views

Samhi Hotels Ltd on Friday, September 22, made a stock market debut, with its shares listing with 6 per cent gains on the BSE and NSE. The company’s shares opened at Rs 134.5 apiece on the NSE as compared with the issue price of Rs 126 a share. The shares, however, fell after the listing and are now currently trading at Rs 129.5 apeice on the NSE as of 10.40 am.

On the BSE also, Samhi Hotels’ shares listed at a premium on the BSE also at Rs 130.55 on BSE. As of 10.41 am, its prices stood at Rs 4.70 apiece on the BSE, which is 3.73 per cent higher than its issue price.

Shivani Nyati, head of wealth, Swastika Investmart Ltd, said, “Samhi Hotels listed at Rs 134.5 per share, a premium of 6.7 per cent to its IPO price of Rs 126. On the one hand, the company is loss-making, and its financial performance has been poor for the last three years.”

She said that on the other hand, the company is making progress on cutting losses, and the sales multiple is 3.7X, which is below the industry average. “Investors should book profit and exit their position, and those who still want to hold should maintain a stop loss at the listing price.”

The IPO was open for subscription between September 14 and September 18. The IPO had a fresh issue of up to Rs 1,200 crore and offer for sale of up to 13,500,000 equity shares.

Price range for the offer was at Rs 119-126 a share.

Gurugram-based Samhi Hotels earlier said it mopped up Rs 616.54 crore from anchor investors.

In a pre-IPO placement, external investor Blue Chandra had sold 10.32 million shares, or 8.4 per cent of its stake, to renowned investor Madhusudan Kela’s wife Madhuri Kela, along with Nuvama Crossover Opportunities Fund and TIMF Holdings, for a total consideration of Rs 130 crore.

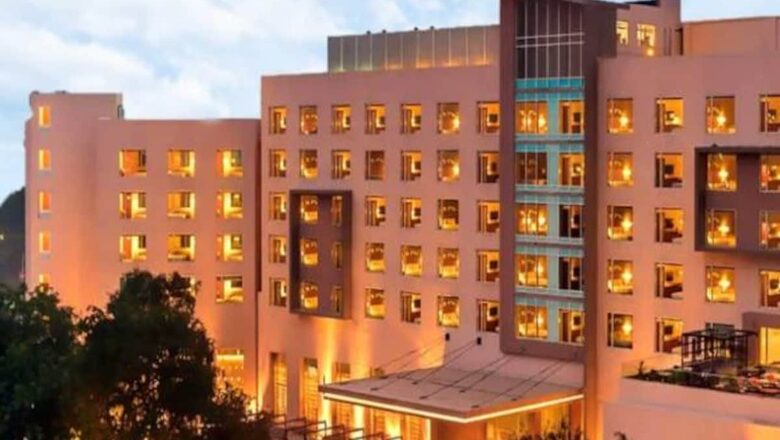

Samhi acquires and builds primary hotels and thereafter renovates, rebrands and rerates the property and runs it.

JM Financial and Kotak Mahindra Capital Company were the managers to the IPO.

Comments

0 comment