views

New Delhi: If we want to go to Goa from Mumbai there are several vehicular options. We can travel by airplane, drive in car or bus, take a train or sail in ship.

Similarly when we want to make any kind of investment, there are different investment vehicles e.g. mutual fund, portfolio management services (PMS,) direct (investing on your own in stocks, Bank FDs, gold, property, etc), insurance etc.

Goa is the destination and airplane; car; bus; train, ship etc are vehicles. Similarly, debt, equity and property are asset classes and mutual fund; PMS; 'direct' and insurance are investment vehicles.

It is important to clarify here that property includes real estate, bullion, collectibles, art etc. To invest in Debt, Equity & Property we have to choose investment vehicles, which suit are requirement.

In earlier times 'direct' was the only investment vehicle available. If we wanted to buy fixed deposit/bond we had to apply on our own.

Similarly, when we wanted to buy shares, we had to call up stockbrokers, who would procure shares on our behalf and same was the case with property. The cost involved in 'direct' buying is least amongst all investment vehicles.

However we need to have skills and time to use this form of investing.

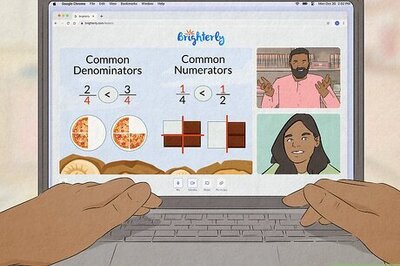

Another investment vehicle is a mutual fund. Mutual fund works on the concept of pooling in money.

Assume there are five to six friends who want to invest money in a particular asset class say equity. Also assume they do not have skills and time.

However one of them knows an expert who regularly invests in stock markets. All these friends go to an expert and give him their investment amount.

The expert invests on their behalf. If there is profit in investment, they all benefit and if there is any loss they suffer. Experts get certain fee for investing on their behalf.

This is the concept of a mutual fund. Investing in mutual fund is slightly expensive than "direct" form of investing. However the decision-making and procedure of investing is transferred to the Mutual Fund Company.

Insurance as an investment vehicle works somewhat similar to mutual fund as far as ULIPs are concerned.

While traditional insurance plans invest only in debt-based products and are not market linked, ULIP invests in debt, equity as well as a combination of the two.

PAGE_BREAK

Only difference in case of insurance is that expenses charged by insurance company are much higher compared to most other investment vehicles. PMS is usually tailor-made for your needs.

Based on your financial goals portfolio managers create investment portfolio for you. For creating and maintaining your portfolio, PMS charges fees.

Also if your portfolio earns profit beyond a certain amount, then the portfolio manager shares the profit. However if there are losses then the same is charged to your account only.

While choosing any investment vehicle keep in mind your skills, time available with you to create and maintain your investments and costs involved.

If you have the skills and time available with you then "direct" form of investing is ideal as it has least of costs amongst all other vehicles.

On the other hand insurance is the most expensive investment vehicle and hence it should be kept away from as far as possible.

PMS services works better for wealthy (high net worth) individuals. Though profits have to be shared, there is also advantage of getting tailor-made portfolio.

Only catch is to ensure that portfolio created and maintained for you is tailor-made and that the PMS is not another mutual fund scheme, where all investors get the same portfolio.

For small and medium investor – who does not have skills and time – mutual fund seems the best option.

Currently in India we have mutual funds, which invest in two asset classes, debt and equity. However in the very near future there is a likelihood of having mutual funds, which will invest in gold as well as real estate.

PAGE_BREAK

How to choose mutual funds based on our goals.

Funds need to be parked for contingencies, we can choose either liquid funds (if amounts are large) or short term debt funds. There are some fund houses which gives ATM access to debt based funds.

For goals, which are 1 to 3 years away, choose debt based funds. In raising interest rate scenario consider floating rate funds, while if interest rates are falling invest in pure income/bond funds.

For goals, which are likely to happen between 3 to 6 years, use combination of debt and equity based funds.

When goals are 8 to 10 years away, equity is the best option.

Over a long term, equity has usually beaten inflation by vast margins and probability of losing money is very low. If you are new to equity investing, start with index funds.

Index funds replicate the index eg Sensex based index fund will invest in only those companies, which are constituents of the Sensex.

As and when you get comfortable with equity investing, move to diversified equity funds, which invest in large cap companies.

Large cap companies are well-established companies having long presence.They are usually less volatile than small-mid companies and can withstand downturns in economy better than newer companies. Small and mid cap companies rise and fall faster.

On risk ladder they are more risky compared to large companies but can also give higher returns (and severe fall.) Having gained confidence with large cap companies, move to mutual funds, which invest in small-mid companies.

Once you are a 'fish in water' with volatility of equity markets, consider sector funds. These funds invest in single sector as IT, Banks, FMCG. They are very high on risk ladder.

Mutual Fund as an investment vehicle is the most convenient vehicle for investing in various assets classes.

It gives benefit of professional management, option of investing in smaller amount, quick liquidity and diversification benefit.

The author is Gaurav Mashruwala, a Certified Financial Planner.

Comments

0 comment