views

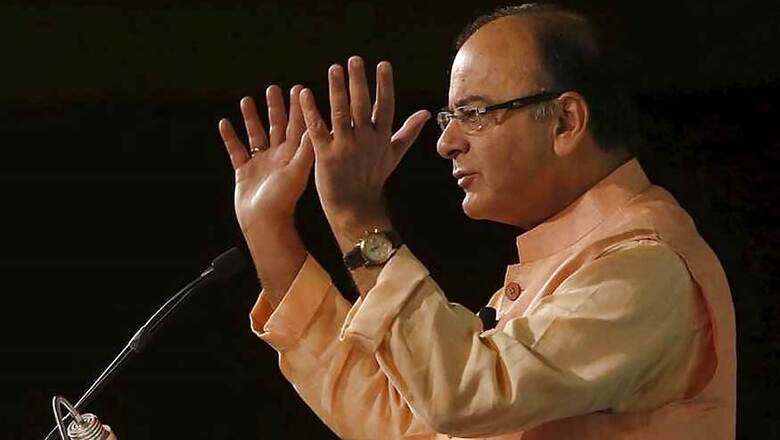

New Delhi: Asking domestic black money holders to take advantage of the ongoing scheme to come clean, Finance Minister Arun Jaitley on Thursday said those who have not yet declared their undisclosed foreign assets will face the consequences.

"One of the objectives behind 2015 black money law was (providing) an opportunity to assessees to comply...some people made use of that opportunity and I can tell you with almost certainty that those who did not, have taken a big risk because this is one area where world is opening out now with G-20 initiative, US domestic law," Jaitley said.

Finding out details is not difficult once there is a real-time sharing of information, he said, adding, "those who have missed the bus certainly have missed a lot".

Speaking on the occasion, Revenue Secretary Hasmukh Adhia said there will not be second window for the disclosure of foreign black money.

"I don't think the intention of the government ever was to reopen that. Having closed the date, one should not reopen the window. That I think would be FM's view also," Adhia said when asked if the government is considering to provide another window for declaration of foreign black money.

With regard to Income Disclosure Scheme (IDS), Jaitley said the government wants more and more people to use this. The four-month window under the IDS 2016, which closes on September 30, allows domestic black money holders to declare their ill-gotten wealth by paying a tax and penalty totaling 45 per cent.

"This Income Disclosure Scheme is part of the strategy where we want people to clean up their books," he said. Hinting that the tax department has information about the black money, Jaitley said the technology is a facilitator even to taxmen.

Detection of tax violation will get easier with improvement in technology, he said, adding, implementation of GST will also help check evasion.

Talking about various tax initiatives, Jaitley said the government has sort out a few cases of retrospective taxation. "We are trying to maintain stability of tax policy and one of the efforts is that corporate tax must be brought down to globally competitive rate because assessees world over are going to look over before investing," he said.

The government proposes to bring down corporate tax rate in a phased manner from the existing 30 per cent to 25% over a period of four years beginning this fiscal.

Comments

0 comment