views

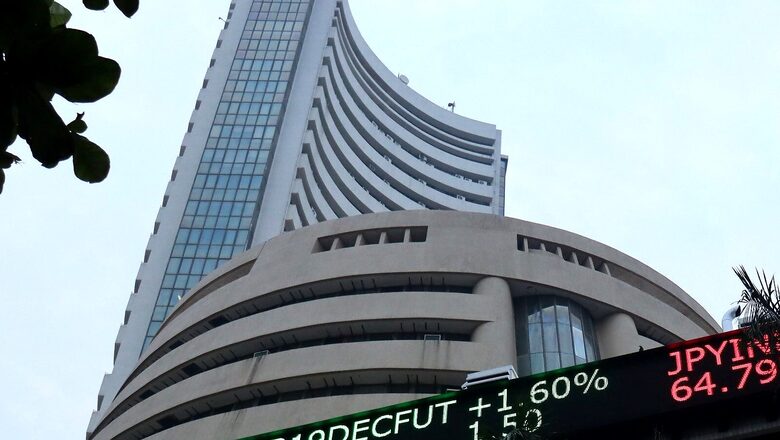

People are buying shares because prices are going up, and prices are going up because people are buying. That pretty much sums up the current trend as the market has managed to take the Evergrande crisis, global energy crunch, chip shortages and rising crude prices in its stride.

“Valuations are outrageous, but right now the bigger risk is in being outside the market rather than inside it,” says Old Monk, a veteran trader-investor, referring to the way in which share prices have shrugged off negative news. And despite the market’s resilience, most people seem dissatisfied. “Those who have invested are sulking that all other stocks are rising except the ones in their portfolio, and people who are not invested think every investor is rolling in money,” he says.

Self-fulfilling prophecy

After a disastrous August for IPOs, many thought that high networth individuals (HNIs) would become choosy about which issues they would apply for. But easy availability of funds and the odd blockbuster listing have resulted in a short memory. An HNI with Rs 1 crore of his money can subscribe to Rs 100 crore worth of shares in an IPO, thanks to a long queue of NBFCs eager to lend. Massive bidding, like the one seen in Paras, gives the impression of huge demand, and triggers follow up buying on listing. Looking at the subscription numbers, institutions and retail investors did not seem too enthusiastic about the issue, but HNIs were, despite expensive valuations. Leading the action in the stock on Friday was said to be a low-key but highly influential Mumbai-based HNI with an abiding passion for cricket.

In the short term, Paras—as the name means in Hindi—may help some junk IPOs pass off as gold.

Meri Aawaz Suno

In late June this year, fund managers at domestic fund houses and portfolio management service (PMS) firms were surprised when they got an invitation for a call with the Abbott India management. That is because in the past, such calls with the company have been as rare as Halley’s comet. The call was not an interactive one; participants were in a ‘listen only’ mode. The top brass responded to ‘as many questions as it could’, all of which were ‘received in advance’.

The fund managers appear to have left the meeting impressed, because the stock has been consistently outperforming the pharma index by a wide margin since then. Two months after the analyst call, the NSE announced it was adding 8 securities to its futures and options (F&O) list effective October 1, Abbott among those. And while the stock may have ticked the relevant boxes for inclusion in the hallowed list, many wondered at the choice given that daily volumes in the stock have ranged mostly between 10,000-20,000 shares. Lower the liquidity in a stock, easier it is for some vested interest to control the moves in the derivative segment.

In the week leading to October, Abbott India saw some sharp swings. A fund house is a said to have dumped a fair-sized lot, sending the stock into a tailspin. But it quickly rebounded, as some HNIs, who had been lying in wait, swooped in.

Smart Strategy, not Fat Finger

Options traders have been noticing a strange trend in weekly Bank Nifty contracts. On expiry day, when the index has been falling, there is a sudden demand for deep out-of-the-money call options, leading to a spike in the premium of those contracts. A similar anomaly has been spotted when the index is rising on expiry day; there is a big demand for deep out-of-the-money put options. Ideally, premia for such deep OTM contracts should be falling on expiry day and even otherwise, it makes no sense to go for such contracts when the market is moving in the opposite direction.

Initially, these swings were thought to be the result of fat finger trades or newbie traders with no understanding of how options worked. But turns out that some smart traders are using this strategy to free up a part of their margin funds locked up with the exchange. The rationale here is that it helps limit the effective value at risk if prices move adversely, as the deep OTM trade sets a cap or floor. Of course, there is a cost to buying deep OTM contracts. But if the freed up margin can be used for a much more profitable trade, then ‘why not’? is what some traders are saying.

Rise of IIIs and Celebrity Operators

You have heard of foreign institutional investors (FIIs) and domestic institutional investors (DIIs). But the category which is right now powering the bull run in mid and small cap stocks is the III- Individual ‘Insta’-gram Investor, as some in the market would like to call them. This group can be seen hanging out on social media platforms-notably Twitter and Instagram—following as many market gurus and pundits in the hope of some market wisdom/tips than can help them make some instant profits. This is leading many companies to seek the services of market gurus with a huge following to endorse their stock. The modus operandi works somewhat like this: the celebrity buys a sizeable quantity of the stock and announces it on social media. This will immediately bring IIIs rushing in. The promoter will underwrite losses if any, and the celebrity gets to keep the upside. What’s in it for the promoters? A rise in the stock price benefits them as they play in much bigger quantities with the help of traditional market operators.

Not FOMO, but FONO

Till some months back, the Fear Of Missing Out (FOMO) was prompting many retail investors to invest in equities and mutual funds even if they had little or no understanding of what they were getting into. With fixed deposit rates now at rock bottom, there is another factor making many people desperate for a piece of the stock market action. And that sentiment can be called FONO—Frustration Over Neighbours’ Opulence. The other day J, a small business owner in his early 40s, who operates out of the same co-working space as this diarist, seemed distraught at the market making new highs every day.

“I have to invest in stocks,” he told me.

When Asked Why:

“My friends, who don’t know the A of stock market have made a lot of money from the market in a short time. I wonder what is wrong with me. Why can’t I make money like them?”

A couple of things here. One, everybody looks smart when the market is rising one way. The true picture will emerge only once the bull run ends. Two, your neighbours/friends/relatives will only brag about their winning trades. Few will be honest enough to talk about their losses.

(Edited by : Abhishek Jha)

Read all the Latest News , Breaking News and IPL 2022 Live Updates here.

Comments

0 comment