views

The Reserve Bank of India (RBI) on Friday decided to enable standalone primary dealers (SPDs) to offer all foreign exchange market-making facilities as currently permitted to Category-I Authorised Dealers, subject to prudential guidelines. It also allowed them to undertake transactions in the offshore rupee overnight indexed swap (OIS) market with non-residents and other market makers.

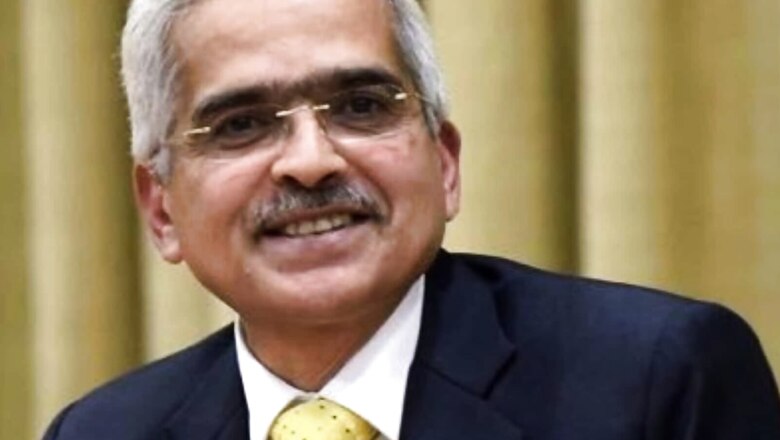

While announcing the August bi-monthly monetary policy on Friday, RBI Governor Shaktikanta Das said, “Standalone primary dealers have played an important role in the development of financial markets in India.”

The central bank has decided to enable SPDs to offer all foreign exchange market-making facilities as currently permitted to Category-I Authorised Dealers, subject to prudential guidelines. “This measure will provide customers with a wider set of market makers to manage their foreign currency risk. This will also increase the breadth of the forex market in India,” Das said.

The RBI also allowed standalone primary dealers (SPDs) to undertake transactions in the offshore rupee OIS market with non-residents and other market makers.

“This measure will supplement a similar measure announced in February this year for the banks. These measures are expected to remove the segmentation between onshore and offshore OIS markets and improve price discovery,” the RBI governor added.

The RBI’s Monetary Policy Committee on Friday unanimously decided to raise the repo rate by 50 basis points (bps) to 5.4 per cent with immediate effect while focussing on the withdrawal of accommodation. It has also retained the inflation and GDP forecasts for the current financial year 2022-23 at 6.7 per cent and 7.2 per cent, respectively.

Read the Latest News and Breaking News here

Comments

0 comment