cash, you'll still need to spend money on fuel, insurance, and maintenance. For example, suppose you've determined that once you get your car, you'll spend $200 each month on fuel, $100 on car insurance, and $200 on your car payment—a total of $500 a month. Save $500 a month toward your car until you've got enough for your down payment. Then, when you get your car, you'll already be used to that expense. Set up an automatic transfer so that when you get paid, the amount you've budgeted is automatically transferred to your savings account. Then you won't have to think about it.

Reduce your monthly expenses.

Look for costs you can eliminate and put that money toward your car. Take a good, hard look at your actual expenses each month and figure out what you can do without. Even a few dollars here and there will add up over the course of several months. For example, if you subscribe to several streaming services, you might cancel all but one. Then, you can put the money you would usually spend on the other subscriptions towards your car.

Do odd jobs for extra cash.

Ask friends and neighbors if they have any odd jobs you can do. Doing odd jobs is a good way to spend some of your free time earning a little extra cash that you can put toward your car. Advertise your skills and services on your social media accounts and see if anyone has some work you can do. Set yourself an hourly or per-project rate. For example, you might decide you'll clean and detail cars for $30 each or for $20 an hour. A lot of "side hustles," like ride-sharing and delivery, require you to have a car already. If you're saving up for a first car, that can be a problem. But you can still do other odd jobs, such as cleaning or mowing lawns. You can also sign up for mobile apps, such as Task Rabbit, that help you expand and do jobs for other people in your area.

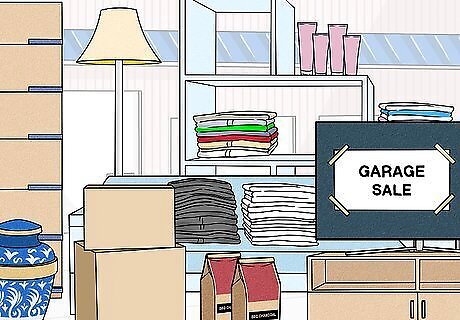

Sell personal items you don't need.

Have a yard sale or list items for sale online to raise money. If you have a lot of things sitting around collecting dust, see if you can turn them into money for your car. You'll get more for big-ticket items, such as electronics, but even a few dollars for clothes and books will add up. If you're planning on having a yard sale, talk to friends and family members. They might have stuff they'd be willing to donate to your sale to help you get more money.

Capitalize on an upcoming birthday or holiday.

Let your friends and family know that you're saving for a car. If you've got a birthday coming up, or there's a holiday soon where people commonly buy you presents, tell them to contribute toward your car instead. Often, people will find it more meaningful to help you reach a goal.

Pick up more shifts at work.

Tell your manager you're trying to save up for a car. Let your co-workers know as well—if they need a day off, they might ask you to cover. When you get extra shifts, take all the money you make on those shifts and put it toward your car. Some employers don't allow overtime, but if you have that option, let your manager know that you're willing to do it. The extra pay will help you save up a lot more quickly.

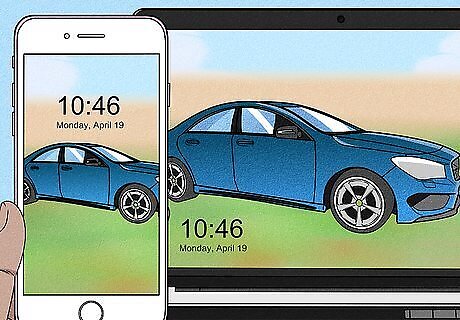

Use images of your car to motivate you.

Set your desktop and phone background to a picture of your car. If you see your car often, you'll keep your goal in sight and be less likely to spend money on other things. You might also put a picture of your car on your bathroom mirror, or create a driving-themed collage to hang next to your bed. Cut a picture of your car out of a magazine or print one off a website and stick it in your wallet. You'll see it every time you go for a credit or debit card, and it will remind you of what you're saving for. You might think twice before making that impulse purchase.

Take a car for a test drive.

Go to a dealership that has a car similar to the one you want. If you still have a lot of saving to do, this might not be the specific car you end up buying—but that's okay! What's important here is that you have the experience of driving the car. Whenever you're tempted to spend money on something different, or are starting to have second thoughts about your savings project, just think about the feeling you got driving the car. Let that motivate you to stick to your plan. If there's a similar model for rent near you, you might also rent it for a day—although this will cost you a little more money. By having the car for the whole day, though, you get a better picture in your mind of what it would be like to actually own the car.

Comments

0 comment