views

Calculating Daily Compound Interest

Collect the necessary information. Unless you are withdrawing the daily interest you are accumulating, it will be added to the original amount of your principal which is a great way to save. To calculate, you will need the principal amount, the annual interest rate, the number of compounding periods per year (365 for daily) and the number of years the money will be in your account.

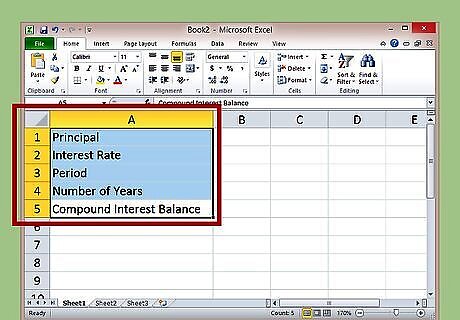

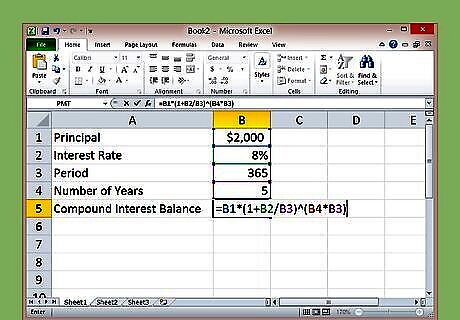

Launch your preferred spreadsheet, such as Microsoft Excel. Assign labels in column A, rows 1-5, for the Principal, Interest Rate, Period, Number of Years and Compound Interest Balance. You can expand the cell by clicking on the right line of the column number, A, B, C, etc. (Arrows will then show that you can manipulate.) These labels are for your reference only.

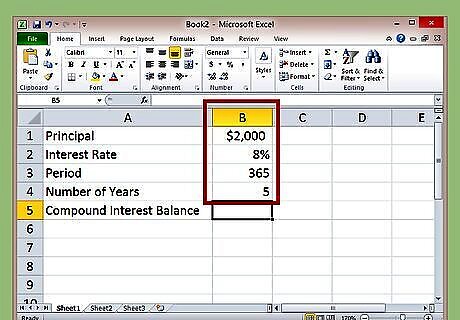

Enter the details for your specific calculation in column B, rows 1-4, to coincide with the labels. Period is 365 and the number of years is whatever you choose to calculate. Leave cell B5 (Compound Interest Balance) blank for now. For example, principal = $2,000, interest rate = 8% or .08, compounding periods = 365 and the number of years is 5.

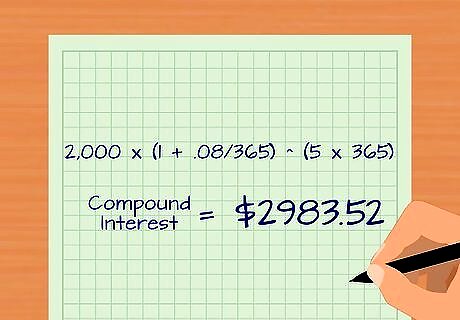

Click on cell B5 to select it and then click inside the formula bar to enter this formula: =B1*(1+B2/B3)^(B4*B3) and click enter. Compounded daily, the total principal and interest earned balance is $2983.52 after 5 years. You can see it is a good idea to reinvest your interest earned.

Calculate compound interest manually. The formula to use is Initial investment * (1 + Annual interest rate / Compounding periods per year) ^ (Years * Compounding periods per year). The ^ indicates an exponent. For example, using the same information from Step 3, principal = $2,000, interest rate = 8% or .08, compounding periods = 365 and the number of years is 5. Compound interest =2,000 * (1 + .08/365) ^ (5 * 365) = $2983.52.

Calculating Daily Interest Using a Computer

Gather the information needed to calculate interest. This includes the amount of money you will be investing or saving, the length of the term and the proposed interest rates. You may have several sets of variables if your intention is to compare alternatives. You will need to prepare a calculation for each alternative in order to complete your comparison.

Launch a computer spreadsheet application to help you calculate interest. You will be entering the data from Step 1 into specific cells on the spreadsheet and then setting up formulas. Once the formulas are calculated you can easily evaluate many different alternatives. Popular spreadsheet programs include Microsoft Excel and iWork Numbers. You can also find free spreadsheet applications online such as Google Docs or Zoho Sheet.

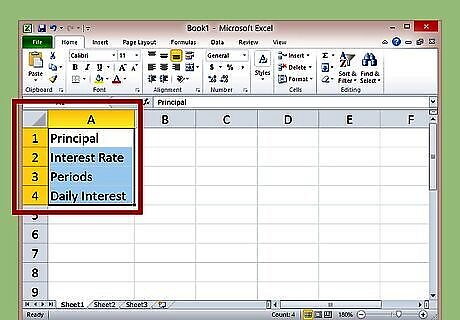

Assign labels in column A, rows 1-4, for the Principal, Interest Rate, Periods and Daily Interest. You can expand the cell by clicking on the right line of the column number, A, B, or C, etc. (Arrows will then show that you can manipulate.) These labels are for your reference only.

