views

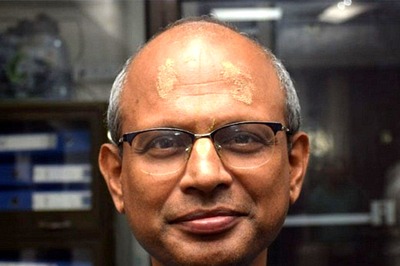

Gyanendra Tripathi, Associate Director, Global Tax Advisory Services,

Ernst & Young: General CENVAT rate reduced from 16 to 14 pc and a rate reduction in CST are steps taken in the right direction for the introduction of GST by the year 2010.

A mixed reaction was expected from the software industry with an increase in excise duty from 8 to 12 pc on packaged software and similar announcement of levy of service tax at 12 pc on customised software – the only silver lining is that of neutralizing input CENVAT and possible refund to exporters.

The key focus appears to be on service tax, with several changes proposed: threshold limit of exemption increased from Rs 8 to Rs 10 lacs per year and this will be a welcome move for small and medium service providers.

Utkarsh Palnitkar, Partner & Industry Leader, Health Sciences Practice, Ernst & Young: It is heartening to note the growing emphasis on life sciences in Budget declarations over successive years. Budget 2008-09 laid tremendous emphasis on health, agriculture and the social sectors as is evident in the initiatives announced. The life sciences sector, particularly, has a lot to benefit across the spectrum. These measures will provide a great impetus to the industry.

The Government has recognised the growing importance of R&D-focused entities who have been incentivised with the 125 pc deduction. The decrease in excise duty was a long-standing demand which has been met.

The withdrawal of excise duty on life saving drugs and reduction of customs duty to 5 pc on these drugs was eagerly sought and this is another demand of the pharmaceutical sector which has been met by the Finance Minister.

Insertion of a new sub-section (11C) in Section 80-IB to grant a five-year tax holiday for setting up hospitals anywhere in India and especially in Tier-2 and Tier-3 towns will pave the way for the expansion of private sector healthcare to smaller towns.

A number of pharmaceutical companies focused on AIDS products will stand to gain from the excise duty coming to nil. All in all pharmaceutical companies irrespective of size, scale and geography will largely benefit from these measures.

Ganesh Raj, Partner & National Leader, Real Estate Practice, Ernst & Young: There were more expectations from the Union Budget 2008 for the growing real estate Sector. There has been no relief on service tax on rentals which will continue to increase pricing pressure, though in the short to medium term this will not have a drastic impact as supply outstrips demand.

Eventually, the burden would be passed on to tenants.

The 5-year tax holiday granted towards 2/3/4 star hotels in UNESCO-declared 'World Heritage Sites' will boost development and offer relief to shortage of rooms in India. Further, tax holiday on establishing hospitals anywhere in India and specially in Tier-2 and Tier-3 cities will fuel growth in these cities and attract investment.

PAGE_BREAK

Clarity on Reverse Mortgage on the stream of revenue received by senior citizens not being treated as 'income' will ease the cash flow for senior citizens. A hike in excise duty on cement will have some adverse impact on developers increasing construction costs. The possibility of avoiding the incidence of double dividend distribution tax is a good move since a lot of real estate assets are held by companies in SPVs.

Pinakiranjan Mishra, Partner, Retail & Consumer Products Practice, Ernst & Young: The retail industry will be disappointed by the fact that the FM did not provide any relief on the service tax on lease rentals, as had been demanded by them. However, in view of the high rentals being charged by mall owners, there is enough scope to reduce lease rentals to adjust for the additional outflow. It was precisely for this reason that the case of the retail community was quite weak.

On the brighter side, the lowering of excise duty and the increase in income tax slabs will mean more disposable income with consumers and lower prices of goods. This would lead to more demand for retailers.

The exemption of excise duty on cold chain equipment will mean more investment in these facilities over a medium/long term. This will help retailers in the food and grocery sector apart from reducing losses for the farmers.

However, the government seems to have ignored the food processing sector. Incentives could have been provided for the food processing industry, either through tax incentives or setting up of food parks. This would have been also in line with its farmer-friendly Budget.

Shantanu Prakash, Managing Director, Educomp Solutions: The Budget is very positive for education. The government has clearly articulated that quality of education remains a huge concern.

Apart from the huge increase of 20 pc in the education Budget, the establishment of 6000 high-quality schools is also significant. Allocating funds to all the Sainik Schools for quality upgradation is a welcome move. The move to increase the spend to Rs 4,500 crores in secondary schools will create new opportunities for many.

Comments

0 comment