views

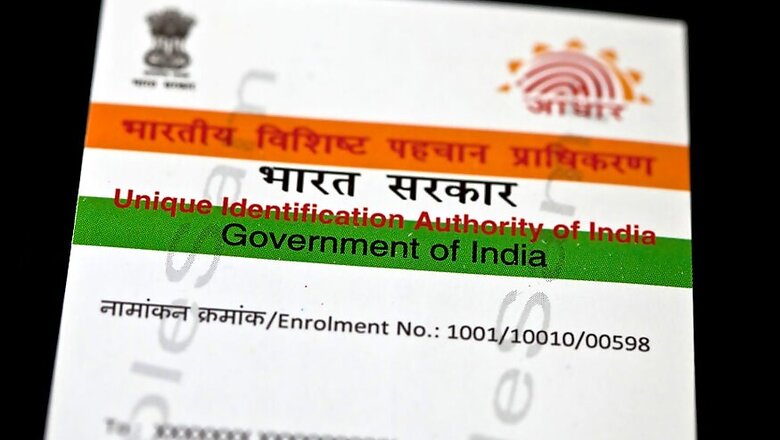

New Delhi: The government has issued a notice making it mandatory to link existing Aadhaar numbers with permanent account number(PAN) of taxpayers, the deadline for which is August 31 .

The government has amended the Income Tax rules and has made Aadhaar a must at the time of application of PAN. Finance Minister Arun Jaitley through an amendment to tax proposals in the Finance Bill for 2017-18 had made Aadhaar mandatory for filing income tax returns and provided for linking of PAN with Aadhaar to check tax evasion through use of multiple PAN cards. Even while applying for a new PAN card, it will be mandatory to furnish 12-digit Aadhaar card details.

Here’s what you need to know about linking Aadhaar number with PAN cards:

Why Link Aadhaar Card with PAN Card

This move is cited to deter Income Tax evasion that happens due manipulative practices like filing ITRs via multiple PAN cards.

How to Link Aadhaar with PAN Card

You can link your Aadhaar card with PAN by visiting the official website of Income Tax Department of India at incometaxindiaefiling.

You can also send an SMS to 56161 or 567678 from your Registered Mobile Number (RMN) of Aadhaar Card in the below mentioned format:

UIDPAN

What if You Fail to Link

If you do not link or fail to link your Aadhaar card with your PAN card, then your PAN card might be rendered invalid by December 2017. Currently 99% adult population in India is enrolled with Aadhaar and the government deems it possible that every adult will be covered by the end of 2017.

Comments

0 comment