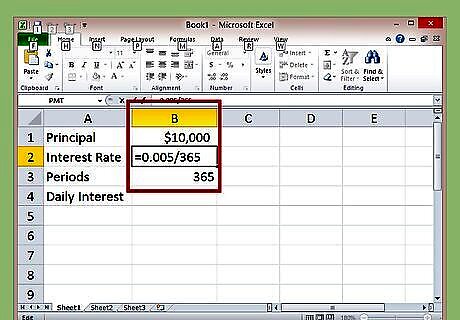

Enter the details for your specific transaction in column B, rows 1-3, to coincide with the labels. Convert the percent interest to a decimal by dividing it by 100. Leave cell B4 (Daily Interest) blank for now. The interest rate is usually shown as an annual figure; it will need to be divided by 365 in order to reach the daily interest rate. For example, if your principal to invest is $10,000, and your savings account is offering .5 percent interest, you will enter "10000" in cell B1 and "=.005/365" in cell B2. The number of periods determines how long your investment will remain in the account untouched, except for the compounding interest that is added. You can use a sample term of one year, which will be entered in cell B3 as "365."

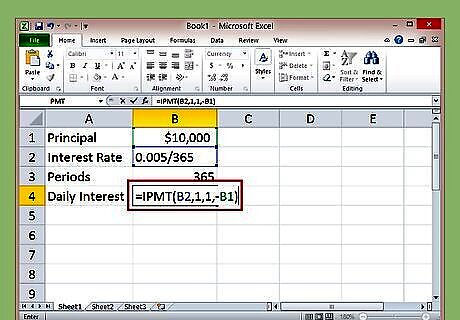

Create a function in cell B4 to calculate the annual interest as a daily amount. Functions are special formulas offered by the spreadsheet designers to make your calculations easier. Do this by clicking first on cell B4 to select it and then by clicking inside the formula bar. Type "=IPMT(B2,1,1,-B1)" in the formula bar. Press the Enter key. The daily interest earned on this account, for the first month, is $.1370 per day.

Calculating Daily Interest Manually

Gather the details needed to calculate interest. This includes the amount of money you will be investing or saving, the length of the term and the proposed interest rates. You may have several different interest rates that you want to compare.

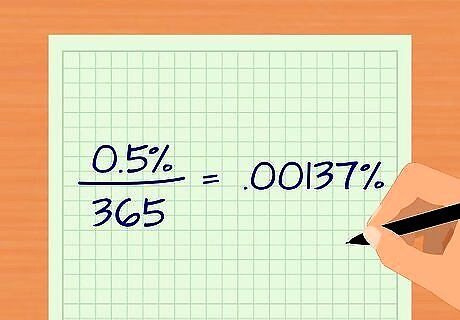

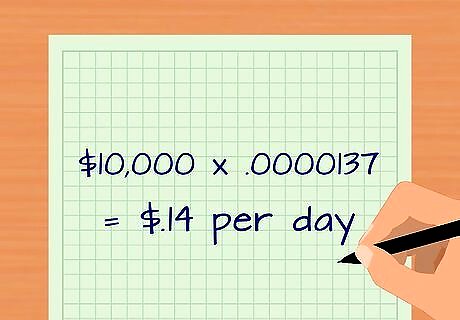

Convert the percent interest rate to a decimal. Divide the number by 100 and then divide this interest rate by 365, the number of days in a year. This will give you the interest rate to use in the formula. An annual percentage rate of .5 percent or .005, when divided by 365, is equal to .00137 percent, or .0000137.

Multiply the principal by the daily interest rate. If the principle is $10,000, when multiplied by .0000137, it is equal to $.1370. Rounded up, this account will earn approximately $.14 per day, based on these examples.

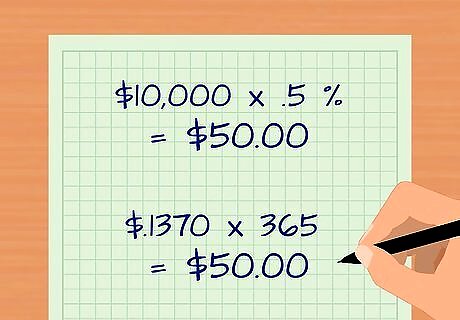

Check your math. Multiply the principal, $10,000, by the annual percentage rate of .5 percent or .005 to calculate interest manually. The answer is $50.00. Multiply the daily interest amount of $.1370 by 365 days; the answer is also $50.00.

Comments

0 comment